Trump-style recession is coming, when will the Federal Reserve cut interest rates?

Reprinted from panewslab

03/15/2025·1MAuthor: Luke, Mars Finance

The craze fades away, and the clouds of recession are shrouded in

At the beginning of 2025, the U.S. financial markets moved from fanaticism to uneasy. When Trump won the election in November last year, investors set off a "Trump deal" craze, hoping that his tax cuts and regulatory relaxation could continue economic prosperity, and the stock market rose. However, this optimism quickly faded, replaced by concerns about the "Trump recession."

The Nasdaq index suffered its biggest single-day decline since September 2022, with technology stocks and bank stocks falling sharply for days, and consumer spending willingness to shrink at the fastest pace in four years. AFP bluntly stated that the "honeymoon period" between the financial market and Trump has ended. JPMorgan raised the probability of recession this year from 30% to 40%, Goldman Sachs adjusted from 15% to 20%, and the probability of a recession in the United States on Polymarket also reached 40%.

The market began to question: Is Trump's policies pushing the US economy into the abyss? During this storm, everyone is asking: When will the Fed cut interest rates so that it can press the pause button for this storm?

Tariffs and layoffs: the fuse of the recession?

Less than two months after Trump took office, policies have caused waves. He regained tariff weapons and proposed a 10% to 25% tax increase plan for Canada, Mexico, the EU and even China, trying to reverse trade imbalances and stimulate manufacturing backflows.

Meanwhile, the "Government Efficiency Department" led by Musk cut federal employees and announced layoffs of 172,000 employees in February alone, setting a record high in the same period since 2009, with a total of more than 100,000 in the future. These measures have made the market uneasy: corporate costs are rising, price pressures are looming, and consumer confidence is shaking.

The Atlanta Fed predicts that GDP growth will slow in the first quarter, and historical rules show that since 1980, after the Fed raises interest rates to more than 5%, there have always been crises within 2 to 4 years, and now is the risk window after the 2022 rate hike.

"This is a transition period, we are doing big things," Trump said on March 9. However, Nomura Securities strategists believe that he may be intentionally creating a recession to slow economic growth and drive deflation. Barclays' latest forecast also reflects this trend, with the Federal Reserve expected to cut interest rates by 25 basis points in June and September respectively, compared with the previous expectation of a rate cut once in June. The adjustment may be deeper concerns about inflation and economic slowdowns.

Debt pressure on the top and the Fed plays

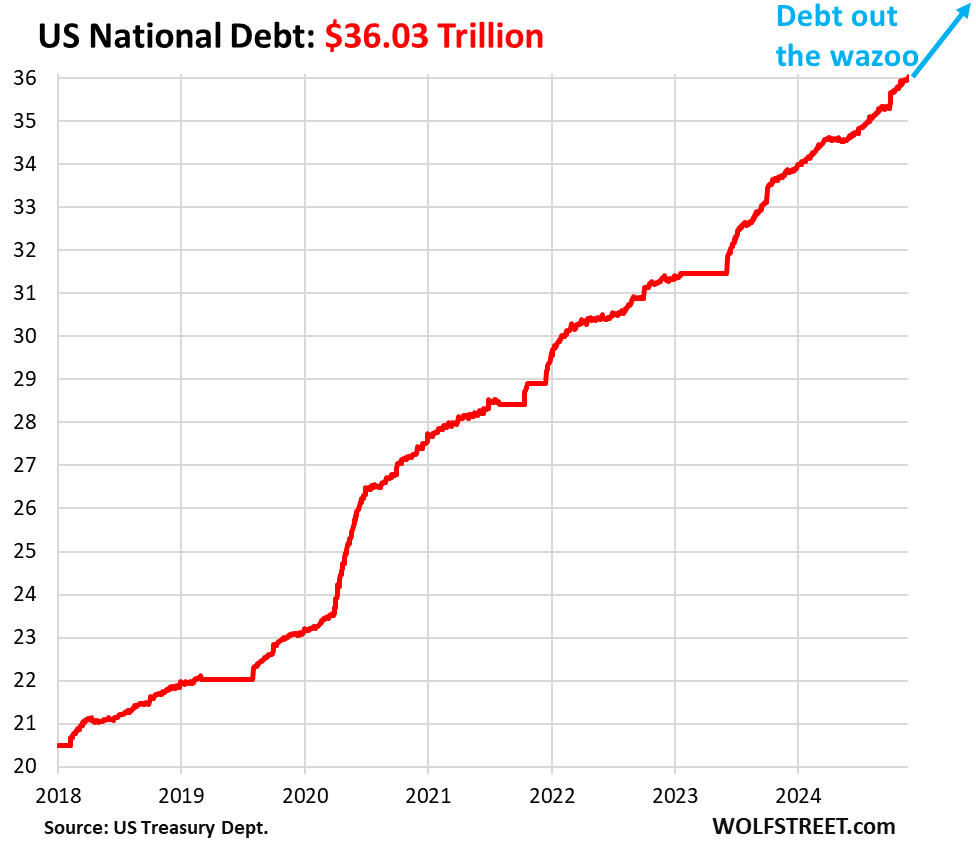

Trump's policies may be aiming at deeper goals. The U.S. federal debt has reached $36 trillion, and interest expenses have become a fiscal burden. According to the Congressional Budget Office, interest costs will reach $952 billion in fiscal 2025, which may soar to $1.8 trillion in 10 years. If the Fed cuts interest rates by 100 basis points, the government can save $3,000 to $400 billion a year, which is an irresistible temptation for Trump.

He had threatened to replace Federal Reserve Chairman Powell, and Musk also appeared in the White House on March 11, announcing a layoff plan while frequently criticizing monetary policy. Finance Minister Bescent said the economy needs to be "detoxified" and getting rid of its dependence on government spending seems to be paving the way for short-term pain.

Currently, the federal funds rate remains at 4.25%-4.5%. Powell said at the beginning of the month that inflation (CPI about 3%) has not yet dropped to 2%, and the economy is still resilient and there is no need to rush to cut interest rates. But the labor market has cracked, with the total number of layoffs doubled in February, and the Federal Reserve may be forced to take action if the unemployment rate rises from 4% to 5%. Market speculation that June may be the starting point for interest rate cuts, and Barclays’ forecast further strengthens this expectation, believing that the September rate cut is a follow-up response to the economic slowdown.

The cost of transformation and unknown risks

Trump's ambitions may be far beyond his sight. His economic adviser Stephen Milan proposed that the United States needs to reshape the dollar system and get rid of the deficit drag of reserve currencies. He envisioned that through the "Haihuyuan Agreement", it would force China and the EU to sell US dollar assets and turn to long-term bonds, achieve a depreciation of the US dollar and stimulate the return of manufacturing. If this plan comes true, it will reshape the global trade pattern, but the premise is that the economy first "detoxifies" - actively puncture the bubble and reduce leverage.

On March 11, Trump told 100 corporate executives: "We must rebuild the country." However, this transformation is expensive: stock market declines, weaker US dollar, and even short-term recessions may be the only way forward.

Harvard economist Lawrence Summers warned that the probability of a recession is nearly 50%, and inflation may return to its 2021 high; British analyst Dario Perkins pointed out that the real recession is not a "purifier", but may leave lasting trauma. If out of control, the Republican prospects for the 2026 midterm elections will be clouded. From "Trump deal" to "Trump recession", the Fed's choice is crucial - whether Barclays predicts the achievement of interest rate cuts in June and September depends on the evolution of inflation and employment data, and the success or failure of this gamble remains unknown.

chaincatcher

chaincatcher