Virtuals starts large buyback, what is the valuation ceiling?

Reprinted from panewslab

01/16/2025·17days agoAuthor: Ismay

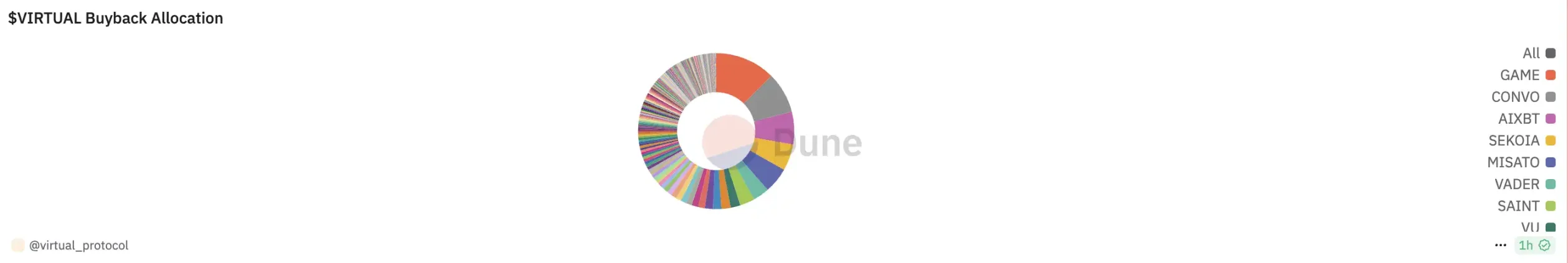

This morning, Virtuals announced that it will use the 12,990,427.85 $VIRTUAL accumulated through post-bonding transaction revenue to repurchase and destroy related agency tokens in the ecosystem based on the time-weighted average price (TWAP) in the next 30 days. . Tokens such as GAME, CANVO, and AIXBT with the highest number of repurchases all experienced increases of more than 20%.

At the same time, Virtuals has updated the value accumulation mechanism. The main changes include:

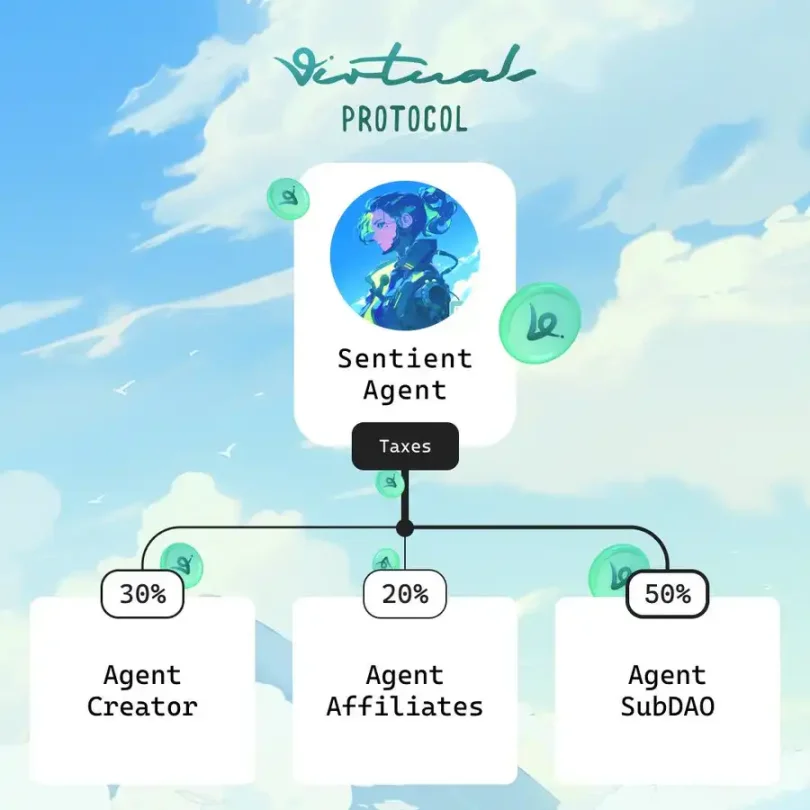

Later pledge tax allocation: 30% is allocated to Agent Creators, 20% is allocated to Agent Affiliates, and 50% belongs to Agent subDAO as a fund reserve for future governance decisions;

How to collect creator rewards: The rewards will be sent directly to the wallet of the agent deployer.

