Nine charts tell you: Are we in a new business cycle?

Reprinted from jinse

01/17/2025·16days agoAuthor: Felix Jauvin, Blockworks; Compiler: Deng Tong, Golden Finance

Since COVID shut down the global economy in 2020, it has become very difficult to tell where we are in the business cycle.

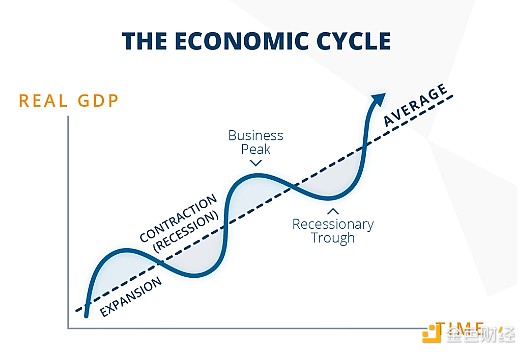

A typical business cycle looks like this, and historically it's easy to get a rough idea of which stage we're in by contrasting it with interest rates and monetary policy:

In recent years, however, everything has turned a bit upside down, confusing many economists.

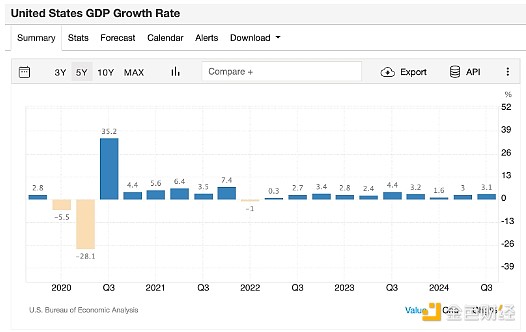

For example, in 2022 we see negative real GDP (initially 2, but later revised down to 1):

However, during that same period, we experienced one of the hottest labor markets on record, according to JOLTS data.

With the labor market so strong, it's hard to believe there's a recession:

Since 2022, we have seen the Fed go through a major rate hike cycle, which overall has not led to a recession. Stocks are hitting new highs every day, the labor market has cooled but remains resilient, and GDP growth is strong.

However, over the same period, if you focus on the manufacturing and goods sectors and leave services aside, it almost looks like we just experienced a manufacturing recession.

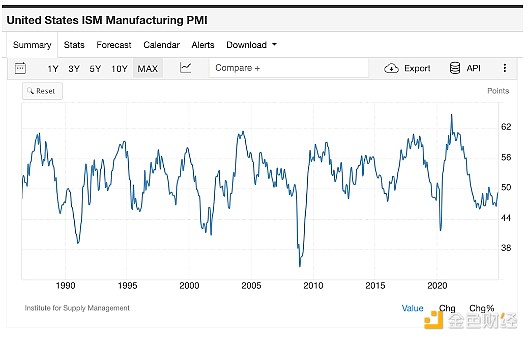

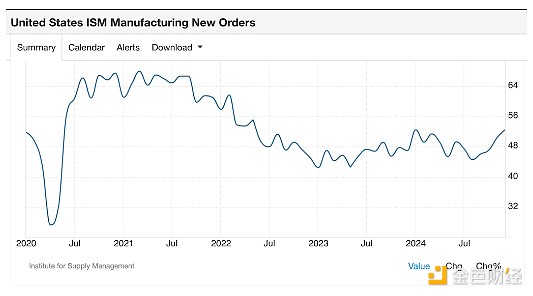

The ISM Manufacturing PMI has been in contraction territory for several years:

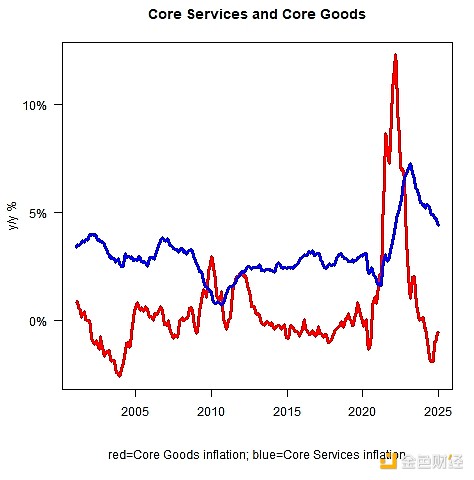

During this period we saw severe deflation, leading to outright deflation in the goods sector of the economy:

Fast forward to today and we've seen the Fed cut interest rates in response to concerns about the labor market and continue to try to give the economy a soft landing into a new recession-free business cycle.

We are now seeing leading indicators suggesting that manufacturing may be emerging from the downturn and heading towards a new upward trend.

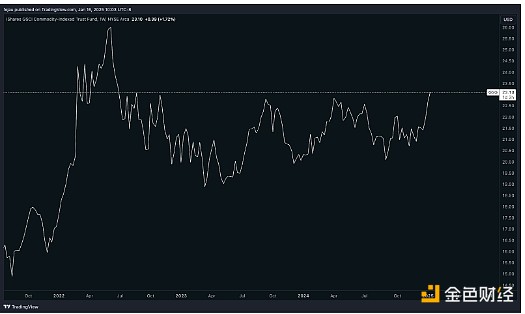

We’re starting to see commodities break out after a two-year consolidation, suggesting economic growth is picking up:

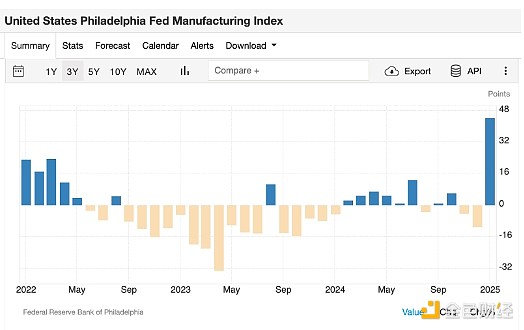

ISM new orders appear to be exploding, as does the Philadelphia Fed Manufacturing Index:

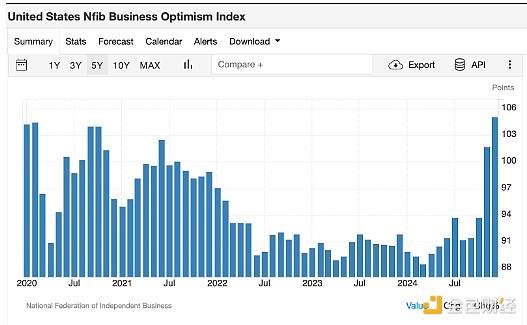

This has been largely driven by optimism in the business sector since the election, according to survey data:

So where does this chart journey lead us?

I think it 's safe to say that we are not entering the late stages of the cycle. We appear to be in the early stages of a new business cycle, having avoided a recession thanks to the huge fiscal stimulus and deficits of the past few years.

chaincatcher

chaincatcher

panewslab

panewslab