Arthur Hayes’ Latest Crypto Market Forecast: Bullish overall, but I’d run away from the top at the end of March

Reprinted from panewslab

01/07/2025·2MAuthor: Arthur Hayes, chief investment officer of Maelstrom Fund, co-founder and former CEO of BitMEX

Compiled by: zhouzhou, BlockBeats

Editor's note: In this article, Hayes analyzes how U.S. dollar liquidity affects the cryptocurrency market, especially the trend of Bitcoin. He discusses U.S. dollar flows by explaining the Federal Reserve's reverse repurchase operation (RRP) and the flow of funds from the U.S. Treasury Account (TGA). How increased sex is driving gains in cryptocurrencies and stock markets. About $612 billion in U.S. dollar liquidity will be injected in the first quarter of 2025, which may have a positive impact on the market. Finally, the author mentioned that Maelstrom Fund is investing in the DeSci field and has a bullish attitude towards the future market.

The following is the original content (the original content has been edited for ease of reading and understanding):

Backcountry ski access at Hokkaido ski resorts offers excellent terrain, most easily accessible via lifts. At the beginning of each year, the biggest concern for ski enthusiasts is whether there is enough snow cover to open these access points. A big problem for skiers is "Sasa," which is the Japanese name for a bamboo plant.

The stems of this plant are as thin as reeds, but the leaves are as sharp as knives and can cut the skin if not careful. Skiing on a sasa is very dangerous because the edges of your skis can slip and you enter into a dangerous game that I call "man versus tree." Therefore, backcountry skiing can be extremely risky if there is not enough snow to cover the "Katsu".

This year's snowfall in Hokkaido hit a record high in nearly 70 years, and the powder snow was surprisingly deep. As a result, back-mountain ski access opens in late December, whereas in previous years it would normally open in the first or second week of January.

As 2025 approaches, investors' focus shifts from skiing to the crypto market, especially whether the "Trump market" can continue. In my latest article, "Trump Truth," I argued that high market expectations for the Trump campaign's policy actions could lead to disappointment and have a negative impact on short-term markets. But at the same time, I also have to weigh the stimulating effect of dollar liquidity.

At present, the trend of Bitcoin fluctuates with the rhythm of the release of US dollars. Financial executives from the Federal Reserve (Fed) and the US Treasury Department hold the power to decide the amount of US dollars supplied to the global financial market. This is an important factor affecting the market.

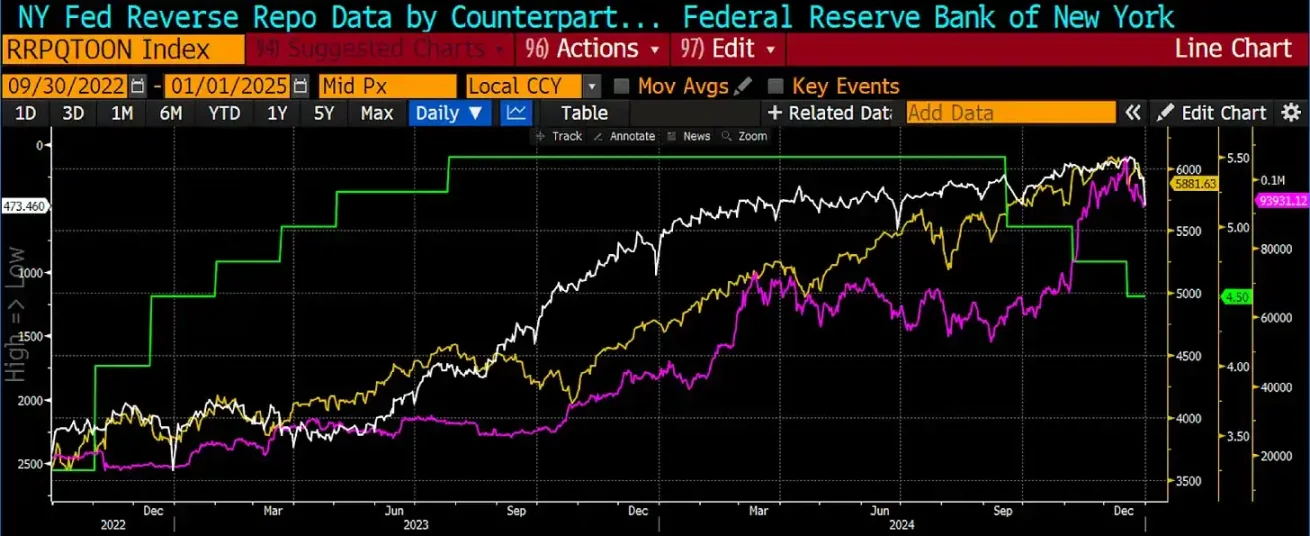

Bitcoin bottomed in the third quarter of 2022, when the Federal Reserve’s reverse repurchase facility (RRP) peaked. Driven by U.S. Treasury Secretary Yellen (nicknamed "Bad Girl Yellen"), the U.S. Treasury Department reduced the issuance of long-term coupon bonds and increased the issuance of short-term zero-coupon bonds, thus drawing more than 2% from the RRP. Trillions of dollars.

This effectively injected liquidity into global financial markets. Cryptocurrency and stock markets, especially large U.S.-listed tech stocks, surged as a result. As you can see from the chart above, the relationship between Bitcoin (left axis, yellow) and RRP (right axis, white, reversed): as RRP decreases, Bitcoin price increases.

The question I am trying to answer in Q1 2025 is whether the positive boost of USD liquidity can mask underlying disappointment in the speed and effectiveness of Trump’s so-called “pro-crypto” and “pro-business” policies. If it can, then market risk will become relatively manageable and the Maelstrom Fund should increase its exposure.

