The "flywheel effect" miracle in the field of encryption Sonic: How to achieve counterattack through 190 million airdrops and FeeM models

Reprinted from chaincatcher

03/06/2025·1MAuthor: @arndxt_xo

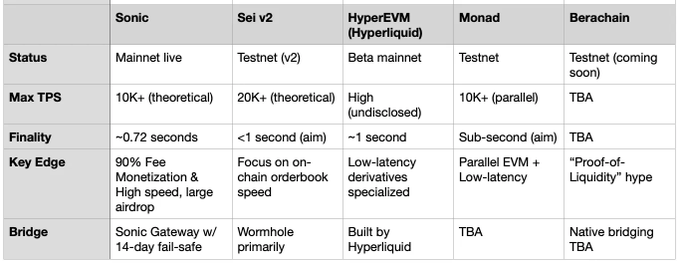

Among many blockchain projects, "Sonic" is the most underrated counterattacker. While Sei, Berachain and Monad were still in the testnet phase, Sonic was already online, with over 80 years of operating capital reserves, was rapidly accumulating TVL (total lock value) and rewarding developers in ways other chains have never tried.

With “10,000+ TPS” (transactions per second), “subsecond final confirmation time”, and a unique “FeeM model” (returning 90% of Gas fees to developers), Sonic is building a DeFi flywheel effect. In addition, Sonic has launched a "$190 million" airdrop program, attracting a large number of DeFi developers and revenue farmers.

This article will explore Sonic's background, technological advantages, token economic model and how to obtain up to "145,000% annualized rate of return (APY)" through participation in the ecosystem.

1. Background and Origin

At the end of 2024, Fantom was officially renamed "@SonicLabs", returning to the Layer-1 (L1) battlefield, focusing on speed, ecological incentives and cross-chain interoperability. In just a few months, Sonic's TVL has grown rapidly, and many new protocols have chosen to launch on its chain. More notable is Sonic's upcoming "$190 million token airdrop", a catalyst that has attracted a large number of DeFi developers and revenue farmers.

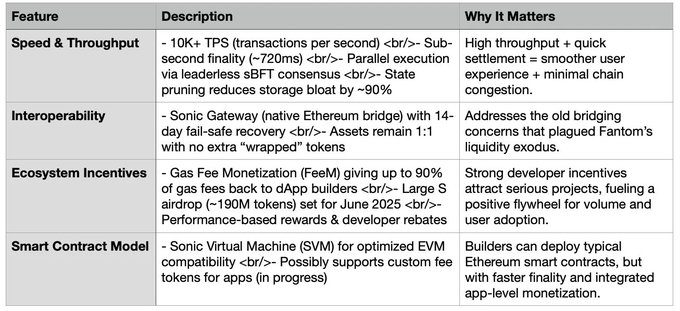

What 's unique about Sonic

- Online and Run: Sonic has processed real transactions, has real liquidity and users, while Sei, Berachain and Monad are still in the testnet phase.

- Developer-friendly: Through the FeeM model, Sonic returns 90% of Gas fees to dApp developers, motivating developers to build high-usage applications.

- Huge airdrop: 190 million $S tokens will be airdropped to users, with rewards including staking, liquidity provision (LP) and participation in ecological activities.

- Improvements to DeFi Best Practice: Sonic adopts and improves the ve(3,3) model while integrating state-of-the-art EVM scaling technology.

2. DeFi flywheel effect

The core of the DeFi flywheel effect lies in the time mismatch between capital

deployment and value realization:

1. Liquidity entry → Price rise → More users are pouring in.

2. Early participants receive rewards → more users join → Ecological growth

starts.

3. New participants hold, pledge or re-invest → Flywheel continues to

operate.

In 2022, Andre Cronje, a heavyweight in the DeFi field, launched the “ve(3,3) model” through the Solidly exchange on Fantom. This model combines Curve Finance's veToken mechanism with Olympus DAO's (3,3) game theory to reduce selling pressure and reward liquidity providers by locking in long-term tokens.

However, the flywheel effect is not sustainable. When liquidity growth slows down and early participants start to exit, the flywheel effect weakens. And Sonic's appearance is to solve this problem.

3. Sonic's technical advantages

1. Speed

- High throughput: 10,000+ TPS, suitable for large-scale DeFi and GameFi applications.

- Parallel execution: Through the leaderless sBFT consensus mechanism, Sonic can process transactions in parallel, increasing speed and maintaining security.

- Dynamic Gas model: Automatically adjust Gas fees according to needs to ensure low fees in high traffic scenarios.

2. Interoperability

- Sonic Gateway: There is no need to rely on third-party native cross-chain bridges to reduce centralized risks.

