ParaFi Capital: How did Ethena grow into the cornerstone of DeFi in one and a half years?

Reprinted from panewslab

04/18/2025·11DAuthor: ParaFi Capital

Compiled by: Felix, PANews

In less than 18 months, Ethena has become the cornerstone of DeFi and CeFi infrastructure.

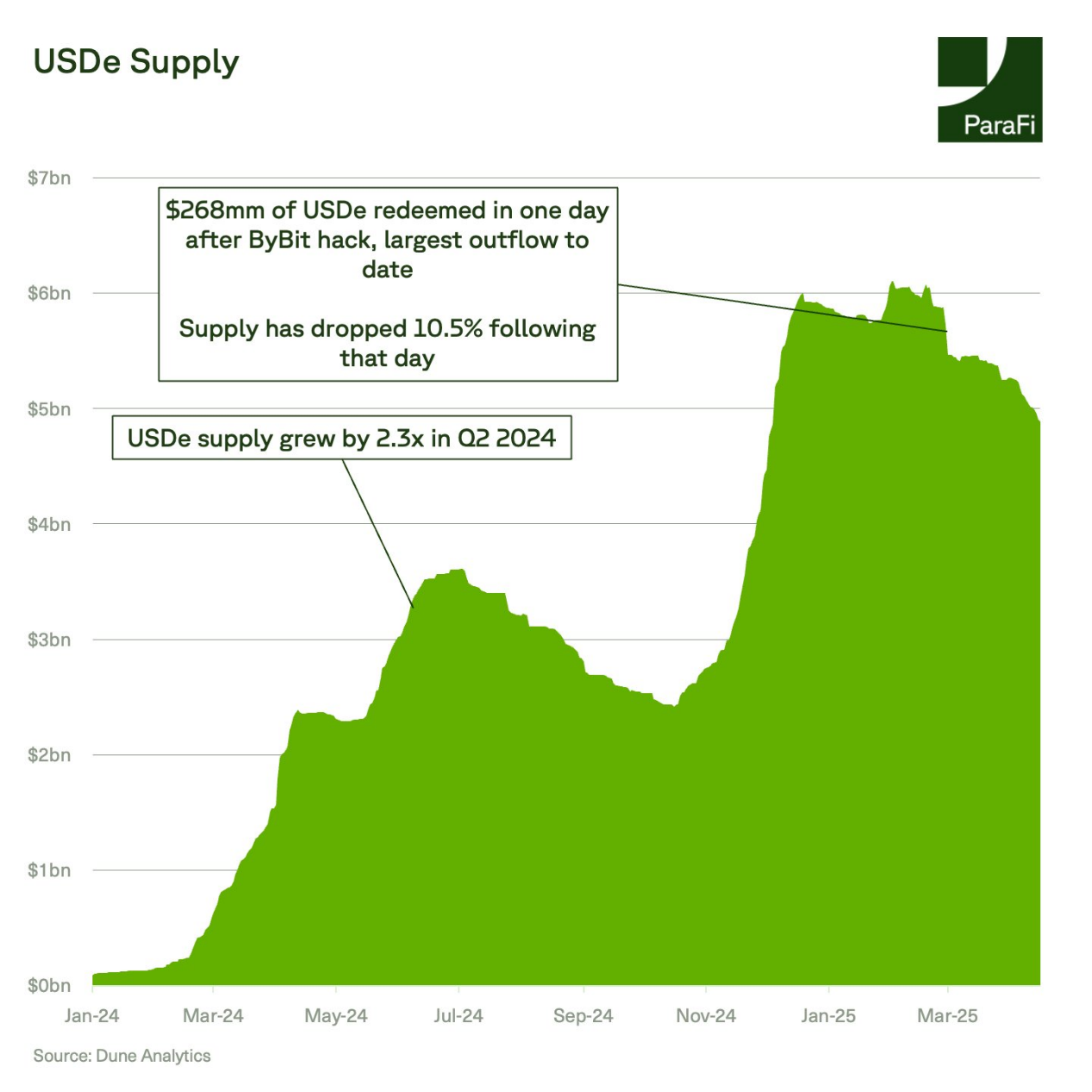

Ethena's USDe has become the fastest dollar asset to reach 5 billion supply. With the rapid growth of Ethena, this article will dig into the mechanisms of this protocol. Mainly focus on the following three aspects:

