What's going on and what happens in the crypto market

Reprinted from jinse

02/07/2025·16DAuthor: 0xTodd, Source: Twitter @0x_Todd

In the past week, many friends called me to inquire about the market. I think it is necessary to disclose my ideas and disclose my views on the current market.

【What exactly changed】

【Future process】

All the family who have been following me for a long time know that I am a long-term investor. So, starting from 2019, I have an annual strategy updated every year. This article is probably for communication and discussion with my family.

1. DeepSeek pierces the bubble

Once the DeepSeek is released, don’t worry whether it really used 500,000 US dollars to train such an AI, but this narrative is like this: [Algorithm Improvement] at least defeated [Computing Power Improvement] in a short term.

Don’t worry about whether this thing is real—since the market unanimously recognizes the 500w incident, you should think it is real.

When our crypto industry reached the end of 24 years, I would not admit it except meme, but objectively, there is only one last narrative left: AIAgent, which can be said to be the hope of the whole village.

However, no one expected that AIAgent was ruthlessly beaten by DeepSeek from the True AI track next door.

Like DS, there are real IQ200 in the team, fresh graduates from Tsinghua and Peking University, and many medalists in the Olympic Games.

In contrast, our industry is popular with second-tier programmers who are idle at home, AI engineers who are dismissed or secretly engaged in side jobs, so sometimes we are forced to IQ50.

so..

On January 27, I stopped all my AI token positions with tears in my eyes. I didn’t sell them at the highest point. I pulled a lot and it was fake to say I didn’t feel sorry for it.

But the colder fact is that this thing turns our entire AIAgent track into a clown, and this is probably true.

The reason why "narrative" is "narrative" before "things" is because this "thing" has not yet been implemented, and can only rely on "narrative". Once the story can't be told, the decline of the track is really irreversible.

2. The President and the President 's Mob

I don’t know how you feel during the Chinese New Year. Anyway, my physical feeling is that many relatives and friends are asking how to register for BN or OKX, but there is no such thing because they want to buy Trump coins.

The last time they were so crazy was on National Day, they wanted to open an account and enter the A-share market.

Source of the trend of the Shanghai Stock Exchange Index: Tencent Securities

If I remember correctly, these Warriors who entered the Big A on the 10.8th are still on the top of that mountain.

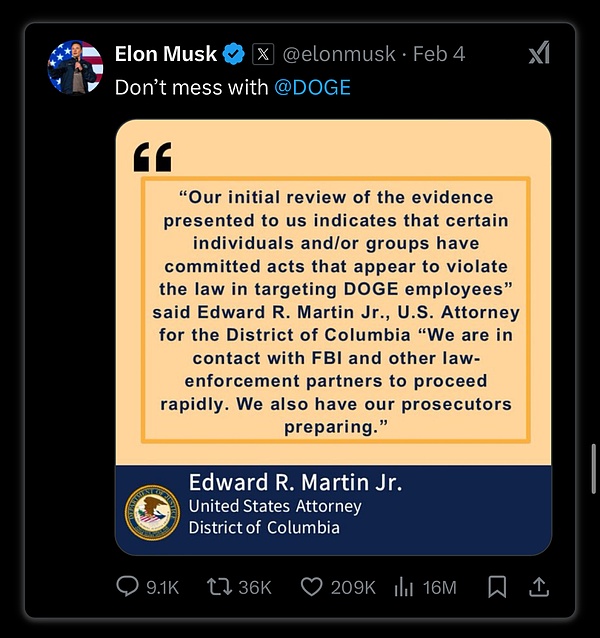

After taking profit AI, to be honest, the more I thought about it, the more I became more and more scared, and then I saw this post.

A brief look: The president seems to be in trouble, but there are two possible reasons:

1. He doesn 't make money in the way you can see

2. He is a fool*

Anyway, I know that the answer is absolutely impossible to be 2.

Yes! Meme is now the president is playing, and he can also make money through channels that we don’t know.

To be fair, are our memes on the same table as Trump?

Can a Thai hippo, an American squirrel, and a bottle of longevity medicine that can prolong the life of flies really sit at the same table as Trump, who lives in the Oval Office?

-

It’s the Chinese New Year, with adults and children.

-

Adults drink famous wine, while children only deserve Sprite.

So, I basically took out the memes in my hand that day. My meme position used to have huge floating profits, but because I took the initiative to reduce the IQ to 50, I did not complete the great retreat, but I have been joining the great revolution.

The feeling of dreaming

3. One top signal: High school brother earns tens of millions

I believe that all the families who play meme, even those who don’t play meme, have heard of this recent legendary story.

A high school brother joined Jelly for a month and beat Jelly at once, and won tens of millions at a high cost.

Of course, it became more and more outrageous when it came to the future, and there were more and more rumors. I was not sure that this matter was 100% true, but I knew that the taste was right.

