Sonic SVM in-depth research report: Solana expansion solution for Web3 games

Reprinted from panewslab

01/13/2025·0M

1. Project Introduction

1. Basic project information

Sonic SVM is the first SVM (Solana Virtual Machine) Layer 2 network expansion project based on the Solana blockchain, focusing on the optimization of games and high-frequency interactive applications. The project vision is to expand Solana's infrastructure based on the HyperGrid architecture to provide game developers with a high-performance, low-cost blockchain environment to support large-scale online games and applications and meet the growing needs of Web3 users.

2. Project development history

2023: The core team of the project has been initially formed, and technology research and development work has been officially launched, focusing on the design of the Sonic HyperGrid framework, which will be gradually improved after multiple rounds of technical verification.

March 2024: The Sonic SVM white paper is released, detailing the architecture and mechanism of Sonic SVM, laying a theoretical foundation for the development of the project.

June 2024: Completed US$12 million in financing, led by Bitkraft, with participation from Galaxy Interactive, Big Brain Holdings, Morningstar Ventures, etc., providing financial support for the further development of the project.

June 2024: Launch the test network and begin to attract developers and users to participate in testing to verify the performance and stability of the project. Over 100,000 wallet addresses were accumulated within a week.

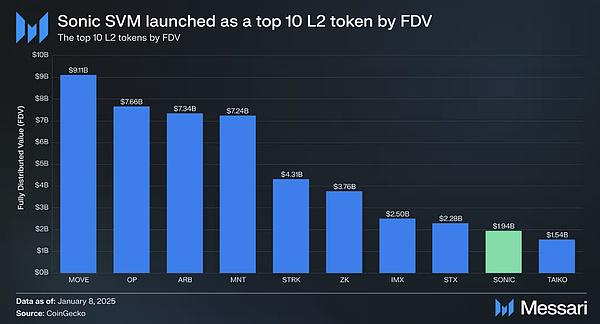

January 2025: $SONIC tokens (TGE) are officially generated and simultaneously launched on well-known trading platforms such as OKX, Bybit, Bitget, and KuCoin.

3. Core team background

The core team of Sonic SVM is very young. The main founders were born out of rct AI. The main personnel include:

Chris Zhu, CEO, graduated from NYU Stern Business School in 2020. He has worked at ByteDance and rct AI. In September 2021, he founded Mirror World (the predecessor of Sonic).

Jialin Zhu, Chief Product Officer, graduated from the Chinese University of Hong Kong in 2021, worked at rct AI, and co-founded Mirror World in 2021.

Jonathan Bakebwa, CTO, graduated from Beijing Institute of Technology in 2020. He worked at rct AI and founded Xtellar Works. In 2021, he co-founded Mirror World.

Yutong Li, finance/legal/human resources manager, graduated from the University of New South Wales in 2021. He has interned at many consulting companies such as Accenture and BCG, as well as Internet companies such as ByteDance and Alibaba. He joined Mirror World in February 2022. Served as product manager.

Arif Kazi, business manager, graduated from BSE Institute Ltd in 2021. He has worked in mesha, Stader Labs, DappLooker and other companies before joining Sonic in October 2023.