Agent Alliance (Agent Affiliates) mechanism: Achieve revenue sharing for various trading platforms or interfaces (such as Telegram Bot) and the Virtuals ecosystem. After the platform becomes an agent alliance, it will receive 20% of the later pledge tax generated by the transaction to stimulate its community. and follow-up project planning.

Why is there this upgrade and its impact?

Each Virtual token will create a liquidity pool (such as AIXBT/VIRTUAL) with $VIRTUAL as the paired asset, and the platform has accumulated a large amount of $VIRTUAL as revenue through transaction fees.

However, these earnings cannot be sold directly, otherwise it may cause market panic and damage the ecosystem, because the price drop of $VIRTUAL will also affect the proxy tokens pegged to it. In addition, if the funds are not properly handled, the platform may face a huge tax burden on this unusable revenue.

Therefore, the platform chooses to utilize this part of the revenue by repurchasing and destroying ecological tokens.

Two types of tokens that benefit

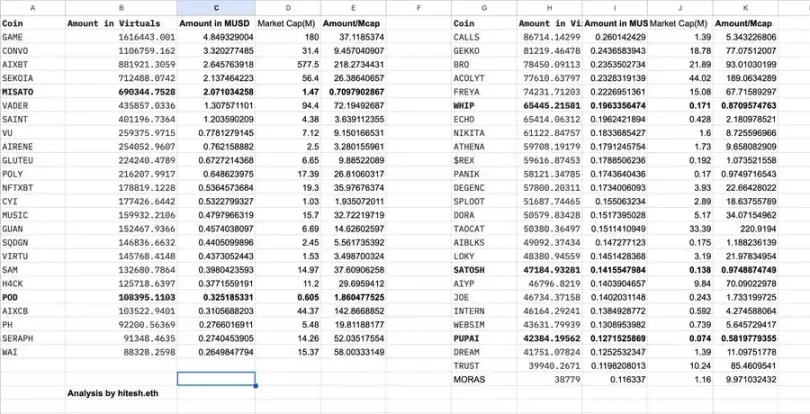

1. Transaction fees are higher than those of tokens with higher market value

The repurchase amount depends on the accumulated amount of transaction fees, so tokens with larger overall transaction volume but relatively lower market capitalization will receive a greater proportion of incentives.

For example, tokens like MISATO surged on buyback news.

2. Most of the liquidity is in the tokens of the non-VIRTUAL matching pool.

The unit of account (VIRTUAL) of such tokens is less affected by selling pressure, but can still receive incentives from repurchases. For example, $AIXBT actually received about $2.5 million in incentives, but was less affected by the VIRTUAL selling pressure because its main liquidity was in other pools.

damaged group

1. $VIRTUAL holders

The sell-off amount of $48 million is quite significant. Previously, the price of $VIRTUAL benefited from the continued accumulation of handling fees (equivalent to a value precipitation of $48 million).

However, these fees will now be converted into cBTC, starting to put selling pressure on the market. The positive cycle that drove $VIRTUAL higher has now reversed into a negative cycle.

2. Only VIRTUAL matching pool or tokens with low trading volume

These tokens receive smaller incentives but are subject to price pressure from the $VIRTUAL sell-off. Newly issued tokens are particularly affected because they accrue less fee revenue.

On-chain analyst hitesh.eth analyzed the top 50 tokens allocated for buyback and destruction based on the 30-day time-weighted average price (TWAP) and found that buyback pressure on some of these tokens even exceeded their current market cap.

What does the community think of this buyback?

It can be said that this upgrade has brought stronger value support to the Virtuals ecosystem, but the community has expressed objections to the updated repurchase and distribution model. Some people think that Virtuals chose to sell $VIRTUAL instead of directly destroying these tokens. . “This approach is contrary to the best interests of the holders and the team, as the team proactively created $48 million in selling pressure. For the ecosystem, part of the incentive flowed to the proxy token where the liquidity is mainly external, resulting in funds out of the ecosystem."

Crypto KOL Liam said that although Virtuals converting handling fees to cBTC is the right direction of transformation, the platform should significantly reduce handling fees to reduce excessive withdrawals from the ecosystem. At the same time, the distribution of handling fees should also be standardized based on the launch time of the token, so that new and old tokens can stand on a fair starting point.

