The "peer-to-peer tariff war" has entered the second stage, and global risky assets have begun to bottom out

Reprinted from panewslab

04/15/2025·11DThis week, BTC opened at $78,370.15 and closed at $84,733.07, up 6.84% for the whole week, with an amplitude of 14.89%, and the trading volume continued to significantly increase. Since late January, BTC prices have effectively broken through the upper edge of the downward channel for the first time. Approximate the 200-day moving average.

Trump's "peer-to-peer tariff war" is still the largest independent variable in global macro finance this week. Its dramatic performance shocked the world, and China's counterattack revealed the strongest counterattack.

In the "collision game", the first person who blinks his eyes is likely to lose. The tariff war against the world has triggered either explicit or implicit reactions from global forces, including not limited to political, business and capital levels.

This ultimately led to capital fleeing the US market, and the US "stocks, bonds, and foreign exchange" achieved a rare triple kill.

Faced with the huge financial crisis, the Trump administration chose to make concessions, or partially suspend the implementation of reciprocal tariffs, or reduce the intensity to supplement the list of exempted goods, and release goodwill to face its biggest rival China at the public opinion level. Since then, the "peer-to-peer tariff war" has gradually entered the second stage, and many parties will start negotiations and compromises.

The risk equity market, which had previously plummeted due to the first phase, ushered in a sharp rebound. Perhaps the most terrible stage caused by the "peer-to-peer tariff war" has passed, but subsequent chaos will continue to dominate various markets. The reciprocal tariff crisis will neither pass easily nor be easily avoided from triggering new crises. Whether the conflict will escalate after subsequent "reciprocal tariffs", whether the Federal Reserve will cut interest rates in a "timely manner" and whether the US economy will fall into recession have become the main observation points.

Policy, macro finance and economic data

Because most countries are unable to counter "reciprocal tariffs", China and the EU's countermeasures have become the main force in resisting US hegemony, and China, which is tit-for-tat, is the mainstay.

After several rounds of confrontation, the US tariffs on China increased to 145%, and China's counter-tariffs on the US increased to 125%. This has actually basically cut off the possibility of normal trade exchanges, so China subsequently announced that it would no longer respond to the possible additional tariffs of the United States.

On April 10, the United States suspended reciprocal tariffs on most countries (excluding China), retained 10% "benchmark tariffs" and started negotiations. US stocks rose sharply, with Nasdaq hitting the second largest increase in a single day in history.

China's seemingly passive behavior actually puts huge pressure on the United States. On the 12th, the United States exempted 145% "peer-to-peer tariffs" of some Chinese goods, including smartphones, tablets, laptops, semiconductors, integrated circuits, flash memory, display modules, etc.

It is not just China's countermeasures that really push the Trump administration into the "second phase". There are also strong "opposition" from the US political and business markets and stock, bond and foreign exchange markets.

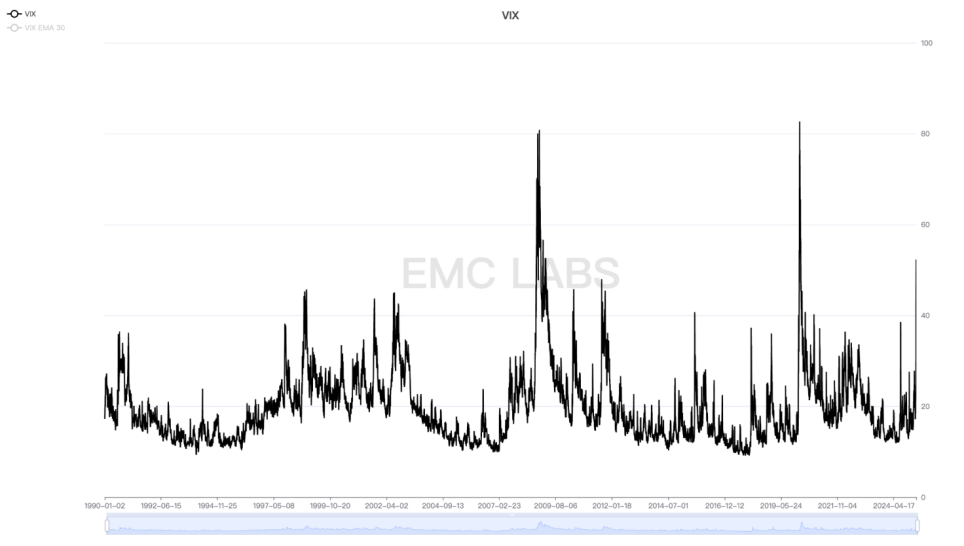

On Monday, April 7, the three major U.S. stock indexes fell sharply and hit adjustment lows, entering or approaching a technology bear market. The next day, the VIX panic index hit a high of 52.33, the third peak since the subprime debt crisis in 2008 and the new crown epidemic crisis in 2020.