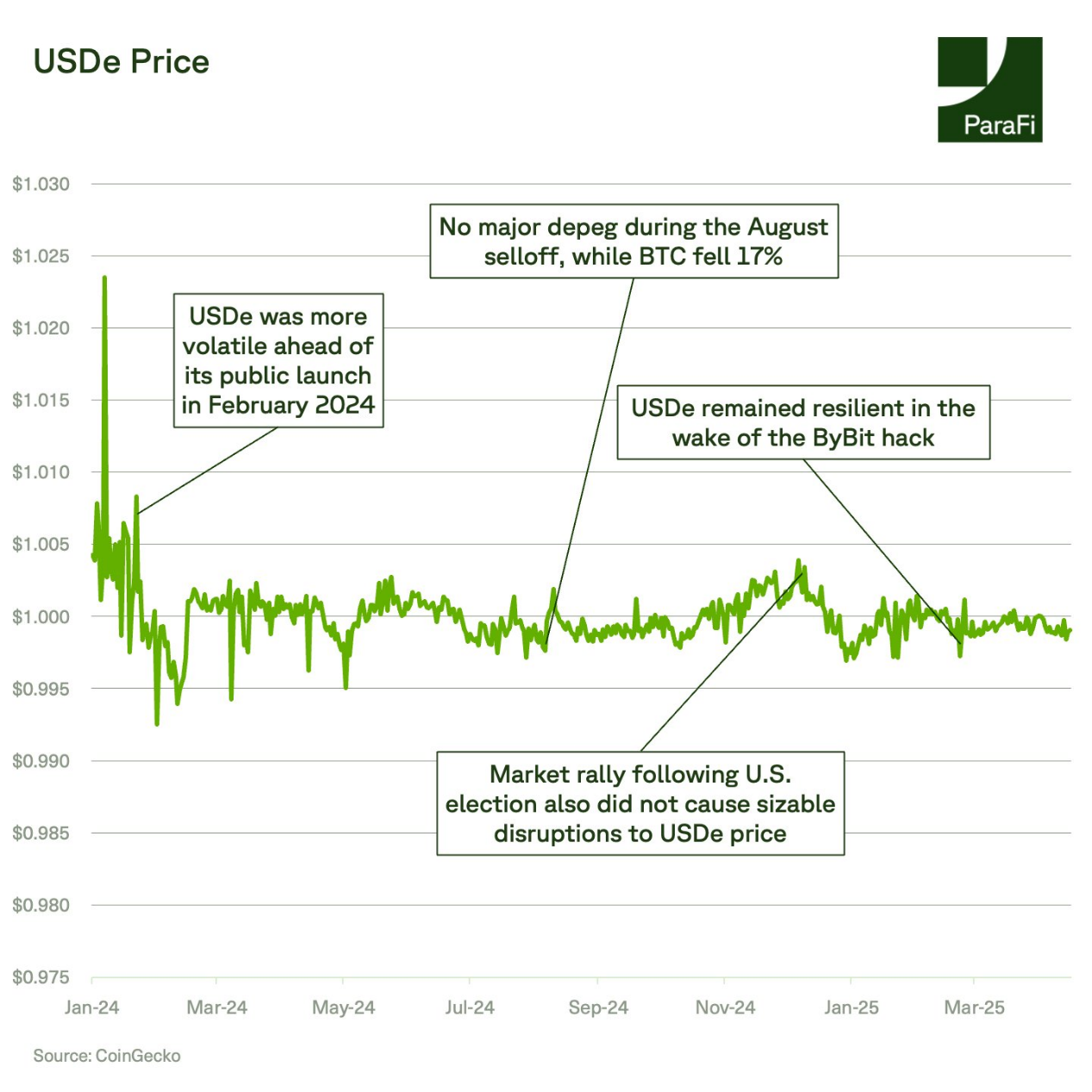

- Anchor Elasticity: To what extent does Ethena maintain anchoring in a sharp market decline?

