The market rebound is over, and the next positive news is Trump firing Powell?

Reprinted from panewslab

04/11/2025·18DAuthor: Luke, Mars Finance

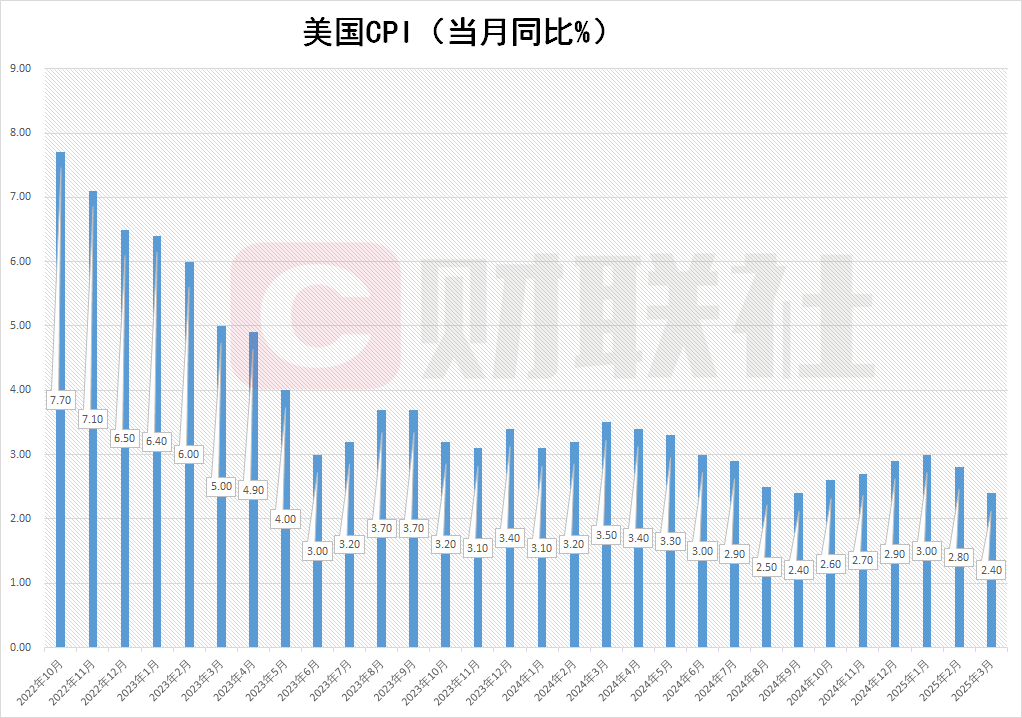

The U.S. financial market is experiencing drastic turmoil. The March CPI data unexpectedly showed that inflation had cooled down, and the year-on-year growth rate of core CPI hit the lowest in four years and fell for the first time in five years. However, the threat of the Trump administration's high tariff policy quickly overshadowed the positive, raising concerns about the escalation of the trade war. U.S. stocks, the U.S. dollar and cryptocurrencies were sold, with safe-haven assets gold, the Japanese yen and the Swiss franc rising strongly. Amid the market panic, a bold guess emerged: Will Trump fire Fed Chairman Powell become the key to saving the market? This article starts from the current market situation, analyzes this possibility, explores the legal, procedural and market impact in depth, and reveals the game between Trump and the Federal Reserve.

CPI's favorable benefits are covered up by the tariff war, and the market

panics again

The March US CPI data should have injected confidence into the market. The year-on-year growth rate of core CPI fell to its lowest in four years, and the month-on-month decline was the first time in five years, suggesting that inflationary pressures were easing. However, Trump's 145% tariffs on China and the high tariff threats to Mexico and Canada have ignited panic in the global trade war. Expectations that tariffs could push up prices quickly overwhelm positives, and investors turned to safe-haven.

On Thursday, the three major U.S. stock indexes failed to continue their rebound on Wednesday. The S&P 500 fell by more than 6% during the session, approaching the circuit breaker, and closed down 3.46%. Technology stocks led the decline, with Tesla falling more than 7%. The cryptocurrency market was also sluggish, with Bitcoin falling 5.2% and Ethereum falling 11.7%. The US dollar index hit its biggest single-day decline since 2022, with an intraday decline of more than 2%. The safe-haven currency Swiss franc rose nearly 4% against the US dollar, marking its biggest intraday gain in 2015; the yen rebounded simultaneously. Gold performed well, with spot gold breaking through US$3,170 during the session, setting a record high, with an increase of about 3%.

