A review of AI Agent investment by experienced players: The opportunity of a hundred times and a thousand times is not that there are no opportunities, but the lack of decisive action

Reprinted from panewslab

01/07/2025·2MAuthor: Tomb

Compiled by: Deep Wave TechFlow

Main points of this post

-

Review the development trends of agents and AI in the past few months;

-

Review some of the obvious investment opportunities in the market;

-

Taking a break during the New Year, observing many things from an outsider’s perspective, and reflecting deeply on past successes and missteps;

-

Next, I will try to share all my thoughts as clearly as possible;

A look back at the developments in agents and AI over the past few months

AI Agent Review

-

Very pleased with the performance at the end of last year.

-

From September to early October, we entered many narrative areas about AI, agents and infrastructure very early.

-

Without overcomplicating the analysis of these trends, it is clear that these are the next phase of the AI supercycle (with more important catalysts to come).

-

This mature judgment comes from long-term experience in capturing narratives in the market. When you are able to identify these trends, you can invest money quickly and without too much hesitation.

-

Even now, I see some people arguing about trivial issues such as the encapsulated application of ChatGPT, the specific functions of a certain agent, the failure of a certain protocol to respond in a timely manner, and so on.

-

But do these really matter? We are here to make money, not to prove ourselves right.

-

The key is to know where you are in the market cycle. Each cycle has its own unique rules and strategies.

-

This is also why many people hold on to old projects for too long, thus missing some hot trends in “simple mode”. What I mean by "old" is not really old, but rather "relatively old" compared to the rapid development of the industry.

-

Remember, new hot topics emerge every day, and money moves faster and faster – if teams can’t communicate their ideas clearly or show a clear roadmap, money will flow to those who can communicate better and can. Agreement for quick implementation of projects.

-

When I first encountered Goat, I realized its potential and focused on it very early on - I'm surprised it took so long for others to move to Base or Go via a cross-chain bridge. Start exploring agents on Sol.

-

This phenomenon is largely due to the "mid curve effect" (referring to over-complicated thinking) and market panic. If you were unaware of these issues until now, you need to seriously reflect on why.

-

I feel so grateful for the past few months that I haven’t experienced too many serious losses.

-

I seized the opportunity of ai16z when its market value was 30 million, and also entered aixbt when its market value was 30 million. In addition, there were opportunities for some game and dialogue projects to be deployed when their market value was below 10 million.

-

Of course, there are some missed opportunities, such as Zerebro, Fartcoin, Snai and Swarm Node, etc. But that’s okay, it’s impossible to seize all opportunities, it’s important to reflect on why you missed them and why they succeeded.

quality

As always, quality is always the key to victory or defeat:

-

High level developers;

-

Excellent branding;

-

Innovative ideas or unique technologies that provide a competitive advantage;

-

Cohesive, high-quality communities;

-

Clear and valuable information and communication;

These are the core elements we have been focusing on. If two or more of the above are missing, there is a risk. Why? Because there must be other teams that can do better.

For example, in the current environment of Virtuals, as long as a high-quality team launches an AI agent or related infrastructure, I will invest quickly in the early stage (ie "stud"). The identities of the developers are open and transparent (doxxed). They have been working in this field for more than 5 years and have participated in multiple protocols - as long as I find such a team in the early stages, I will enter the game decisively.

-

In fact, you don’t even need to invest much money to get substantial returns. For example, I discovered the GEKKO project when it was first launched and had a market capitalization of only $4 million. Because it was developed by the Axal team and received investment from a16z - this was enough for me, so I invested decisively. As a result, its market value increased from 4 million to 40 million, and the profit was very considerable. I believe it will grow further. Turn $4,000 into $40,000, which is a year's salary for some people. Sometimes, you don't need to invest a huge amount of money, and $2,000 or $4,000 can bring you considerable returns. Don’t underestimate the potential of these funds.

-

Another one I have been planning is Acolyt. This team is very strong and the narrative is similar to GEKKO. I have also mentioned before that if there are 100 different AI agents that can all provide high-quality market intelligence (alpha), then the only thing that can distinguish them is identity, user interface (UI), brand, developer level, etc.— —It’s no different than any other area of life.

