The first community release exceeded expectations by 15 times and was postponed. Will Solayer, which has updated its narrative a few times, become a dark horse?

Reprinted from panewslab

01/14/2025·25days agoAuthor: Frank, PANews

At the beginning of 2025, new activities on the SVM track on Solana frequently ignited various hair-raising groups. First, the Sonic SVM airdrop sparked discussion on social media, and then another Solana ecological project, Solayer, announced that it would be launching a community sale, once again triggering the market's enthusiastic imagination about wealth cryptography.

According to many social media accounts, due to Solayer’s KYC rules, the prices of accounts that resell overseas KYC information have increased. There are also many hairy bloggers jokingly posting pictures of collecting KYC information in African countries. In the face of such popularity, Buidlpad, the partner that jointly conducted this sale with Solayer, urgently announced on January 13 that because the number of registrations far exceeded imagination, it would postpone the Solayer community sale by 3 days to January 16 to ensure fair distribution. .

Is Solayer's popularity a result of the market's new expectations for the SVM track, or is the project itself a dark horse potential?

From re-staking to hardware acceleration, three narrative updates in one

year

Solayer is a relatively young project, founded in 2024. In less than a year since its establishment, Solayer has completed many narrative transformations, and it seems that it can hit the mark in time every time.

At the beginning of its creation, Solayer was positioned as a re-pledge protocol. After the mainnet went online in August, it became a popular re-pledge protocol on the Solana chain. In the same month, it successfully completed a US$12 million seed round of financing. This round of financing was led by Polychain Capital, with participation from Binance Labs and Arthur Hayes family office Maelstrom. The post-investment valuation reached US$80 million. Previously, Solayer also completed a Pre-Seed round of financing of an undisclosed size, with investors including Solana co-founder Anatoly Yakovenko and Polygon co-founder Sandeep Nailwal.

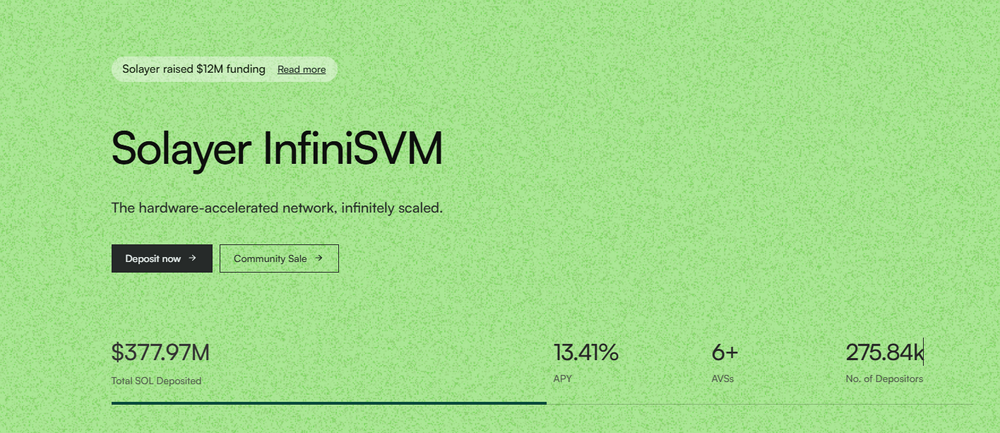

In the field of re-staking, Solayer has also achieved good results. As of January 13, its official data shows that the current TVL amount has reached 370 million US dollars, the number of depositors is approximately 275,000, and the average annualized income The rate reached 13.41%. Ranked ninth among Solana’s TVL and sixth among all re-staking protocols.

However, re-pledge does not seem to be the ultimate goal of Solayer. In October, Solayer launched the RWA narrative and launched the synthetic stablecoin Solayer USD. This is a stablecoin asset also based on treasury bonds. It has the same characteristics as the USD0 launched by Usual some time ago. Different approaches but similar results. The current market capitalization of this stablecoin is approximately US$30 million, ranking sixth in the Solana ecosystem. Of course, this volume is still relatively small in the entire network, ranking only 46th.