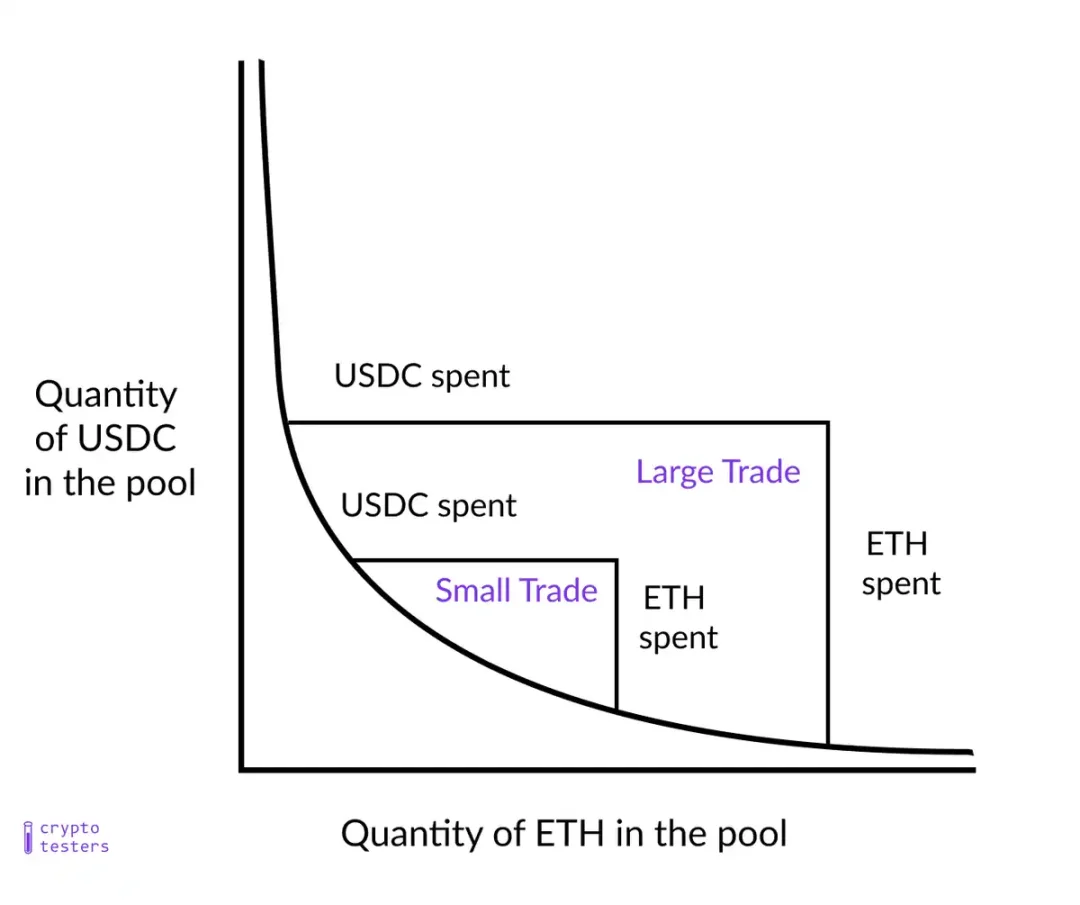

However, this view that "buyback will bring huge selling pressure" has also been questioned and said to be untrue, because these Agent tokens are bound to $VIRTUAL in pairs, and using $VIRTUAL to purchase Agent tokens will not sell any $VIRTUAL, just adds $VIRTUAL to the liquidity pool. If the liquidity pool was denominated in WETH, then $VIRTUAL would be exchanged for WETH first, but this is not the case this time.

However, this does create indirect selling pressure, as the value of the token increases as the amount of $VIRTUAL in the liquidity pool increases, and holders may sell more $VIRTUAL as a result. However, due to the characteristics of the liquidity pool and the price impact, and the liquidity of many of these tokens is very low, it is impossible for them to sell all the tokens directly.

Leftcurve DAO member mcSleuth believes that the announcement will not bring direct selling pressure, while indirect selling pressure will be almost negligible, especially considering that $VIRTUAL has a market capitalization of $3.6 billion and is extremely liquid.