Why is Bitcoin L2 said to have more market potential than Ethereum L2?

Reprinted from jinse

01/13/2025·0MAuthor: Jon Charbonneau Source: DBA Translation: Shan Ouba, Golden Finance

introduce

Bitcoin’s top layer two network (L2) will unlock one of the largest markets in crypto.

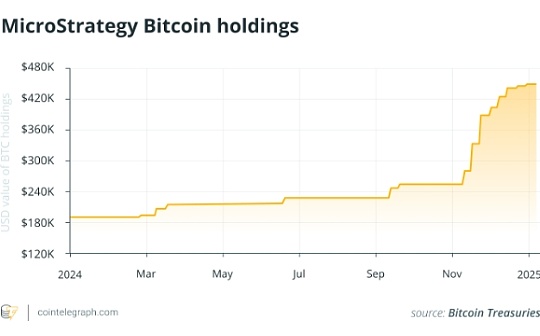

The potential is obvious: Bitcoin (BTC) has a market value of nearly $2 trillion and is gradually surpassing gold to become the world's largest asset. A network platform that can dominate the use of Bitcoin is destined to become a giant in the future.

Currently, most people try to understand Bitcoin L2 through the lens of Ethereum L2. However, this kind of analogical thinking often leads to erroneous conclusions, including:

1. Underestimating the market size : Bitcoin L1 lacks programmability, which means that the market opportunity of Bitcoin L2 is essentially greater than that of Ethereum L2.

2. Ignore the factors that determine the “winner” : Compared with Ethereum L2, Bitcoin L2 has higher security requirements, and security will play a more important role in the early stages.

3. Underestimating what is possible to build : Recent technological breakthroughs have made it possible to build Bitcoin zero-knowledge rollups (ZK-rollups) with optimistic-ZK bridging (with “1 out of n” trust assumptions). Even more surprising is that these innovations will arrive sooner than expected. Possible future Bitcoin upgrades may even be completely trustless (for example, supporting direct ZK verification and removing the “1-of-n” mechanism).

In this article, we will use a broader definition of L2, including everything from trust-based (such as sidechains) to trust-minimized (such as ZK-rollups), but mainly focus on fully programmable L2 , rather than payments Channels and other more specialized protocols.

The potential market for Bitcoin L2 is larger than Ethereum L2

Let’s start with the first misconception: underestimating the addressable market (TAM) of Bitcoin L2.

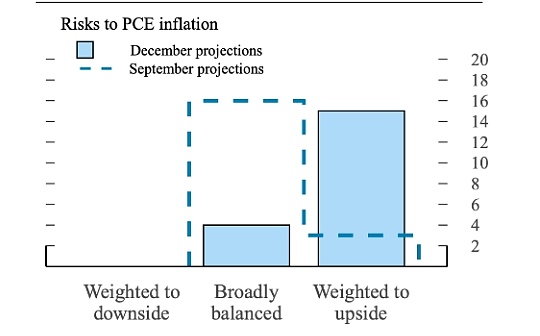

The market opportunity of Bitcoin L2 is far greater than that of Ethereum L2. This conclusion is partly obvious because Bitcoin’s market cap is about 4.7 times higher than Ethereum’s, but more importantly for the following fundamental reasons:

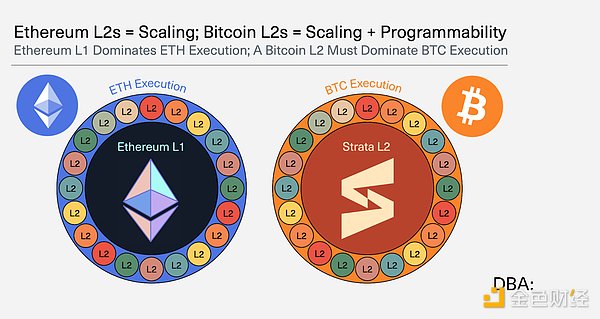

1. The purpose of Ethereum L2 is to expand its capacity

Ethereum L1 provides a complete programmable execution environment, and the state value stored in L1 is much higher than that of L2, although L1 is slow and has low throughput. The role of L2 is to provide the same functionality as L1, but faster and cheaper. L1 is still where the “real money” is, while L2 is more of a place to “test the waters”.