2. Business model

1. Technical logic

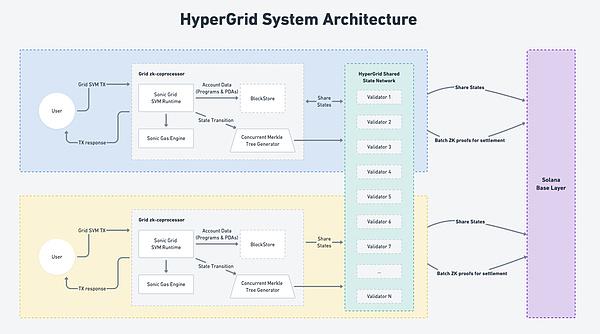

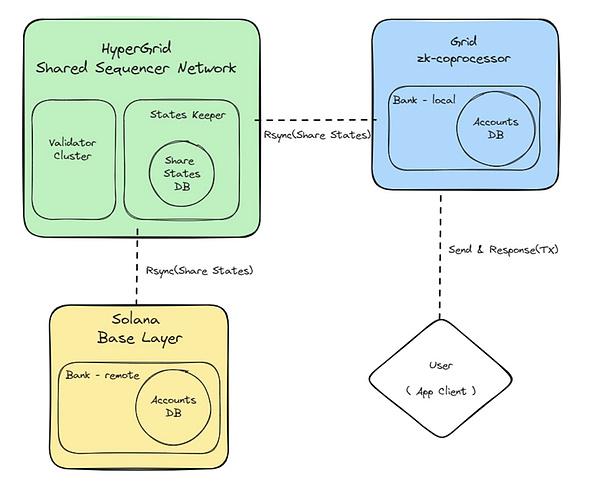

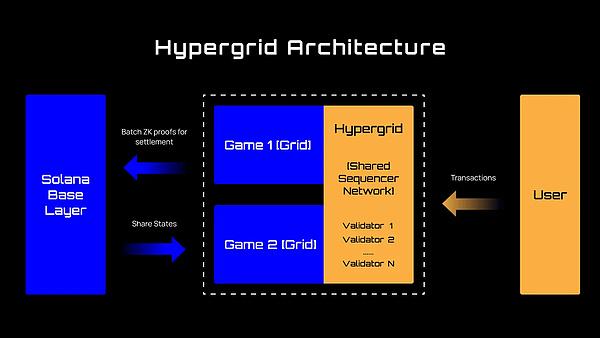

Sonic SVM revolves around HyperGrid technology and realizes the distributed operation of games and DApps by building a multi-grid architecture (Grids).

HyperGrid is a parallel processing framework that enhances Solana's infrastructure. HyperGrid is designed to be highly customizable and extensible while maintaining native composability with Solana. Applications supported by HyperGrid can be written on EVM, but are ultimately executed on Solana. The final settlement layer is Solana, which is conducive to bringing EVM ecological environment applications to the Solana chain. This is different from the direction of MoveVM technology whose final settlement layer is Ethereum.

Grids are designed to allow a large number of DApps to run on HyperGrid to reduce the impact on Solana L1 performance and minimize performance interference between DApps. With the support of the HyperGrid architecture, DApp developers can choose to use the HyperGrid public grid according to their own needs, or expand horizontally to create their own dedicated grid. The choice depends entirely on the developer's assessment of performance and cost. In addition, DApp developers can also close the grid they created without affecting other grids, because the verification, recording and reading of transactions and state changes generated by each grid are ultimately through the connection between HyperGrid and Solana L1 The connection between them is done independently.

2. Staking and Verifier Network

The HyperGrid ecosystem employs a staking protocol where validators (Validators) need to stake $SOL as collateral to participate in the network. This staking mechanism is not just a passive lock-up of funds, but an active commitment to ensure the security and continuity of all grids within HyperGrid. Echoing EigenLayer’s re-pledge concept, the collective pledge pool serves as the underlying security guarantee for the entire HyperGrid system.

Validators in HyperGrid play multiple roles, not just producing blocks. Their responsibilities include:

Ø Transaction Sequencing: Validators sequence transactions from the grid to ensure order and consistency in the processing process.

Ø Slots Proposal: As network facilitators, Validators propose Solt (equivalent to blocks) to each grid. This can be viewed as an outsourcing of execution, where the grid is responsible for the computation of state transitions.

Ø Execution Verification: After execution, Validators verify whether the result meets the expected state transition. This step is critical to maintaining the integrity of the ledger.

Ø State Commitment: After successful verification, Validators are responsible for publishing the verified state transition to the Solana main network.

3. Incentive model

Delegating a set of actions to validators is critical to maintaining a trustless and decentralized environment that ensures that no single entity can exert undue influence over the network.

In recognition of the critical role of validators, they are compensated with HyperGrid tokens for the services they provide. This incentive model is designed to encourage honest participation and deter malicious behavior. The reward structure, including detailed numbers and equations, is planned to be adjusted through an iterative development process. It will be calibrated to the performance and security needs of the network, ensuring that validators’ interests are closely aligned with the health and success of the HyperGrid ecosystem.