- Earnings Overview and System Support: What changes have occurred in the asset composition and yield drivers of this agreement so far this year?

- Capacity Limit: Is Ethena close to DeFi TVL or open contract limit?

USDe has experienced extreme market volatility, including eight Bitcoin declines of more than 10% and the largest crypto hacker attack in history. Since its launch, the agreement has processed $3.3 billion in redemptions, but the USDe's deviation from the dollar anchorage has not exceeded 0.5% over the past year. The agreement has experienced $409 million in redemption since PANews Note: Trump called April 2 "Liberation Day" and announced the global tariff plan.

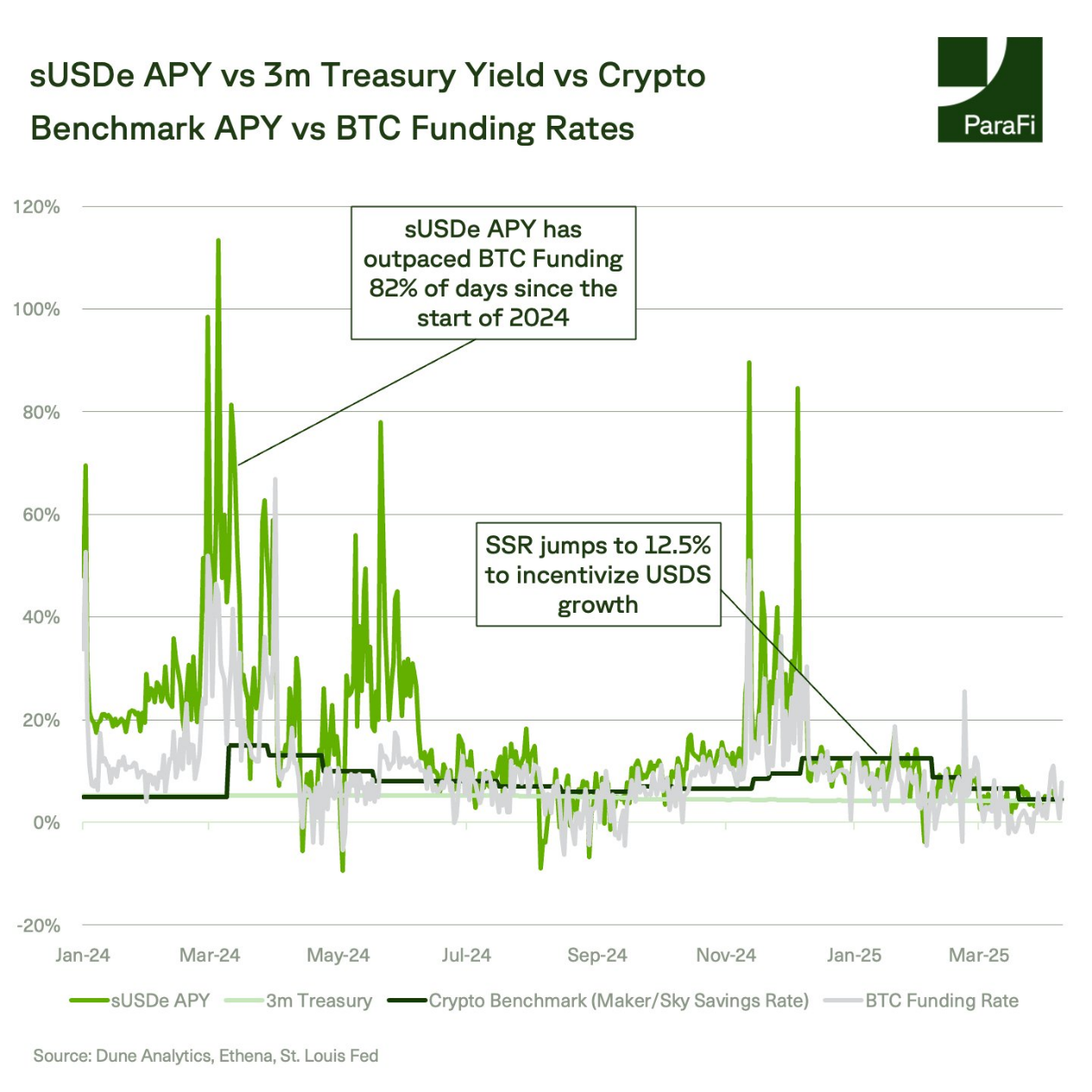

sUSDe has become the yield benchmark for DeFi – an indicator that institutional investors in traditional finance (TradFi) may increasingly pay attention to to assess risk appetite and market sentiment.

Ethena’s revenue mechanism is rooted in its structural advantages.

A large portion of sUSDe APY comes from the funding rates used in basis transactions to hedge spot exposure. Historically, these funding rates have been positive. For reference, 93% of the days in the past year have been positive.

sUSDe can provide a rate of return that often exceeds the funding rate of BTC, thanks to two key factors:

- Not all USDes are pledged, which means that the proceeds are concentrated in smaller supply groups;

- Ethena's custody framework supports cross-deposit margins, optimizing funding efficiency. Currently only 43% of USDes are pledged, the lowest percentage since August.

In the past six months, sUSDe's average yield was 12.3%, far exceeding the 8.8% rate of Maker/Sky savings rate and 9.2% rate of BTC funding rate.

It is worth noting that Ethena only operates in a high interest rate environment where federal funds rates are above 4%. Given that sUSDe yield should be negatively correlated with real interest rates, a decline in real interest rates may increase the demand for crypto assets leverage, thereby pushing up capital rates and, in turn, sUSDe yields.