- Failure recovery system: Users can still retrieve assets even if the network or bridge is offline.

- 1:1 Asset support: Cross-chain assets do not need to be packaged, and they directly maintain their native value.

3. Incentive mechanism

- FeeM model: Developers receive 90% of transaction fees, incentivizing building high-usage dApps.

- 200M $S Airdrop: Through the Sonic Innovator Fund allocation, users receive airdrops by participating in ecological activities (such as providing liquidity, governance).

4. Smart Contract

- Sonic Virtual Machine (SVM): Optimizes Ethereum smart contract execution and reduces Gas fees.

- Custom Gas tokens: dApp can use its own tokens to pay for Gas fees to improve user experience.

4. Token economy and airdrop mechanism

$S is a native token for the Sonic network, with the following features:

- Transaction Fees: Used to pay Gas Fees.

- Verifier Operation: $S is required to run the verification node.

- Staking: Users can receive rewards by pledging $S.

- Governance: Token holders can participate in protocol governance.

Inflation and destruction mechanism

- Linear inflation model: an annual inflation rate of 1.5% lasting for 6 years and is used for ecological development.

- Destruction mechanism: Unused inflation tokens will be destroyed, ensuring the controllability of the token supply.

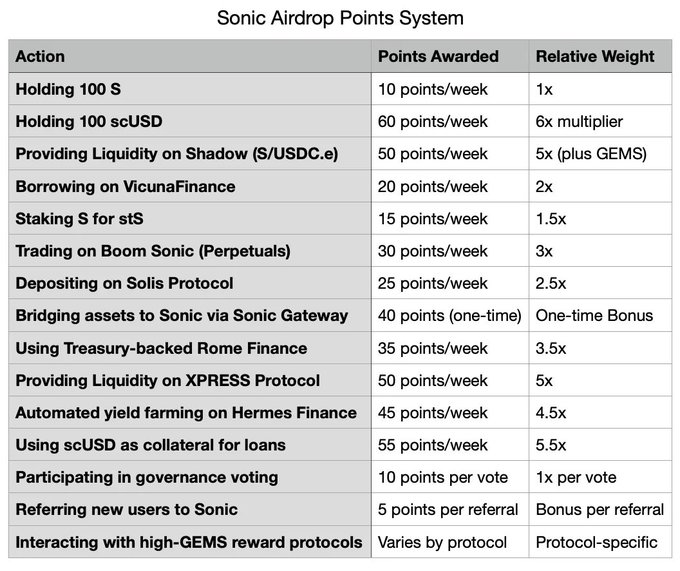

$190 million airdrop (June 2025)

- Purpose: To attract new users, reward early participants, and stimulate DeFi use.

- Points System: Users receive points by holding assets and participating in dApp activities (such as liquidity provision, borrowing and lending).

- Vacancy period: 25% of the airdrops can be collected immediately, and the remaining portion will be released gradually within 9 months.

5. Ecology and DeFi protocol

A number of leading DeFi projects have emerged in the Sonic ecosystem:

Shadow on Sonic: Centralized liquidity DEX with x(3,3) model, TVL is over $100 million.

Stout: Lending and lending agreement, synergize with stable assets such as

scUSD.

Boom Sonic: Perpetual contract DEX focusing on advanced trading features.

Snake, EGGS, Vicuna Finance: Provides liquidity mining and lending

opportunities with high APR.

6. Profit Opportunities

Sonic offers DeFi farmers a wealth of profit opportunities:

- High APR DEX mining: For example, S/USDC.e or USDC.e/EGGS trading pairs, the APR can reach more than 1000%.

- Lending and liquidity staking: Stake $S through MySonic or a third-party LSD provider to get 5-8% APR.

- Airdrop Multiplication: Further increase airdrop points through protocol-specific GEMS rewards.

7. Comparison with other L1s

Sonic has a significant first-mover advantage in the next generation of high-speed EVM L1. While competitors are still in the testnet phase, Sonic has attracted real liquidity and users. Its high throughput, sub-second final confirmation time and developer incentive mechanism give it a place in the future of DeFi multi-chain.

8. Conclusion and Prospect

Sonic attempts to reproduce Fantom's success and surpass it through high throughput, developer incentives and secure cross-chain bridges. In the short term, Sonic has the upper hand in the competition with its advantages of real-time use, fresh liquidity and parallel EVM execution. However, sustainability after airdropping in June 2025 remains its biggest challenge. If user activity and developer confidence can continue, Sonic is expected to occupy an important position in the multi-chain future of DeFi.

panewslab

panewslab

jinse

jinse