2. The purpose of Bitcoin L2 is expansion and programmability

Bitcoin L1 lacks programmability features. And programmability is the key to unlocking stronger privacy, a better self-custody experience, and basic BTC DeFi. If L1 is unable to provide these capabilities, then this leaves huge room for building Bitcoin's dominant execution layer.

Currently, most market participants use Ethereum L2 as a model to understand Bitcoin L2, but the correct comparison object should be Ethereum L1 . The winning Bitcoin L2 will become Bitcoin’s execution layer —the infrastructure that powers the best crypto assets.

Just ask yourself: If Bitcoin L1 were fully programmable, would you use it? I definitely will. Thankfully, however, Bitcoin L1 does not offer this universal programmability, as this simplicity is one of the core strengths of Bitcoin as a currency. However, the value of layering this functionality onto L2 is undeniable, and L2 now has the opportunity to make it happen.

Considering that the execution layer usually exhibits extremely strong power-law distribution characteristics:

• Ethereum : Ethereum L1 remains the most valuable execution layer, dominating indicators such as revenue, DeFi lock-up volume (TVL), and stablecoin issuance. The scale of L2 is much smaller than L1.

• Bitcoin : We can also expect that Bitcoin L2 will have a long-tail distribution, and the largest Bitcoin execution layer will gradually widen the gap. However, due to the lack of programmability of L1, the dominant execution layer of Bitcoin must be L2 . The only question is: which L2 will emerge as the winner?

Just as Ethereum L1 did for ETH, I believe the dominant Bitcoin execution layer must:

1. Significantly enhance the functionality of Bitcoin (such as better privacy, more friendly self-custody user experience and basic DeFi functions).

2. Do not significantly weaken the core advantages of Bitcoin (such as secure self-custody, resistance to confiscation, and permissionless use).

Therefore, security will be the deciding factor.

L2 security

Ethereum L2: Prioritize speed over security

Let's now look at the second misunderstanding: thinking that the high security of Bitcoin L2 is irrelevant because Ethereum L2 users are not sensitive to security.

Observe the current Ethereum L2:

• Secure L2 : The three Stage 2 Rollups currently online have almost no interest.

• Insecure L2 : Users do not hesitate to invest billions of dollars into "L2" deposit contracts, and these contracts are controlled by unidentified 3/5 multi-signatures, with no verification mechanism and no chain. Even Base is only in Stage 0. Optimism and Arbitrum have entered Stage 1, but have taken many shortcuts (for example, Optimism has had no verification mechanism for years, while Arbitrum still has a whitelist).

From this, many people have concluded that the success of Bitcoin L2 requires prioritizing speed and ignoring security to quickly attract users. This is called "speed > security".

Some even go further and believe that Rollups and verification bridging are failed experiments. Users don't seem to care about L2 security, and L2 doesn't seem to be motivated enough to achieve complete decentralization.

Does Bitcoin L2 have higher security requirements?

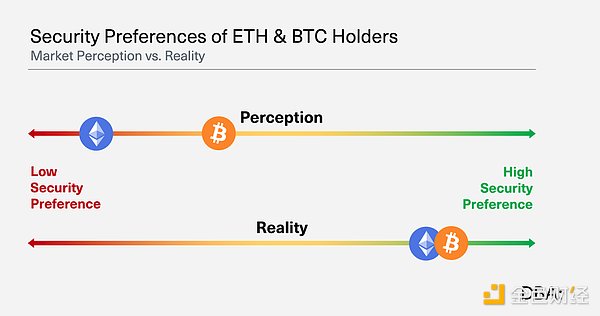

A common rebuttal is that Bitcoin L2 security is more important because Bitcoin holders are more sovereign-minded and risk-averse than Ethereum holders.

I don't completely agree with the above two views:

• Drawing conclusions based on current usage patterns of Ethereum L2 users is misleading. The security of Bitcoin L2 will be more important than Ethereum L2 and needs to be taken seriously earlier.

• But this is not because there is a significant difference in the risk appetite of Bitcoin and Ethereum holders. I don't think there is a fundamental difference in this regard. Regardless of the assets they hold, large capital holders are mostly rational in their assessment of risk.