**** S&P 500 VIX Index

During the same period, the yield on short-term treasury bonds fell to 3.8310% on Thursday, while the yield on long-term treasury bonds rebounded sharply on Friday, closing at a high of 4.4950%.

US 10-year Treasury yield

After the US stock market suffered a large-scale sale, US bond funds also joined the sell-off. In addition, funds fled to the United States and went to Europe and other places, and the US dollar index DXY also fell sharply.

USD Index

The "three kills" of stocks, bonds and foreign exchanges forced the Trump administration to send signals of easing the tariff war and announced the exemption list. At the same time, the Federal Reserve also sent a "dove" signal to the outside world. Boston Fed Chairman Collins said in an interview with the Financial Times on Friday that the Fed is "absolutely ready" to use various tools to stabilize financial markets when necessary.

The ease of tariff war and the Fed's verbal rescue have temporarily eased the US financial market. On Friday, the US valuations also rose one after another and ended a turbulent week.

EMC Labs judged that the US-peer tariff war has entered the second stage, and market fears have eased and gradually began to bottom out, but based on the "irrationality" of the Trump administration and the huge risks in the US economic recession and inflation (the University of Michigan consumer confidence index released this week continued to fall to 50.8), a V-shaped flip into a smaller probability event.

Selling pressure and selling

The selling pressure on the long and short bracelets has weakened this week, slightly stopping the panic selling for three consecutive weeks. The sales scale on the whole weekly chain is 188,816.61, including 178,263.27 for short hands and 10,553.34 for long hands. On the 7th and 9th, the short-hand group suffered huge losses again amid the global market panic.

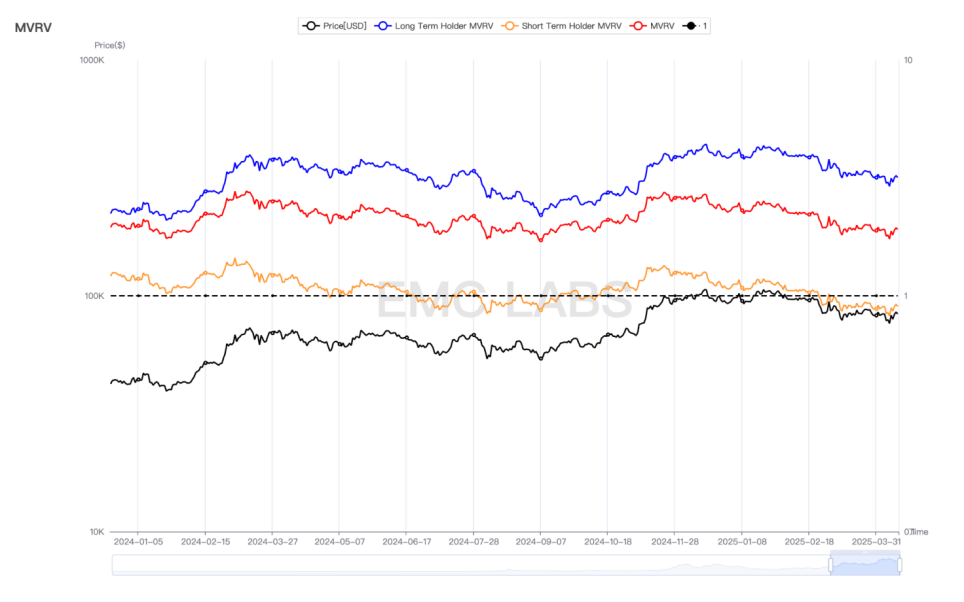

At present, the long-term group is still playing a stabilizer role, increasing its holdings by nearly 60,000 this week, indicating that the market liquidity is still quite lacking. As of the weekend, the short-hand group was still at a floating loss level of 10%, indicating that the market is still under tremendous pressure.

**The entire market on-chain is profitable and loss**

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics index is 0.125, and the market is in an upward relay period.