The bond market reflects complex sentiment. Ten-year U.S. Treasury yields once rose by more than 10 basis points, indicating that inflation expectations are heating up. After the release of CPI data, the two-year U.S. Treasury yield plunged by more than 10 basis points, and the short-term yield fell. Market turmoil stems from the dual threat of tariff wars: pushing up prices and dragging growth. This has attracted much attention from the Federal Reserve policy, and the contradiction between Trump and Powell has become the focus of the market.

Can fire Powell save the market?

In the market downturn, Trump's firing of Powell was seen by some investors as a potential turning point. The idea is that if Powell is replaced by a loose-minded chairman, the Federal Reserve may cut interest rates quickly to ease the pressure on stock markets and cryptocurrencies by high interest rates. If the tariff war pushes up the US dollar, the new chairman may cooperate with exchange rate intervention to boost export competitiveness. This expectation is quite attractive under the desire to cut interest rates.

However, reality is far from that simple. The firing of Powell may shake the independence of the Federal Reserve and trigger violent market fluctuations. The new chairman may not be completely obedient to Trump. Historically, the change of chairman has always been accompanied by uncertainty rather than immediate favor. In addition, inflationary pressures triggered by tariffs may limit the room for interest rate cuts. Whether Powell can really become a "saving drug" needs to be analyzed in depth from the perspective of law and procedurally.

Trump’s grudges with the Federal Reserve: Why is it incompatible?

The conflict between Trump and the Fed is a naked political showdown, and the core lies in his firm belief that the Fed is interested in "cooperating with Biden and targeting himself" under the leadership of Powell. This perception not only stems from policy differences, but is also deeply rooted in Trump's persistence in political loyalty and suspicion of "establishment" manipulation.

Evidence of "favoritism" in Trump's eyes

Trump has repeatedly accused the Fed of "too cooperating" during Biden's term. From 2021 to 2022, the Fed maintained low interest rates to support the post-epidemic recovery, which coincided with Biden's push for a massive stimulus package, which Trump interpreted as a "secret help" to the Democratic Party's agenda. In contrast, Powell has gradually raised interest rates since 2018 and maintained high interest rates from 2023 to 2024 due to high inflation. Trump believes that this directly weakens his economic growth commitment and trade war offensive. He repeatedly declared at the 2024 campaign rally: "Powell obeys Biden's words, but destroys me." Although this narrative lacks direct evidence, it caters to his supporters' distrust of "deep state" and strengthens Trump's image as a challenger in the system.

The Fed 's "political motivation" false

From a political standpoint, the independence of the Federal Reserve itself is Trump's target. Powell stressed that decisions were based on data, but Trump saw it as a "political disguise." He believes that the Fed, as part of the Washington establishment, is naturally inclined to uphold the Democratic Party's preferred stability rather than support its radical "America First" change. For example, Powell's tolerance of inflation at the beginning of Biden's term was interpreted by Trump as "letting the Democratic Party out of money", while high interest rates during his term were regarded as "intentional constraints." This cognitive bias stems from Trump's extremely demanding loyalty: any institution that does not fully cooperate is labeled as "hostile".

Amplification effect of historical background

Trump's suspicion is not groundless. Frictions with Republican presidents in the history of the Federal Reserve are not uncommon, such as the criticism of Wallach during the Reagan era. But Trump's situation is even more special: he came to power with an "anti-establishment" attitude, and regarded the Federal Reserve as a symbol of the elite. Powell was nominated by Trump, but did not show his expected loyalty. Instead, he emphasized independence many times in public, and even hinted in 2023 that he would not adjust his policies due to pressure from the White House. This sense of "betrayal" convinced Trump that the Fed led by Powell intends to stand on its political opposition and continues the Democratic "moderate" line.

The catalysis of voter resonance

Trump has portrayed the Fed as an "anti-public opinion" bureaucratic machine, igniting the anger of grassroots voters towards elite institutions. He claimed that Powell “puts workers and businesses suffering” and blames high interest rates as “betrayal of ordinary Americans.” This political rhetoric not only strengthens its image as a "fighter", but also conceals the complexity of the Fed's independence and further solidifies the narrative "for Trump".