Therefore, I believe that BTC and ETH holders are equally sensitive to security risks. Additionally, due to the excessive focus on those early ETH L2 users, many underestimated the sensitivity of most capital to the security risks of bridging.

If capital is really highly sensitive to bridge security, why does a large amount of ETH still flow to unsafe bridges?

The answer is actually very simple - users show their preference for high security by not bridging!

Currently, only about 2.5% of the ETH supply is bridged to L2, and ETH ETFs already hold more than that. Even hardcore Ethereum supporters understand that the current security of L2 (just for holding ETH) is actually less secure than ETFs. Security issues are hindering the flow of large capital to L2.

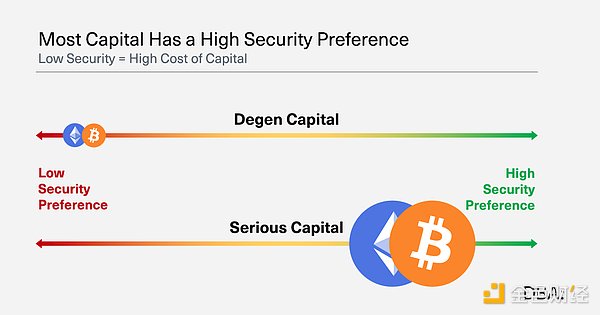

The risk of the bridge being hacked may result in assets being reset to zero, bringing high hidden costs to capital. Low safety = high risk = high cost of capital = less capital inflows.

The reality is that most capital here behaves quite cautiously and risk- averse. You might gamble on L2 with your risk capital (degen capital), but leave your main capital (more risk-averse capital) in L1.

So when we look at the current usage patterns of L2 bridging, we're really only seeing the appetite of this small subset of venture capital:

1. We cannot conclude that "L2 bridge security is irrelevant" just because mainstream L2 prioritizes speed over security, and these "less secure" L2s attract more ETH. Most capital expresses its high need for security by avoiding bridging.

2. We can conclude that in this small portion of risk capital, the difference in security between existing L2s is not a decisive factor.

Prioritizing speed over security is indeed the right strategic decision for these early days of Ethereum L2. They need to come online quickly to capture market share. Among its target market (risk-seekers), incremental improvements in L2 security are unimportant.

For example: when friend.tech first launched, you might put a few dollars on Base if you wanted to try it out. If you want to chase a new AI concept coin on Base, you'll invest some cash. Whether Base has a complex ZK verification mechanism or time lock contract upgradeability has little impact in this case.

There's a reason Ethereum L2 is targeting smaller risk markets, as Ethereum L1 was always going to attract more serious capital (at least in the early days).

• You can complete basic ETH DeFi operations on L1.

• You don't need another high gas limit, EVM copy of the same application to reap the benefits of ETH.

• Using L1 is safer than bridging to L2, while the higher fees of L1 are acceptable for large transactions (i.e. using serious capital).

The situation with Bitcoin is completely different:

• Bitcoin L1 inherently cannot support most basic functions natively.

• This changes the value proposition and target user group of Bitcoin L2 compared to Ethereum L2.

• This also changes the most important properties of Bitcoin L2 and Ethereum L2.

Absolute security versus relative security

In the competition for Bitcoin L2, both absolute security and relative security are crucial.

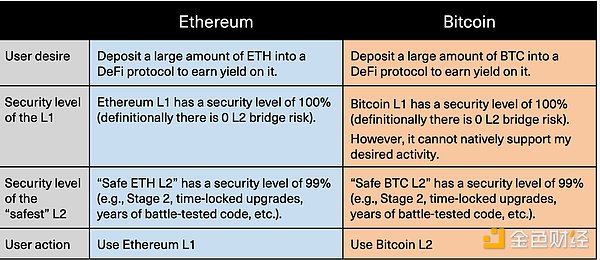

We illustrate this with two examples. To simplify the discussion, assume that we can precisely quantify the "security level" of an L2 bridge:

In the first example, assume that Base's security has improved significantly, but you still choose Ethereum L1. The reason is: the basic DeFi protocol can be used almost everywhere, and the high gas fee of L1 has almost no impact on large transactions (the incremental cost approaches 0). Therefore, most user behaviors (such as lending, token exchange, anonymous transfers, re-staking, etc.) prefer to use L1 directly when possible.

