The ironic answer to de-dollarization: The crypto killer app is the dollar itself

Reprinted from jinse

01/13/2025·29days agoAuthor: Jeff Lewis, hedge fund product manager at Pantera Capital; Erik Lowe, content director at Pantera Capital; Compiled by: 0xjs@金财经

The growing trend of de-dollarization, in which countries and institutions no longer rely on the U.S. dollar for global trade and financial transactions, has raised concerns about the U.S. dollar’s long-term dominance.

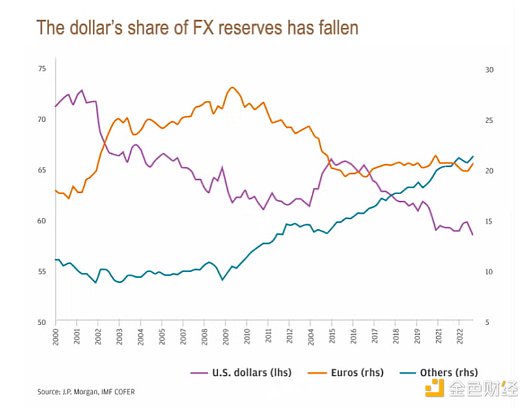

The most common measure of dollar dominance - the greenback's share of foreign exchange reserves - has been on a long-term downward trend, down 13 percentage points since 2000.

We believe this trend is about to reverse, ironically driven by what most U.S.

policymakers and central bankers five years ago considered to be the

accelerators of the dollar’s decline: blockchain technology and

tokenization. What was once seen as a potential destroyer of the dollar's

status is now becoming its biggest enabler.

We believe this trend is about to reverse, ironically driven by what most U.S.

policymakers and central bankers five years ago considered to be the

accelerators of the dollar’s decline: blockchain technology and

tokenization. What was once seen as a potential destroyer of the dollar's

status is now becoming its biggest enabler.

" The most ironic outcome is the most likely." - Elon Musk

super dollar

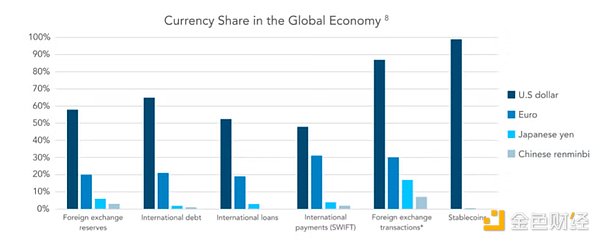

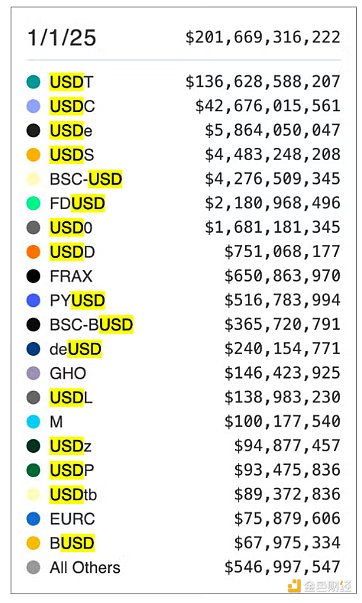

The public chain enhances the circulation of legal currency, allowing the world 's 5 billion smartphone users to easily use legal currency and enabling easy cross-border flow. The demand for tokenized fiat currencies, known as stablecoins, has created a massive industry worth $200 billion, in which the U.S. dollar dominates. Castle Island and Brevan Howard released a report, which includes the chart below, showing the almost 100% dominance of USD collateral among stablecoins relative to other economic categories.

Source: Castle Island and Brevan Howard reporting

Among the top 20 fiat-backed stablecoins, 16 have “USD” in their names.

Source: rwa.xyz

In the 16 years since the birth of blockchain, people’s general views on it have hardly changed. Bitcoin’s original advocates did see the cryptocurrency’s potential to challenge the U.S. dollar’s dominance. In recent years, Bitcoin has been increasingly viewed as a store of wealth rather than a medium of exchange, minimizing its threat in this regard. The rise of the stablecoin/RWA phenomenon enables blockchain to deliver on Bitcoin’s original promise of providing a stable and ultimately profitable means of transactions. Far from weakening the dollar 's correlation, it strengthened it.

emerging markets

In emerging markets, dollar-backed stablecoins are a practical alternative to holding physical cash or relying on fragile banking systems. Given a choice, merchants and citizens in countries with unstable currencies will increasingly prefer the stability of a digital dollar. In a report by Castle Island and Brevan Howard, they published the results of a survey of existing cryptocurrency users in emerging markets. A key takeaway: dollar-denominated savings are a huge driver of emerging markets.