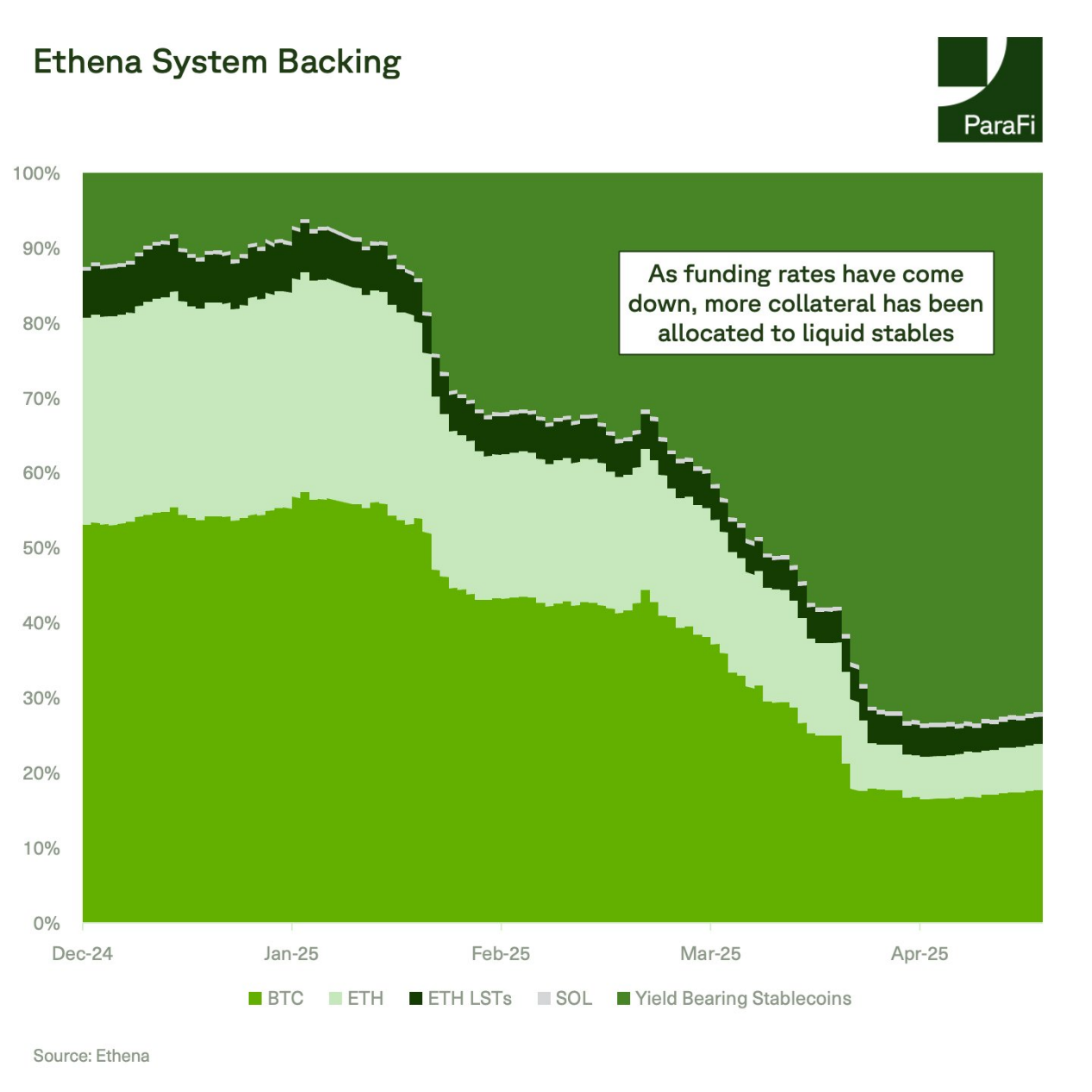

Ethena achieves its earnings targets by dynamically managing collateral. Depending on the earnings environment, Ethena will strategically convert between capital rate arbitrage, stablecoins and Treasury yields.

In December 2024, Ethena launched USDtb, a stablecoin powered by BlackRock BUIDL products, with a supply of more than $1.4 billion.

Currently, 72% of Ethena's collateral is allocated as liquidity stable assets, which is a significant change from the end of 2024 when 53% of collateral is allocated as BTC and 28% of collateral is allocated as ETH. This shift reflects a decline in funding rates relative to Sky and Treasury yields.

In the early stages of online launch, capacity limitation is the main problem.