In the second example, assume that Bitcoin L2 is as secure as Ethereum L2, but users must use Bitcoin L2. Although limited operations can be performed on Bitcoin L1 through DLC and other means, most functions are still unavailable. Therefore, users are more dependent on Bitcoin L2.

The optimization direction of L2 depends on the target user group:

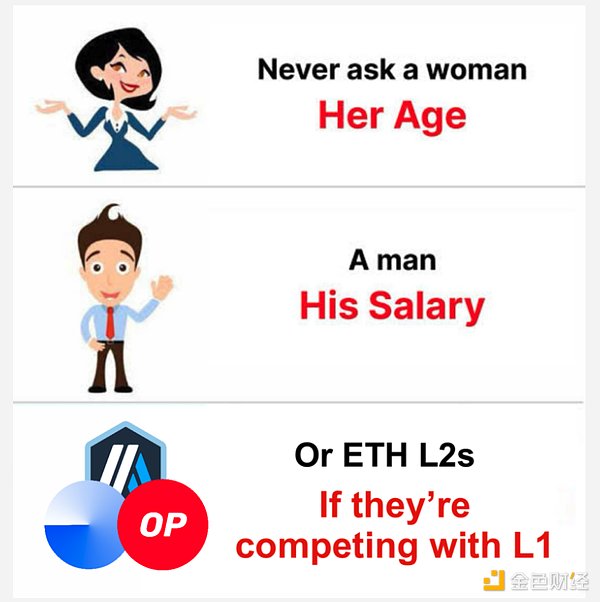

• Ethereum : Ethereum L2 is not over-optimized for security increments because for its target market (risk-lovers), additional security does not bring more business growth. Therefore, prioritizing speed over security is the primary strategy. Security will only become a bottleneck when L2 starts competing directly with L1 to attract large capital.

• Bitcoin : With Bitcoin L2, security will become key sooner. Currently, the basic needs of both risk-lovers and risk-averse individuals are not being met. Occupying the most secure Bitcoin execution layer will be extremely valuable, and this market is still open.

Two keys to victory:

• Absolute security : Assume that the most secure Bitcoin L2 is only 50% secure. Currently, all programmable execution layers using Bitcoin require the "honest majority" assumption (and sometimes even rely on more fraught security practices). If the security of L2 does not meet my minimum acceptable level, I will either choose to stay on L1 and give up the desired operation (such as gaining revenue or enhancing privacy), or move to a centralized product (which is a worrying trend at the moment).

• Relative security : If there is an L2 that meets the minimum acceptable security and can complete my target operation, then I will choose the most secure L2 when other conditions are equal.

Compared to Ethereum, building Bitcoin’s preferred programmable execution layer is a massive market in its own right, with relatively few competitors:

• Less competition : There are not many teams in the world with the ability to promote the cutting-edge development of Bitcoin L2 technology. Developing Bitcoin-related technology is extremely difficult, with multiple breakthrough research efforts required in the past year alone to advance current state-of-the-art designs, and more technical challenges will need to be solved in the future. However, most Bitcoin L2s choose shortcuts and sacrifice security.

• The market is huge : Head L2 will attract the vast majority of applications, capital and developers. Bitcoin’s limited decentralization capability (DA) also determines that only a few execution layers can take full advantage of its security guarantees.

Although there will still be some risk-loving Bitcoin capital flowing to L2 with compromised security, this market is smaller and more competitive. In fact, it is likely that the security L2 that ultimately "wins" will also host a lot of this activity, as speculation tends to follow projects that appear valuable or interesting. For example, in the past year, the NFT craze on Bitcoin was obviously dominated by speculation, and Bitcoin was not optimized for these, but users were still willing to pay high costs to participate because it was "fun."

Furthermore, the eventual "winning" L2 is likely to scale to attract more users willing to accept lower security compromises. For example, they may extend to selective data availability (volitions) and L3 layers to provide lower-cost non-Bitcoin DA options.

Alpen Labs

Bitcoin's dominant L2 needs to be as close to Bitcoin itself as possible, and security is particularly critical here. Therefore, building this L2 must rely on the team at the forefront of Bitcoin scaling R&D. Additionally, Bitcoin culture may also play an important role, so the team also needs to be truly serious Bitcoin supporters with a long-term commitment to the Bitcoin vision.