-

47% of respondents said they use stablecoins primarily to save in U.S. dollars (this is slightly lower than the 50% who use stablecoins primarily to trade cryptocurrencies or NFTs)

-

69% of respondents have exchanged their national currency for stablecoins that are not used for transactions

-

72% of respondents expect increased use of stablecoins in the future

Note: Countries surveyed include Nigeria, Indonesia, Türkiye, Brazil and India

Whether the user is a small consumer or a multinational corporation, the U.S. dollar is likely to crowd out other local currencies as economic agents tend to choose the safest and most liquid currencies.

In America’s Best Interests – Stablecoin Legislation in 2025?

Legislative momentum is building, with the Trump administration expected to pass stablecoin-focused regulations. There is bipartisan support for Patrick McHenry’s Stablecoin Bill, which was originally proposed in 2023 and was recently introduced in the House of Representatives by Rep. Maxine Waters. Stablecoin legislation has long been viewed as the first step toward achieving regulatory clarity in the United States. We believe we will see meaningful progress in 2025, especially as policymakers increasingly recognize the strategic role of stablecoins in expanding the U.S. dollar’s influence.

Stablecoins are in the best interest of the United States because they will increase the proportion of transactions denominated in U.S. dollars and create demand for U.S. Treasury collateral.

A country with $37 trillion in outstanding debt needs distribution of fiat currency, and cryptocurrencies can provide this distribution.

Stablecoins Vs. CBDC

For the sake of clarity, fiat-backed stablecoins and central bank digital currencies (CBDC) are two similar but fundamentally different technologies and should not be conflated.

JPMorgan Chase published a report in October on the growing trend of de- dollarization. One of the potential drivers they highlighted was the push to automate payments through new technologies. They mentioned projects such as mBridge, a multi-central bank digital currency initiative, as potential alternatives to U.S. dollar transactions.

While emerging payment systems such as foreign CBDCs further fuel de- dollarization pressures, we believe the booming market for USD-backed stablecoins contradicts this narrative. We believe that stablecoins built on decentralized, permissionless blockchains will be preferred as they offer better privacy, censorship resistance, and cross-platform interoperability .

Meeting demand for U.S. Treasuries with tokenized products

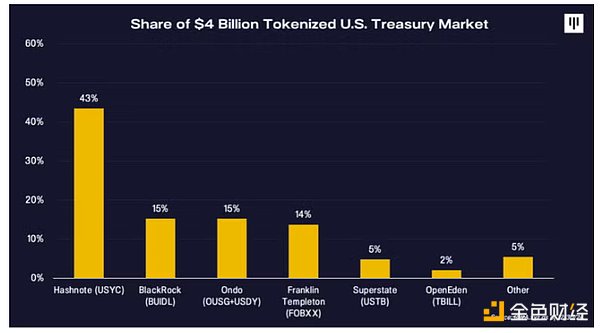

According to the U.S. Treasury Department, $120 billion of stablecoin collateral is invested directly in U.S. Treasury securities, which has led to increased demand for short-term securities. In addition to stablecoins, direct tokenization of U.S. Treasuries is also a growing trend. Companies such as BlackRock's Securitize, Franklin Templeton, Hashnote and Pantera portfolio company Ondo all control this $4 billion market.

Ondo offers two core products in this area:

-

USDY (U.S. Dollar Yield Token): Tokenized notes collateralized by short-term U.S. Treasury bonds and bank deposits, providing stable, high-quality income to non-U.S. investors.

-

OUSG (Ondo Short-Term U.S. Government Securities): Provides liquidity exposure to short-term U.S. Treasury securities, allowing qualified purchasers to mint and redeem immediately.

Products like USDY provide people living overseas with easier access to U.S. dollars and Treasuries than traditional channels.

A new era dominated by the dollar

Far from weakening the hegemony of the US dollar, blockchain technology has created a digital infrastructure that consolidates the hegemony of the US dollar. The ability to tokenize and mobilize U.S. dollar assets globally keeps the U.S. dollar indispensable, even as geopolitical and technological forces drive pressure to de-dollarize. As JPMorgan notes in its report, the structural factors supporting the dollar’s dominance — deep capital markets, rule of law and institutional transparency — remain unparalleled. Stablecoins extend these advantages to a digital, borderless environment.

The U.S. dollar was once seen as the weak side in the face of blockchain innovation, but now it has become its biggest beneficiary. Blockchain’s “killer app” may well be the U.S. dollar itself , demonstrating how the technology can transform traditional power structures while strengthening them. With the emergence of supportive regulatory frameworks and growing demand for tokenized assets, the U.S. dollar’s move on-chain could solidify its position as a cornerstone of global finance. Whether U.S. regulators or lawmakers are Democrats or Republicans, they will all agree that any force supporting demand for U.S. Treasuries is a force that should be leveraged, not resisted, making meaningful regulatory progress all but a fait accompli.

panewslab

panewslab

chaincatcher

chaincatcher