What’s keeping ETF inflows positive for BTC and ETH

Reprinted from jinse

01/08/2025·1MAuthor: André Beganski, Decrypt; Compiler: Baishui, Golden Finance

Bitcoin and ethereum ETFs saw a combined $1.1 billion in inflows on Monday, building on positive momentum after spot funds saw $320 million in inflows at the start of the year.

Despite posting losses at the start of the year, spot Bitcoin and Ethereum ETFs saw positive inflows for two days in a row, taking them to a combined $1.75 billion in 2025, according to CoinGlass.

Investors poured $38 billion into the products last year after they debuted on Wall Street, a development that has made it easier for financial market participants to access leading cryptocurrencies through traditional brokerage accounts in the United States.

Experts hailed the launch of spot Bitcoin ETFs as a historic success, but nearly a year after their approval, the products are having their best days yet in 2025.

Last year, daily inflows into the spot Bitcoin ETF exceeded $900 million only four times. On Friday and Monday, they attracted $907 million and $978 million, respectively.

Juan Leon, senior investment strategist at Bitwise, attributed the inflow to the impending return of President-elect Donald Trump. Leon told Decrypt that investors may allocate funds to spot cryptocurrency ETFs in anticipation of his pro-crypto administration taking over the White House in less than two weeks.

“There’s a lot of excitement about what this administration can accomplish in terms of the [supporting cryptocurrency] regulatory agenda,” he said. “We’re seeing a lot of pro-cryptocurrency picks in the Trump administration’s cabinet, whether it’s the SEC or the Treasury Department.”

Over the past three trading days, inflows have been concentrated in the Fidelity Wise Origin Bitcoin Fund (FBTC), a departure from the dominance of BlackRock's iShares Bitcoin Trust (IBIT), which hit a record high last year. new high.

IBIT has attracted $110 million since the start of the trading year. Meanwhile, FBTC has attracted $763 million, with inflows of $370 million on Monday, the third-highest single-day inflow on record.

Last year, IBIT withstood daily outflows just eight times as the product attracted nearly $37 billion during 2024. On Thursday, outflows of $332 million exceeded all negative outflow days last year combined.

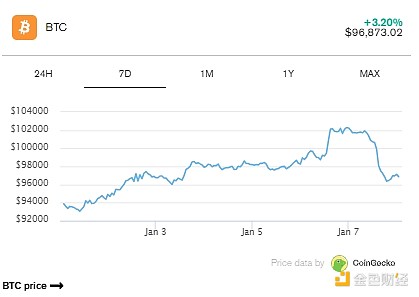

As spot Bitcoin ETFs saw strong inflows on Monday, the asset climbed above $100,000 for the first time this year after reaching $108,000 in December. However, as of this writing, the asset's price has fallen 5% on Tuesday to just under $97,000.

For a spot Ethereum ETF, two days in a row of inflows is less jaw-dropping. The category has so far attracted $110 million in 2025, following Friday's $77.5 million outflow.

panewslab

panewslab