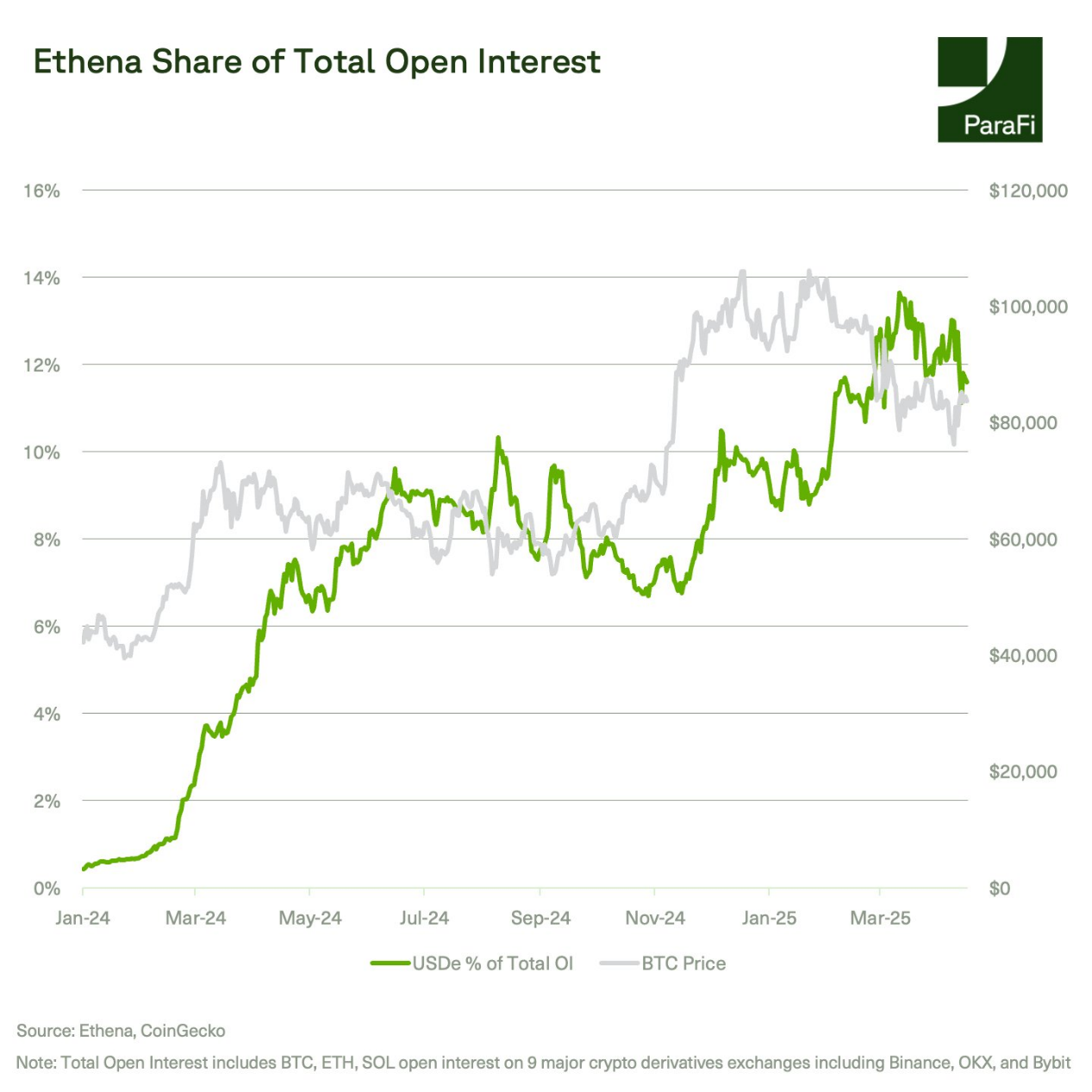

Currently, Ethena's supply is about 5 billion, and its total TVL accounts for only 12% of open contracts for Bitcoin, Ethereum and Solana futures. This is a relatively conservative measure, as not all Ethena collateral is tied to perpetual contracts.

During the explosive growth of open contract volumes, such as at the end of 2024, Ethena's supply reached US$6 billion, its supply accounted for only 14% of the market share.