Looking back at the 1-3 days before the 69K historical top in 2021, I am feeling:

-

Intern, the yield is easily defeated by the fund boss

-

ENS's grassroots community contributors received tens of millions of airdrops

That moment

Just like

At this moment

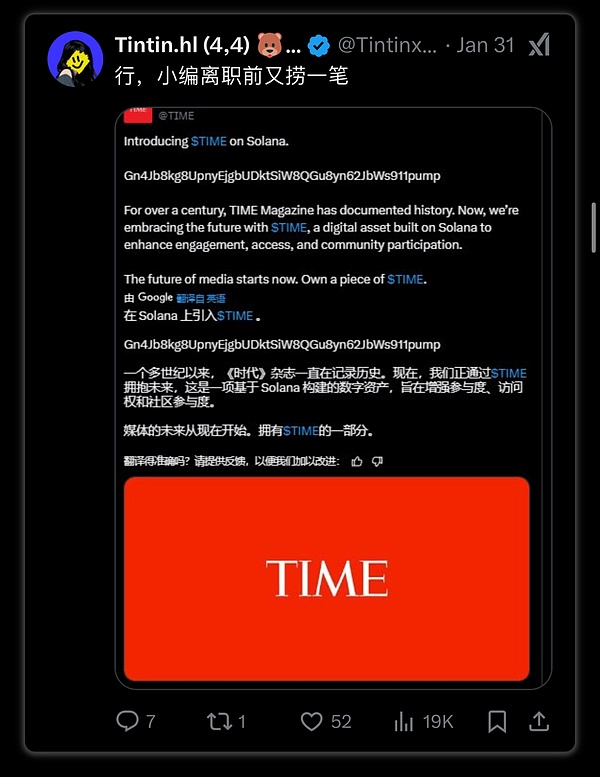

I liked this post. A TIME editor (or of course a hacker) can immediately harvest countless SOLs by relying on a fake Twitter.

I ask you, what does this mean?

It’s not that making money is not enough - experts can always make money, even if they can still make money at the bottom of the bear market.

But if the subject becomes a normal person:

The intern brother makes a lot of money, the ENS contributes brother makes a lot of money, the high school brother makes a lot of money, and the editor brother makes a lot of money.

Meaning: [At this moment, everyone's hands are particularly loose]

Friends who often play cards know that they will only become loose when the floating profit is extremely high.

This means that the greed index has reached its true culmination.

This is a super top signal.

So, on the 30th, I cleared almost all the altcoins, only retained BTC, and a small number of mainstream coins, ETH/SOL/DOGE exchange coins.

Although there are still losses, the fruits of victory were left behind in three melons and two dates.

I admire my high school brother’s wonderful operations, and I also respect the iron market rules of this alternative investment product.

4. Questions about BN and BN’s responses

Alas, to be honest, I don't want to talk about this topic.

As a former CEX practitioner, I have seen this set of consultant-listing- shipment dramas too many times. From the initial anger to the gradual numbness behind it, it is no longer surprising.

However, in the past, this thing was placed under the table, which was "small greed and small corruption were the lubricant for development";

It belongs to "the water is clear and there will be no fish". There is a slight turbidity under the water surface, which is considered part of the rules of the game.

After all, we do not live in a utopia, nor in a vacuum home.

However, the most taboo thing about this thing is to take it from under the table to the counter.

I have no intention of criticizing BN or No. 1 sister because this matter exists in almost every CEX.

If this is placed in the traditional world, to put it in an exaggeration, it is a huge scandal, which can cause hundreds of people to be laid off and dozens of people to be punished at once.

Maybe the number one sister might as well not respond, learn from celebrities to treat cold treatment, and give retail investors some thoughts.

However, most of our industry are skeptics, and a huge scandal is a heavy hammer that is hard on the heart of every holder.

It defeated many people 's beliefs.

Our industry really needs "god" because it is maintained by consensus.

But when everyone discovered that the public servants under the "God" actually wanted to make some quick money, their faith suddenly disappeared and quickly projected to God's relationship - all the altcoins on BN. At this moment, we are all facing huge suspicion and gaze from retail investors. Since AI and HOOK are like this, are other coins really better?

5. Future scripts

If we follow the view of Jizhou Juejian, this decline is very similar to 5.19. We suggest that you review the trend after 5.19 in person.

Trends after 519 in 21 years, source: Bitfinex

If you follow the script of 5.19, there will be a turbulent plot that lasts for two months until the most loyal person is washed out of the car and then the new $Bitcoin ATH is ushered in.

Of course, some people suspect that this is the plot of 12.4, the beginning of the AKA bear market.

Just from the inner tendencies, I hope this is 5.19.

After all, Bitcoin’s US national strategic reserves are becoming clear, so don’t underestimate the huge influence of this matter, really.

Even if Bitcoin reaches 85K-88K, I am willing to add some additional positions.

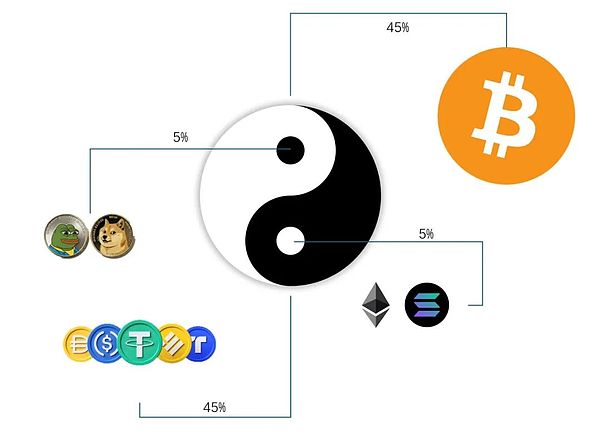

6. My position distribution

My current position:

40% BTC

20% mainstream coins (ETH, SOL, DOGE, BNB/MNT)

40% stablecoin financial management

Bitcoin is my eternal belief. I think I will never sell BTC and will no longer do bands.