In December, Solayer quietly updated its blog with an article titled "Software Expansion Has Reached Its Limit - The Future Lies in Hardware Expansion." The article proposed that with the state fragmentation, throughput limitations, latency and cost, and system complexity, Problems such as these have caused the current software upgrade of the Ethereum EVM layer 2 network to reach a bottleneck period, and the high performance of Solana and Sui also comes from the characteristics of software simplification and hardware acceleration. However, in this article, Solayer did not reveal that its next plan is to upgrade its hardware to become the fastest network on the entire network.

Million TPS, 100Gbps, technical narrative is still effective

Until January 7, Solayer released its 2025 roadmap. Through hardware expansion, Solayer will launch the first novel hardware expansion SVM, which can achieve 1M TPS and 100Gbps. PANews learned from the white paper that Solayer proposed the technical principles to achieve million-level TPS and 100Gbps bandwidth. The core of the technology comes from a hardware acceleration technology called Infiniband RDMA, which can achieve microsecond-level cross-node communication. This technology can be divided into two parts. One part is Infiniband (wireless bandwidth), which is a high-performance network architecture used to efficiently connect computing nodes, storage systems and other devices. It is widely used in supercomputers and data centers.

Another core technology is RDMA (Remote Direct Memory Access), which allows devices to directly access the memory of remote nodes without operating system intervention. This "zero-copy" communication method greatly reduces CPU load and communication delays. It is understood that these two technologies are currently mainly used in fields such as high-performance computing (HPC), artificial intelligence and machine learning, finance and distributed storage. Solayer should be the first to adopt it in blockchain networks. For now, it is uncertain whether this technology can be realized.

Judging from the team’s experience, Rachel Chu, the founder of Solayer, was a core developer of Sushiswap. Another co-founder, Jason Li, graduated from Berkeley University with a major in computer science and had previously created the non-custodial Web3 wallet MPCVault. In addition, on January 8, Solayer also announced the acquisition of Fuzzland, a smart contract hybrid fuzzer company. According to reports, one of the tasks of this acquisition is to focus on building a hardware-accelerated SVM chain.

Community sale sparks participation boom

On January 9, Solayer announced its first community sale in partnership with Buidlpad. According to published information, the total issuance of LAYER tokens is 1 billion, and this sale is 30 million. The total amount raised is US$10.5 million. The average price of the token is approximately US$0.35. The token calculated based on this The valuation is US$350 million. 100% of LAYER tokens from the community sale will be unlocked on the day of the Token Generation Event (TGE).

In addition to the token sale, Solayer also released a debit card called the Solayer Emerald Metal Card, a virtual + physical debit card in partnership with Visa that can be used online and offline for export and fiat spending. The exact timeline for this product will be announced separately by Solayer. Users who participate in this sale will have the opportunity to receive a Solayer Emerald Metal Card. Previously, it was common to see token sales issuing whitelists to users who own certain hardware or products. Solayer’s model of buying coins and getting cards is relatively rare.

No matter what the considerations are, various hairdressing studios and many crypto KOLs have posted tweets on social media about rushing to register for KYC. Taking the newly launched Sonic SVM as an analogy, the current market value of SONIC tokens is approximately US$240 million, and the fully diluted market value is approximately US$1.6 billion. In addition, the market seems to have higher expectations for Solayer. Even based on the expected market value of US$1.6 billion, LAYER's expected value increase seems to have room for 4 to 5 times.

As expected, the KYC subscription for LAYER is particularly popular. According to Buidlpad, the current number of registrations is more than 15 times the expected number, and they have also noticed a large number of robots and hair-raising studios. Therefore, we had to suspend registration and postpone the sale to January 16.

Of course, we cannot predict the performance of LAYER after its launch. Judging from Solayer's development history in just one year, from re-staking to RWA, to hardware acceleration and encrypted payment cards, at least in terms of narrative and rhythm control, we can Seeing that this team has full experience, Following a route similar to Hyperliquid's delivery of products first and then technology, if the technical strength and operational strength behind it can be matched simultaneously, it can achieve the goal of one million TPS and a new technological milestone of millisecond transaction speed, Solayer will truly become the next A rising star that cannot be ignored. The outcome of all this depends on when Solayer can bring the product to the market.

jinse

jinse

chaincatcher

chaincatcher