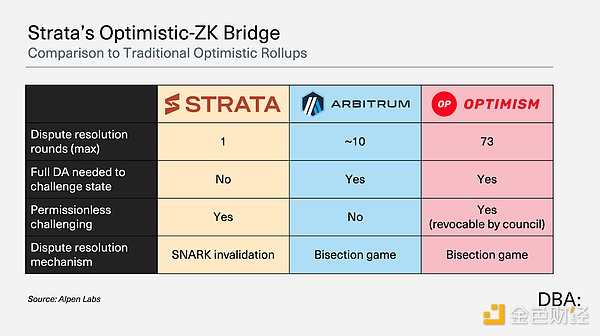

The DBA considers Alpen Labs to be this team . They are building Strata, which we expect will become the dominant execution layer for Bitcoin. Specifically, Strata is a Bitcoin-based zkEVM Rollup (using SP1) equipped with hybrid optimistic-ZK bridging technology.

Alpen Labs has been working on expanding and enhancing Bitcoin with zk-SNARKs since 2022. They are undoubtedly one of the most impressive and principled teams we have ever seen. We are very pleased to be able to support them.

They have made unparalleled contributions to the field, work that ultimately led to the design of Strata:

• Trey Del Bonis : In early 2022, Trey released a design proposal on how Bitcoin’s ZK-Rollup works.

• John Light : Later in 2022, John wrote the landmark "Bitcoin Validity Rollup Report", which brought Bitcoin Rollup into public view and ignited a large amount of research work in this field.

• Simanta Gautam : In January 2023, several members of Alpen Labs (including Sims) co-authored "ZK-Rollup on Bitcoin: A Technical White Paper" (summarized in a talk at BTC++).

• Liam Eagen : In April 2024, Liam co-authored the breakthrough paper "On Proving Pairings" (summarized in a speech at the DBA Annual Research Day), which was critical to the implementation of Strata Bridge. He also co-authored other important research, such as Shielded CSV: Private and Efficient Client- Side Validation.

In addition, they help popularize concepts through easy-to-understand resources, such as David Seroy's whiteboard courses on Bitcoin Rollup and Strata bridging technology based on BitVM2. The team is growing.

This high-caliber team is necessary to build the most secure Bitcoin bridging technology, now and in the future. With possible future Bitcoin soft forks (such as re-enabling OP_CAT), the design will further evolve and be enhanced to provide better bridging solutions.

Strata

Let's dig into Strata's design.

ZK-Rollup: basic functions

In fact, building a ZK-Rollup on Bitcoin is relatively "simple". You can easily launch a sovereign ZK-Rollup, utilize Bitcoin blocks to store the Rollup data, and create proof of its validity. Rollup clients can easily verify data availability and correctness, ensuring its security.

However, if you want to establish a two-way bridge between Bitcoin and Rollup, things are much more complicated. This bridging is the key to transferring BTC into Rollup, but to achieve this we need a mechanism for Bitcoin nodes to verify off-chain execution.

In October 2023, Robin Linus's BitVM paper proposed a mechanism for optimistic verification on Bitcoin, which was a major breakthrough. However, the initial implementation was relatively cumbersome and inefficient, had some open security issues, and the prospects for practical implementation were unclear.

This technology has made significant progress over the past year. As the technology matures, some of the early concerns, such as liquidity pressures, have been alleviated. Strata Bridge is a hybrid optimistic-ZK bridging technology inspired by the BitVM2 paper. Alpen Labs worked with other members of the BitVM Alliance to lay the foundation for its bridging technology. Strata Bridge is based on the original BitVM design and optimized with multiple latest research results to make it more practical, scalable, capital efficient and secure.

Ultimately, Strata was able to build a ZK-Rollup based on Bitcoin and achieve BTC's 1/n trust assumption through a hybrid optimistic-ZK bridge. This is Strata .

If you want to dive into the technical details, I recommend David Seroy's Strata Bridge whiteboarding course, as well as Alpen Labs' blog post where they detail the design and prototype implementation.

This is no longer the BitVM of a year ago, nor the "honest majority" sidechain of today. The security model of 1/n is already excellent , and future Bitcoin upgrades (such as OP_CAT) may enable L1 to support direct ZK verification, achieving a completely trustless design.