That’s what I’m looking for: teams that have been building for a long time—top developers who are passionate, keep tweeting, and keep rolling out new products. They are the only place for my money, I won't consider other places.

Things to avoid

-

Avoid unidentified one-person development teams, especially when building speculative agent projects, as this risk is high.

-

Another thing to be wary of is the intelligent agent projects initiated by individual “Internet celebrities”. Such projects are often abandoned shortly after being announced because the developers realize the responsibilities are greater than expected.

narrative in struggle

- I have to admit that there are some narratives that I personally am very optimistic about, but they do encounter some difficulties in their development. That’s not to say these projects are bad, but they’re moving relatively slowly.

It's really frustrating to put money into a project that seems promising only to find that it doesn't perform as expected while other projects around it grow 2-3x in a short period of time.

-

These projects are often of the “slow-heat” type, or end up becoming “auxiliary experiments” for other projects.

-

To give a few examples, such as $GRIFT + $REALIS + $OMEGA . I still hold some of them, but from a practical perspective, I should have cut my losses earlier and moved funds to stronger AI infrastructure projects, such as REI and ARC. The potential of these projects is more obvious and their performance is more stable.

-

At the time, I invested approximately $100,000 to $120,000 in these "pilot" projects with the expectation that they would capture a larger market share. But looking back, projects like Griffin that are supported by Solana are obviously stronger, while projects like Realis need more time to mature, perhaps because their ideas are too advanced or their teams are smaller.

-

On reflection, when you get 20-30x returns on a project like $GAME, you feel like you have enough capital to "test the waters" or take risks, so you don't care too much about putting money in a project that's going slowly. on the project. But in reality, as a trader or investor, this is not how we should treat our own money.

Over the next few weeks, I will continue to share observations about agents and market operations, while also keeping an eye on the next possible market rotation opportunity. We all know that no narrative can last forever. This doesn’t necessarily mean the agent narrative is over, but they may be entering a new stage of development.

Remember, today’s market is changing very quickly, accelerating almost in every direction. If you slack off, you may be eliminated. Pay attention to market dynamics every day, because the "hot potato" is getting hotter and hotter.

Review some of the obvious investment opportunities in the market

Some market opportunities are obvious to some but not necessarily to others. I won’t list all the examples, but I will share some of the main ones and how I navigated these narrative threads.

VIRTUALS

When I first saw the GOAT program take off, I was fascinated by it. Realizing its potential, I immediately invested. But then, I completely missed $ZEREBRO and $BULLY, both of which have been doing very well so far. This made me look even more eagerly for the next possible opportunity.

That's when I discovered aixbt . When I learned about its functionality and positioning, I immediately knew this was the next project to watch, especially after seeing $GOAT, $ZEREBRO, and $BULLY discussed in the community. I have noticed that the market is gradually shifting from entertainment-oriented projects to practical projects. This shift is what got me started looking at projects like Base, Virtuals, $GAME, and $CONVO.

In fact, it was Jeff 's article about how Virtuals became a billion dollar protocol that made my decision. The token economics, branding, and ecological advantages of the Base chain mentioned in the article further convince me that Virtuals has huge potential.

By studying $GAME, I was finally able to properly understand the concept of "frameworks". This knowledge allowed me to seize many excellent investment opportunities over the next few weeks. While I'm not a technical geek and don't fully understand all the details, I'm very interested in this area and willing to learn as much as I can about it.

Interestingly, I did not invest in Virtuals when it reached a market cap of $500-600 million.

I think that when you identify the potential of an ecosystem, for example, it may grow to a scale of 5 billion, 10 billion or even 20 billion US dollars, you need to focus on two key points: one is the "first mover", and the other is those who continue to occupy Agents of the user’s mind .

For example, $LUNA is a typical forerunner, while $VADER is the first DAO/ALPHA project.

In this ecosystem, there are many projects worthy of attention. For me, the team is the most critical factor, followed by concept and practicality, and finally brand and identity. These three constitute the "holy trinity".

Here are some excellent projects worth looking into:

> $WAI ;

> $ACOLYT ;

> $SEKOIA ;

> $GEKKO ;

These projects are all worthy of attention, especially those that are part of the Agentstarter ecosystem.