Reasons for retaining ETH:

To be honest, belief in ETH is weakening.

However, objectively speaking, the president's DeFi project is buying ETH.

I don’t know if there are many people in my family who are speculating on US stocks. Many people regret not following the order [Nancy Capitol Hill Female Stock Goddess of Pelosi].

Image source: World Magazine

Pelosi's highlight moment was the President of the House, which was just the third pick in American politics.

-

Trump is now the real president. The crypto president is holding ETH in a large position (although it has been deposited with untraceable Coinbase custody), and this amount cannot be underestimated.

-

Secondly, ETH has fallen to its current position. I think it has reached the extreme of FUD, and there may be the thought that things will turn back. I can 't buy it without anyone paying attention to it, at least don't sell it without anyone paying attention to it.

Reasons for retaining SOL:

There is a low probability that ETFs may be;

However, the cooling of AI narrative and the short-term sluggishness of MEME are two small hazes.

Reasons for retaining DOGE:

Grayscale has launched Dogecoin Trust, and Doge also has a low probability ETF

In addition, Musk is working hard in the DOGE department;

I think I can sleep in the same car as the world's richest man and "Director of the US Development and Reform Commission".

Reasons for retaining exchange tokens:

The ugly words are ahead, and the exchange has no possibility of taking a bigger stage.

Coinbase doesn't list BNB, and Binance doesn't list MNT.

But the exchange is the only institution in our industry that can make money + make concessions;

If the bear market really comes, exchange tokens are relatively more resistant to declines. Occasionally, an IEO can still recover its blood, and this is the only way to survive in the bear market.

7. Cruel View: The good days for the old men are over

In addition to the above, I am most likely not to hold any counterfeits in a large position in the short term - the reason is also very simple, inflation is too fast.

The speed of new users and new funds entering the market is simply not as fast as the printing speed of these coin-issuing monsters.

Source: Decrypt

A few days ago, there was a statistics that the most awesome account on pumpfun was issued 17,000 coins in three months.

Not 170, not 1700, but 17000! His contribution alone may exceed the sum of tokens issued in the entire bull market in 2017.

Why did the investment strategies of Lao Dengs fail?

Too many choices

Too many angles!

Even N CAs at the same angle

Where is the turn of Lao Deng’s copycat?

The old Dengs’ favorite strategy: buy a waist mountain race at 100M or 200M.

Hold it for 2-3 months and bet it outperforms Bitcoin.

However, now I am afraid that even ETH cannot win.

Marshal P's favorite strategy: buy a project with a 10K valuation in the internal market.

Run away after 30 minutes.

A real man never looks back at the explosion.

Obviously, in today's token inflation, Marshal P is far better than Lao Deng.

I don 't call on everyone to become a young player, I just hope that everyone will at least not be old.

8. Best position: 50% big cake + 50% stablecoin financial management

In addition, I sincerely recommend that you hold a certain U to spend the next time.

You have to accept the fact that no one can really sell it in the super big top.

There is one on the top of the mountain every 4 years. You can find a day to sell it in more than a thousand days. The probability of 1/1,000 is naturally very few, and all of them are super lucky.

At this stage, half of the position is the best choice.

If you invest 50% of your principal in financial management, we don’t talk about what mines to invest in or what arbitrage to do.

We will do the simplest Ethena USDE, and now Pendle can still give an interest rate of 18%.

If Pendle is too lazy to do it, it will throw it into AAVE or mainstream CEX financial management, there is still 10%.

The other 50% are mainly Bitcoin, quietly waiting for the day when the US Bitcoin strategic reserves arrive.

Existing interest cash flow,

Have dreams and beliefs,

You must be comfortable,

Packed.

Of course, you can cut out another 5% of the altcoins you truly believe in, whether it is ETH, SOL, DOGE or any of your faith coins.

If you cut out 5% of the funds, go to PVP twice. If you win, you will be free and use it as a consumption if you lose. Isn’t it beautiful?

Finally, this distribution of Tai Chi diagram is formed.

9. Last

I am quite satisfied with my current position. After all, this is my 8th year of ups and downs in the crypto industry. I have always had some experience after so long.

The only thing I feel a little regretful is that I have been playing in Osaka during the Chinese New Year. I am lazy and have not sorted out these thoughts as soon as possible.

The same strategy may help many people by saying it a few days ago, but it will become a review after the fact.

However, it is not too late to make up for the loss of the sheep.

I hope every family can get their own big results in the crypto market.

Of course, if you can't get big results, then keeping some small results and earning more spiritual and social wealth is also worth the trip.

chaincatcher

chaincatcher

panewslab

panewslab