Starting a validator requires the operator to stake 100 SOL tokens. Once validators are established, they are eligible to receive votes from other users. These users participate by purchasing SONIC tokens, which are then locked to be converted into $veSonic. Users are able to share in the rewards generated by validators by staking their $veSonic tokens to validators. These rewards are then distributed between validators and users who staked their tokens, creating a symbiotic relationship within the system that encourages participation and investment in the health and growth of the network.

In the HyperGrid ecosystem, validators also bear the responsibility of shared sequencers, so the L2 platform built on HyperGrid will prioritize shared sequencers among these validators. As part of their compensation, validators will receive a portion of the sequence fees, which helps increase their revenue stream.

In addition, the system also incorporates observation nodes responsible for verifying the accuracy of transactions conducted on various L2s. As a key component in securing the system, these observation nodes play a vital role in detecting any centralized malicious activity, which may trigger the curtailment mechanism. For their monitoring work, these nodes will be rewarded with SONIC tokens.

Holding $veSonic represents capturing value within the ecosystem, such as embedded exchange fees, a share of NFT market transaction fees, and a share of Launchpad revenue. This reflects the intrinsic value proposition of $veSonic. Additionally, in recognition of their contribution to the ecosystem, $veSonic holders are eligible to receive additional ecosystem rewards. Priority is given to $veSonic holders, who will be rewarded with future games released on HyperGrid, allowing users to choose which game rewards they wish to receive, thus enhancing interactivity and participation within the ecosystem.

4. Token Economics

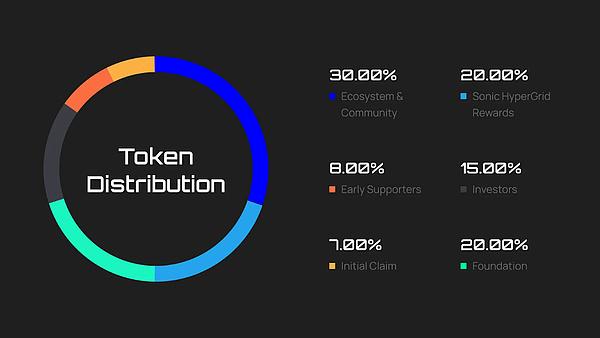

The native token of Sonic SVM is $SONIC, with a total supply of 2.4 billion and an initial circulation of 15%. The specific allocation is as follows:

Ø Community: 57% is allocated to the community, including ecology and community development (30%), initial claim (7%) and HyperGrid rewards (20%).

Ø Early supporters: 8% is allocated to early supporters, and these tokens will begin linear unlocking after 12 months and last for 24 months.

Ø Investors: 15% is allocated to investors, and these tokens will begin linear unlocking after 12 months and last for 24 months.

Ø Foundation: 20% is allocated to the foundation, including team members and advisors. These tokens will begin to be linearly unlocked after 18 months and last for 36 months.

Main uses of tokens:

Ø Payment tool: $SONIC can be used to pay for in-game assets, NFT and other application services.

Ø Staking and rewards: Users and validators obtain network rewards by staking $SONIC.

Ø Governance voting: Token holders can participate in key network decisions, including new project funding and network upgrade proposals.

Ø Incentive mechanism: Support developers and users to obtain token rewards by participating in ecological activities.

3. Project Prospects

1. Industry analysis

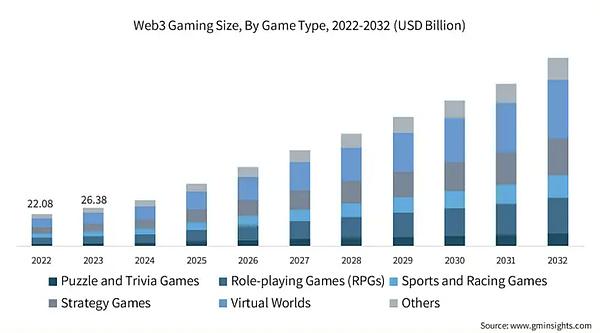

Blockchain technology provides game developers with new opportunities such as digital asset ownership, decentralized economies, and community governance. The blockchain gaming and decentralized application industries are rapidly emerging. According to data analysis, the global blockchain game market is expected to reach US$30 billion in 2025. The number of Web3 game users is also growing at a rate of 50% per year. However, scalability remains one of the main challenges for Web3 games.