AI16z

It may sound random, but when I first came across and promoted daos.fun , I almost directly invested in AI16z because of the name. After digging into projects like the Truth Terminal that Marc funded, I was convinced that this was a project worth paying attention to.

When I learned that AI16z DAO is attracting top developers from around the world and is committed to accelerating the construction of its ecosystem and framework, I was even more convinced of its huge potential. The activity on GitHub continues to rise, and the momentum of the entire project is also rapidly accumulating. This cannot be explained by "middle curve thinking".

Although there was some FUD (Fear, Uncertainty, and Doubt) during the period, the test projects $ELIZA and $DEGENAI in their agent ecosystem have great potential. For example, Eliza's market capitalization has reached $160 million, while @degenspartanai has reached $100 million. Both projects are expected to grow further as AI16z continues to expand – these are very clear investment opportunities.

Other ecology

In Agentic Outlook One, I've analyzed each major Launchpad/Protocol and its Alpha Agent or Beta Project in detail:

-

Creator.Bid | $BID (potential dark horse)

-

Algo | Growth from $2-3M market cap to $25M (obvious opportunity)

-

AVA | From approximately $25 million to $150 million

-

@dasha | From $15M to $150M

The following ecosystems are also worthy of attention:

Other ecosystems worth watching:

-

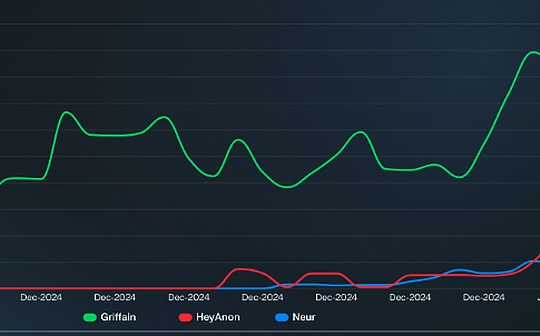

griffain | $GRIFFAIN

Many of these projects have experienced multifold growth.

The complete analysis can be viewed here: link

The list could go on and on, and the potential of these projects goes even higher - they are all very clear investment opportunities.

However, I still hold some other projects that I think have potential, such as $GRIFT and $REALIS. I believe they just need more time and some tweaking to perform well.

Here are some projects that I haven’t had time to analyze in depth, but they are equally worthy of attention:

Of these projects, $REI in particular deserves extra attention.

Outside of the on-chain ecosystem, I am very optimistic about the combination of decentralized finance (DEFI) and agents (Agents):

-

$MODE | Mode , this is a project that I think has great potential.

-

Another thing worth looking forward to is the further development of Uomi .

Stick to projects with great teams, strong infrastructure ( Infra ), and high attention/heat/user mindshare (Mindshare), and you can 't go wrong.

To me, the life cycle of agents is usually short because most projects have difficulty maintaining market attention for a long time. But in my opinion, AIXBT and GOAT are successful models and benchmarks in the field of intelligent agents.

Why reflect on this?

Because it can help you identify your next investment-worthy opportunity.

Things to note

-

It is worth paying attention to some early projects, such as $GNON, $PROJECT89, $AVB, etc.

-

The market value of $OPUS has fallen by 85%, and many early-stage AI projects may have hit bottom.

-

We need to pay attention to whether these projects are still under active development, but also remember that the potential of AI infrastructure (Infra) and agents is huge.

-

New ideas and concepts emerge every week, and these new projects usually have stronger teams and better brands, so we need to continuously scan the entire market.

-

I'm not saying these projects are bad, but I want to emphasize that the market changes very quickly - many traders who experience 80-100x returns will quickly take profits and move on to the next more attractive opportunity, regardless of Is it swarm intelligence (Swarms), decentralized science (DeSci), or DEFI agents and other fields.

-

Great teams always find ways to stay relevant in the market over the long term.

Finally, there are some trends worth watching:

- There are a lot of Hackathons going on right now, which are giving rise to some really interesting ideas and projects. Participating in these events will not only help you expand your horizons, but also give you a better understanding of future technology trends.

Data sources for AI agents:

-

Cookie DAO | $COOKIE ;

-

Decentralised.Co , in partnership with Sentient Market;

Over the next few days, we can discuss the future direction of the field of agents together so that when the market narrative changes, we can be ahead of the curve.

jinse

jinse