Strata Devnet has been live and open source for several months. The complete Strata Bridge implementation will be released with the public testnet in a few weeks, and the mainnet is expected to go online within this year.

The current market severely underestimates the latest advances in Bitcoin L2 technology.

Make Bitcoin stronger

As a Bitcoin supporter and Alpen Labs investor, my goal is not only for Strata to "win" in the existing Bitcoin L2 market, but also for the entire market to grow.

Bitcoin is already the preeminent crypto asset. It has a fascinating story (e.g. it was the first crypto asset, had an anonymous founder). Its basic economic properties are also impeccable (e.g. fixed supply).

However, BTC has other functional shortcomings compared to traditional assets such as gold and other cryptoassets such as ETH and USDC. It lacks native strong privacy, scalability, speed, ease of self-custody, interoperability with other assets, basic DeFi features, and more. These features are very important. This is why on-chain USD stablecoins continue to cannibalize the off-chain USD. The strength of a given asset as a "money" depends on many different properties, and programmable currencies are even stronger.

Unfortunately, for BTC to be scalable and programmable these days, some of its other best features—self-custody, seizure resistance, and permissionless use—have to be completely sacrificed. So, can we have our cake and eat it too?

A better L2 is needed to bring this functionality and scalability to BTC without any sacrifices. They will release BTC the same way crypto orbit releases USD. They will make BTC a better currency.

Specifically, BTC is currently primarily used as a SoV ("digital gold"). It is rarely used as a UoA or MoE ("electronic cash"). Adding the features described here will enhance BTC's capabilities for all three currencies. If BTC aspires to become a MoE and UoA, then making BTC more usable is obviously necessary. However, I often hear the argument that if BTC limits its ambitions to SoV ("digital gold"), then it doesn't need this. I strongly disagree. Even digital gold needs privacy, better self-hosting, and scalability. If the ownership and use of BTC becomes primarily custody and centralization (without even a reliable decentralized backup), it will be hard-pressed to even beat shiny gold. Additionally, you should be able to make your SoV work - BTC is the original collateral (e.g. for DeFi) and is currently underutilized.

If we cannot safely add scalability and functionality to BTC, users will be forced back into the hands of intermediary financial institutions, the kind of institutions we have been working to move away from since the first line of the Bitcoin whitepaper:

-

If we don’t make BTC self-custody and private payments easier and more scalable, we will eventually be dominated by dominant BTC custodians and payment providers.

-

If we don't enable basic BTC DeFi, we will end up with BTC CeFi.

-

If we don't build the most secure and decentralized L2 bridge, we will end up like cbBTC, creating a centralized bottleneck even in the so-called "DeFi" ecosystem.

This has been known for a long time, as Hasu described it many years ago, "We have to ensure that we can meet sufficient market demand with trustless capacity, otherwise the custodial banking system will forever hinder the development of the base layer." Modern L2 technologies such as Strata Crucial to ensuring this never happens.

Additionally, as block rewards disappear, these L2s are the best way to provide Bitcoin miners with a stable security budget in the long term. It is unclear whether simple L1 BTC transfers will be enough to meet demand. Expanding the use of Bitcoin as a DA layer appears to be the most effective way to provide stable income. It will diversify BTC activity types and enable more activity (in the same amount of L1 data, you can accommodate more L2 transactions than L1 transactions), thereby increasing the economic density of L1 transactions. Bitcoin is unique in that it is actually able to continuously charge a premium for DA given the need to use BTC with minimal trust. I think this is likely to happen because currencies have the strongest network effects among cryptocurrencies, and BTC is the king.

No matter what type of Bitcoin supporter you are, introducing these features is crucial:

• Bitcoin Evangelists : The main goal is to make Bitcoin have a positive impact on society.

• Bitcoin Mercenaries : The main goal is to get the price of $BTC to rise, even if this may be accompanied by a managed surveillance society utopia.

For missionaries, privacy, scalability, and ease of use are necessary for Bitcoin to have a positive social impact.

For mercenaries, these features make Bitcoin a better currency, thereby increasing adoption and price. Additionally, Bitcoin’s security budget also needs to be addressed, which is critical to its long-term impact and price growth.