Users have strong demand for high-performance, low-cost gaming experience, especially in application scenarios with high-frequency interaction and real-time response. Developers need a blockchain platform that can support large-scale users and high throughput to build and operate successful Web3 games.

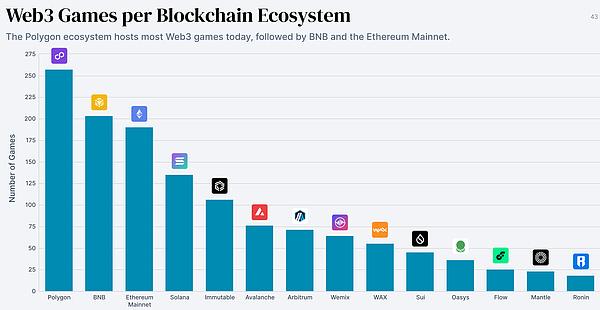

With the continuous advancement of technology and the maturity of the market, Web3 games are expected to become an important part of the mainstream game market. However, most of the current mainstream Web3 games are deployed on Polygon, BNB, and ETH chains. None of the top 25 UAW games run on Solana; none of the top 10 games by market value are also born on Solana. Therefore, Sonic SVM is expected to occupy an important position in this market through its high performance and low latency characteristics, driving the large-scale adoption of Web3 games.

2. Ecological construction

As a project created for Web3 games, Sonic SVM works closely with game studios. In addition to providing technical support, it also jointly carries out marketing activities. For example, the first AAA masterpiece launched in cooperation with the well-known game studio 343 Industries received over 100,000 downloads in the early stage of its launch. The two parties deeply bonded their interests through revenue sharing, NFT joint issuance and other models, and the in-game NFT sales reached the first time. It exceeded US$500,000 per day. In addition, cooperation with social media platforms such as TikTok has introduced massive traffic to the ecosystem, and achieved exponential growth and retention of users through creative challenges, Internet celebrity promotion and other forms. The cumulative number of challenge participants has exceeded 5 million, and Internet celebrity promotion has brought The number of new users exceeded 2 million.

In terms of community building, Sonic SVM has established an active community governance mechanism, and $SONIC token holders can participate in project decisions, including protocol upgrades, fee adjustments, ecological fund usage directions, etc. Regular community AMA (Ask Me Anything) events are held at least twice a month to bring the team closer to users, collect feedback and optimize the project development path in a timely manner. More than 80% of community suggestions have been effectively responded to and implemented.

3. Development plan

According to the Roadmap officially released by Sonic SVM, its development plan is as follows:

( 1 ) Phase 1 : Network Genesis ( Q4 2024 to Q1 2025 )

Ø HyperGrid Network Genesis: Launches the HyperGrid shared state network, supports the creation of interconnected SVM networks, and achieves seamless interoperability.

Ø Sonic SVM Genesis: The Sonic SVM network is officially launched, laying the foundation for scalable on-chain games.

Ø HyperFuse Network Security: Deploy decentralized node clusters to ensure the security and accuracy of HyperGrid.

Ø $SONIC TGE: Complete the token generation event of $SONIC and unlock its complete ecological potential.

( 2 ) Phase 2: Mainnet Alpha Launch ( Q1 2025 )

Ø Sonic Mainnet-Alpha: The Sonic SVM mainnet Alpha version is officially launched, including key services such as bridging, decentralized exchanges, oracles, and NFT programs.

Ø Sonic X - TikTok App Layer: Launch native Android and IOS applications to provide support for high-quality games and digital asset distribution.