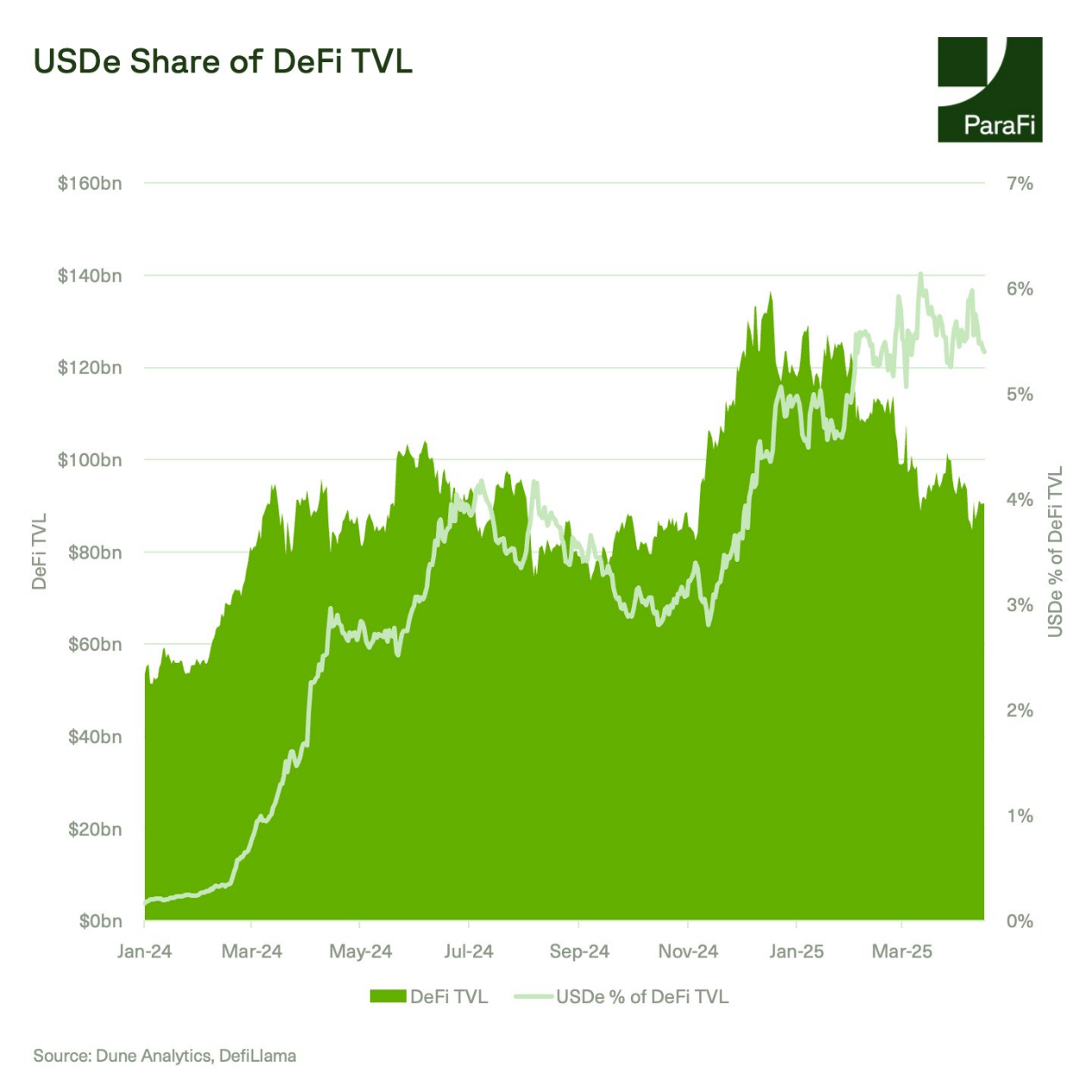

Ethena consolidates its position as a cornerstone of DeFi, with USDe and sUSDe deeply integrated into the entire ecosystem.

USDe alone contributes about 60% of the TVL of Pendle and about 12% of the TVL of Morpho. Ethena's share of DeFi TVL has been growing since its launch, reaching about 6% in March this year.

While DeFi TVL has fallen 23% so far this year, synchronizing with recent price trends, and ByBit suffered a hack in February, USDe's TVL fell just 17%.

What opportunities and risks will be focused on in the future?

- USDe supply under negative capital rate environment

- Exchange operation risks

- USDtb Supply Growth and Integration

- iUSDe organization adopts

- Ethena's Converge is online

- USDe Payment Use Cases

Related Reading: Comprehensive Interpretation of Ethena: The New Generation of Currency Fed

jinse

jinse