Trump's attempt to fire and historic precedent

Trump's dissatisfaction with Powell has long been made public. During the 2024 campaign, he repeatedly threatened to fire Powell. In February, he called Powell "misjudged inflation" and threatened to "fire him if he doesn't obey." In July, he said the Fed chairman should obey his orders "like an adviser." These remarks have triggered fluctuations in the U.S. dollar and U.S. Treasury yields, showing market sensitivity to its intentions.

Trump's actions go beyond words. On April 9, Supreme Court Chief Justice Roberts signed an order to temporarily allow Trump to fire NLRB and MSPB members, suspend the lower court (the District of Columbia Circuit Court of Appeals) and require relevant parties to respond by April 15. The case challenges the Humphrey Enforcer precedent and intends to expand the president's control over independent institutions. If successful, it may open a legal gap for the firing of Powell. Trump tried to interfere in the Fed in his first term, put pressure on interest rate cuts and nominated close friends to the board of directors, but none of them completely succeeded, showing that his long-term goal is to reshape executive power.

Whether Trump can fire Powell depends on the three factors of law, procedure and market. The following analysis is one by one.

1. Legal constraints and the key role of the Supreme Court

The Humphrey Executive stipulates that leaders of independent institutions can only be fired for "just reason" (such as malfeasance). The Federal Reserve Act provides similar protections to the Federal Reserve Chairman, with Powell serving until May 2026. Trump's Supreme Court requested that institutions such as NLRB should not be protected from dismissal. He may make similar arguments to the Fed, saying that monetary policy has far-reaching implications and that the chairman should be under the direct control of the president.

The Supreme Court has tended to expand presidential power in recent years. The 2020 Seila Law case ruled that the removal of CFPB director from a single-leader was unconstitutional; the 2021 Collins case further restricted protection. But the Fed is managed by a seven-member council and meets the "multi-member expert committee" standards of the Humphrey Executive, and its independence is even harder to shake. The April 9 interim order shows that the court is open to Trump’s claims, but the final ruling (expected summer 2025) may only target the NLRB/MSPB and may not necessarily cover the Fed.

If Humphrey Executor is overturned, Trump may fire Powell on the grounds of policy differences, but "justified reasons" are required. Powell is difficult to be accused of malfeasance from a data-driven stance. If fired, he may file a lawsuit to delay the process.

2. Procedural and political resistance

After firing Powell, Trump needs to nominate a new chairman and confirm it by the Senate. Republicans control the Senate, but moderates may oppose radical candidates, and the nomination process may take months. During the transition period, the vice chairman or director shall act as a temporary chairman, and the policy may continue the status quo and weaken Trump's expected effect.

Politically, firing Powell may trigger party differences. Some Republicans support the independence of the Federal Reserve and are worried that interventions will cause economic turmoil. Powell is trusted in the financial industry, and his dismissal may trigger a rebound in public opinion. Internationally, the impairment of Fed independence may weaken the credibility of the US dollar and affect capital inflows.

3. Market and economic consequences

The firing of Powell could trigger short-term market turmoil. The dollar may fall due to independence concerns, and stocks may briefly rise due to expectations of interest rate cuts, but U.S. Treasury yields may rise due to inflation expectations. In the long run, if monetary policy is subject to political intervention, it may lead to out-of-control inflation and damage economic stability. The tariff war has intensified inflationary pressure. If the new chairman cooperates with interest rate cuts or exchange rate intervention, it may alleviate the overvalued US dollar, but the inflation risk will be amplified.

4. Possibility Assessment

- High probability (25%): The Supreme Court overturns Humphrey Enforcement, Trump tries to fire Powell, but lawsuits and Senate resistance may be blocked.

- Medium probability (55%): The court restricts the removal of post protection, Trump puts pressure on Powell to resign, but it is difficult to directly fire.

- Low probability (20%): The court maintains the status quo, and Trump can only indirectly influence the Federal Reserve by nominating the director.

Conclusion

US stocks and cryptocurrencies have fallen into a trough due to the cooling of inflation and the tariff war, and safe-haven assets have become a safe haven for funds. Trump's firing of Powell was seen as a potential positive, but legal and procedural obstacles complicated its prospects. The Supreme Court ruling will determine the president's control over independent institutions, while Powell's stay or stay depends on Trump's strategy and market response. In the short term, the market will struggle with uncertainty. Whether Powell can reverse the decline will still be verified if it is fired.