Ø Sonic Bridge: Integrate the official token bridge and support assets such as SOL, sSOL, sonicSOL and stable currency (USDC/T).

Ø HSSN Validator Onboarding: Activate HSSN validator to ensure network security and operations.

( 3 ) The third phase: Ecosystem Expansion ( Q2 2025 )

Ø HyperGrid Optimistic Rollup Stack: Integrate the new SVM into the HyperGrid Op-Rollup stack to improve network scalability.

Ø Grid v2 Deployment: Launched the Sonic Grid v2 test network and plans to integrate it into the main network to improve network performance.

Ø $SONIC Staking & Rewards: Introducing the $SONIC staking and reward plan, holders can obtain rewards through HSSN verifiers, and implement a penalty mechanism to ensure network security.

Ø RUSH ECS Growth: Expand the RUSH ECS framework and add SDK clients that support more on-chain games.

4. Competitors

Sonic SVM is Solana’s first scaling solution for games. Similar projects include other Layer 2 solutions, as well as gaming-specific blockchain platforms such as Immutable X and WAX.

( 1 ) Immutable X

Layer 2 solutions specifically for NFT on Ethereum have attracted several well-known game projects, such as Gods Unchained. Immutable X has gained market recognition through its high performance and low cost.

( 2 ) WAX

WAX is a blockchain platform focusing on games and NFTs, and has established a rich ecosystem that supports multiple games and applications. WAX attracts a large number of users through its efficient transaction processing capabilities and low fees.

Compared with similar competing products, relying on Solana's high TPS (theoretical peak exceeds 60,000 TPS), Sonic SVM's Layer 2 solution can ensure transaction confirmation in seconds, with an average handling fee as low as $0.5, providing users with smooth and low-cost interaction. The experience far exceeds the transaction efficiency of most competing products on the public chain. In addition, by cooperating with mainstream social platforms such as TikTok, Sonic SVM has a large number of potential users. Compared with promotion limited to crypto-native communities, it has a wider audience and greater user growth potential.

5. Investment potential

Sonic SVM has opened up a new track with its unique technical architecture, innovative business model and forward-looking ecological layout. Since its inception, the project has shown strong momentum of development through a series of key node breakthroughs. Sonic SVM is expected to occupy an important position in the Web3 game market through its high performance and low latency characteristics.

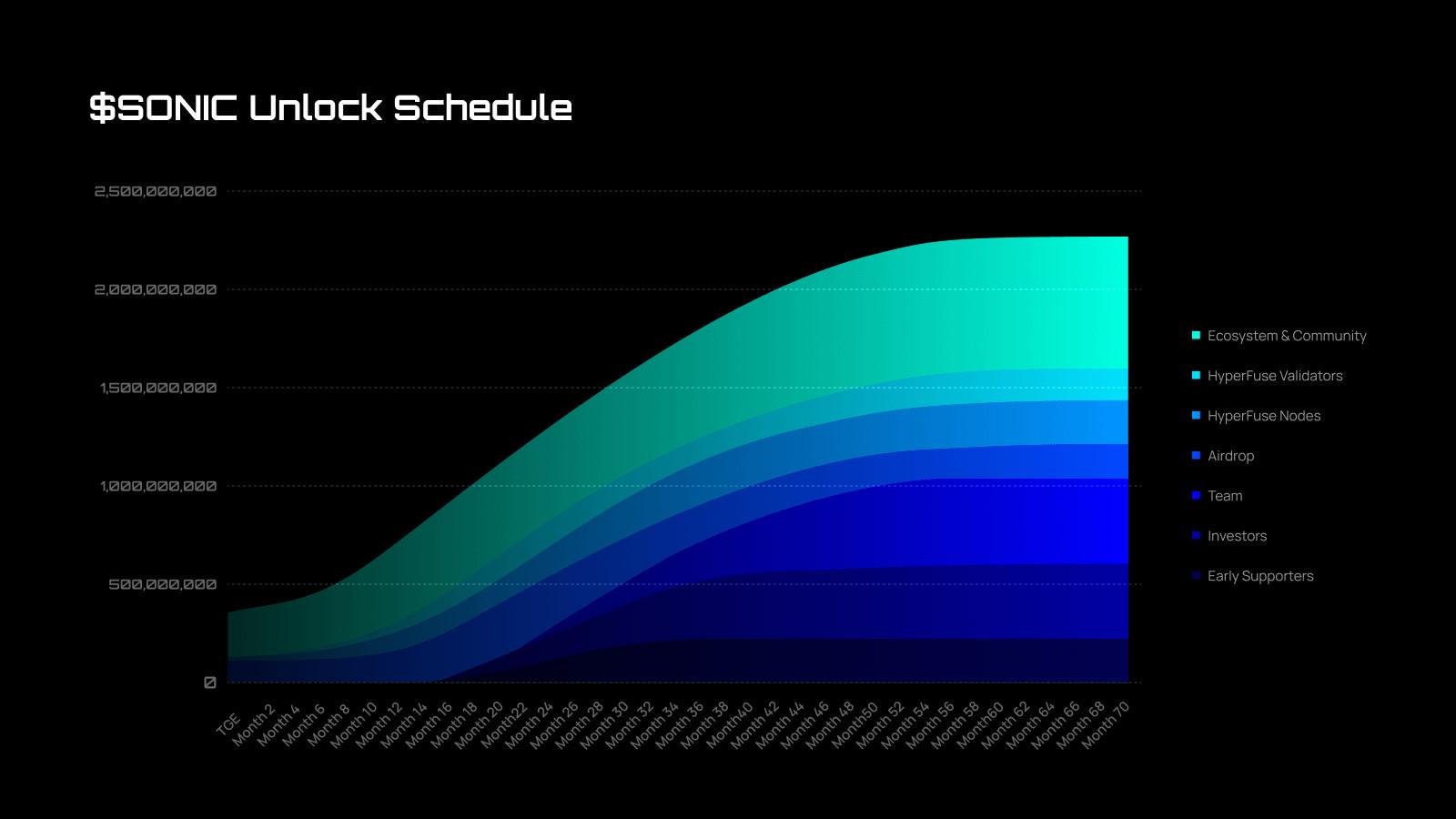

From the perspective of token usage, $SONIC, as the native token of the Sonic SVM ecosystem, has a wide range of usage scenarios. From the perspective of token allocation and unlocking rhythm, the allocation ratio is relatively reasonable, but a large number of tokens will be unlocked in 12 months. At that time, there is great uncertainty whether the development of Sonic SVM can meet the established expectations.

Taken together, the most important investment story of Sonic SVM still lies in the drainage of platforms such as Tiktok (it is worth mentioning that the founder of Sonic SVM worked for ByteDance for 2 years, but his position was relatively low. To what extent can he contact resources? There are certain doubts). If a large-scale breakthrough can be successfully achieved, the valuation of the $SONIC token will have room to rise at least 10 times from the current level, and it may be worthwhile to gamble on the upward probability with a small position; but if it cannot attract a large number of Web2 users to participate as expected, the superposition Solana Network's uncertainty in the Web3 game market and Sonic SVM's story may also be unsustainable.

In summary, it is recommended to carefully consider investing in $SONIC .

4. Summary

As a new Layer 2 solution in the Solana ecosystem, Sonic SVM provides a high-performance, low-cost blockchain environment for games and high-frequency applications through its innovative technical architecture and customized functions. Its cooperation with TikTok and successful market performance further prove its strong ability to attract users and developers. With the continuous expansion of the ecosystem and the continuous optimization of technology, Sonic SVM is likely to achieve greater breakthroughs in the Web3 field and promote the large-scale adoption of Web3 games.

For investors with higher risk appetite and long-term optimism about the development of Web3 games and applications, they can allocate a small amount of $SONIC at low prices on the premise of paying close attention to technological and ecological progress to game the probability of the project becoming a hit; conservative investors It is recommended to wait and see, waiting for the market to become more mature and project uncertainty to decrease before making any decisions.

jinse

jinse