First, I'll discuss the Federal Reserve, which is a minor consideration in my analysis. Subsequently, I will focus on analyzing how the U.S. Treasury Department responds to the debt ceiling issue. If politicians stall on raising the debt ceiling, the Treasury Department will tap its general account (TGA) funds at the Federal Reserve, which will inject liquidity into the market and create positive momentum for the crypto market.

For the sake of brevity, a detailed explanation will not be given of how borrowing and lending in the RRP and TGA negatively and positively impact U.S. dollar liquidity, respectively. Please refer to the "Teach Me, Dad" article to learn more about how these mechanics work.

Fed

The Fed's quantitative tightening (QT) policy is advancing at a rate of $60 billion per month, which means that the size of its balance sheet is shrinking. Currently, the Fed's forward guidance on QT speed has not changed, and I will explain why later in the article, but my prediction is that the market will peak in mid-to-late March, so $180 billion of liquidity will be drained.

The reverse repurchase facility (RRP) has dropped to almost zero, and in order to completely deplete the facility's funds, the Federal Reserve has belatedly adjusted the RRP policy rate. At the meeting on December 18, 2024, the Federal Reserve lowered the RRP rate by 0.30%, which was 0.05% more than the reduction in the policy rate. The move aims to link the RRP rate to the lower bound of the federal funds rate (FFR).

If you want to understand why the Fed waited until the RRP was almost depleted before moving interest rates to the lower bound of the FFR, thereby making it less attractive to deposit money into the RRP, I recommend reading Zoltan Pozar's article "Cheating on Cinderella". My takeaway from this article is that the Fed is using every tool it has to bolster demand for Treasury issuance by avoiding, if possible, halting QT, granting additional supplemental leverage ratio exemptions to U.S. commercial bank branches, or restarting QE (QE), which means "restarting the money printing press."

Currently, there are two pools of money that will help curb the rise in bond yields. For the Fed, the 10-year U.S. Treasury yield cannot exceed 5% because this level will trigger a sharp increase in bond market volatility (MOVE index). As long as there is liquidity in the RRP and the Treasury General Account (TGA), the Fed does not need to significantly adjust its monetary policy or admit that a fiscal dominance situation is occurring.

Fiscal leadership will essentially make Powell's position appear to be subordinate to "bad girl Yellen", and after January 20, it will be subordinate to Scott Bessent. As for Scott, I haven't thought of a nickname that suits him yet. If his decision-making turned me into a modern-day version of Scrooge McDuck due to the depreciation of the dollar against gold, I would give him a more endearing nickname.

Once the Treasury General Account (TGA) is depleted (positive impact on dollar liquidity) and subsequently replenished as the debt ceiling is raised after it is hit (negative impact on dollar liquidity), the Fed will exhaust its emergency measures, There is no stopping the inevitable further rise in yields following the easing cycle that began last September.

This has little impact on U.S. dollar liquidity conditions in the first quarter, just a casual thought on how Fed policy might evolve over the course of the year if yields continue to rise.

The federal funds rate ceiling (FFR, right axis of the chart above, white, inverted) versus the U.S. 10-year Treasury yield (left axis, yellow) clearly shows that when the Fed lowers interest rates in the face of inflation above its 2% target At the same time, bond yields rose.

The real question is how quickly the reverse repurchase facility (RRP) fell from about $237 billion to zero. I expect RRP to be close to zero at some point in the first quarter as money market funds (MMFs) maximize returns by pulling money out and buying higher-yielding Treasury bills (T-bills). To be clear, this means an injection of $237 billion in U.S. dollar liquidity in the first quarter.

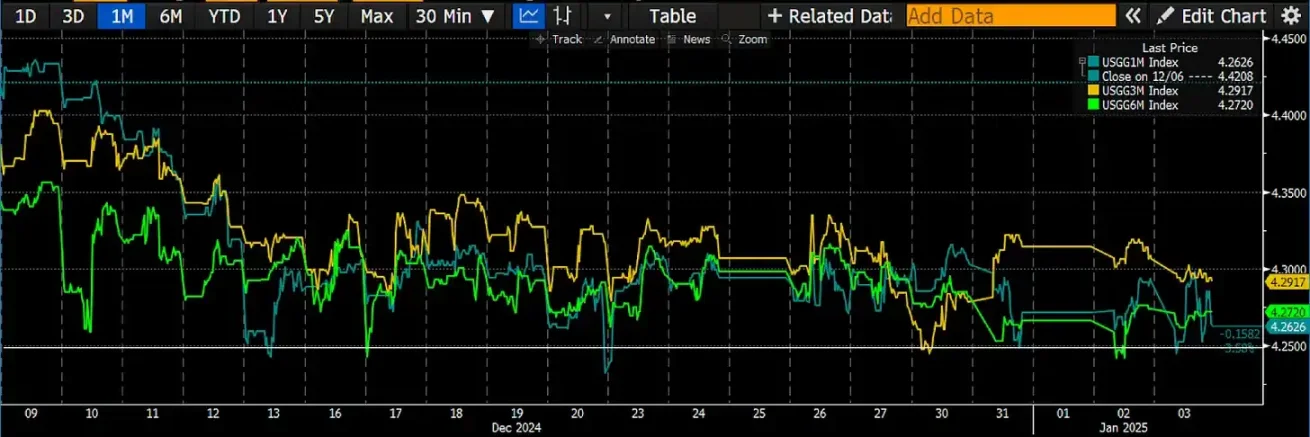

After the RRP rate change on December 18, the yield on Treasury bills (T-bills) maturing within 12 months has exceeded 4.25% (white), which is the lower bound of the federal funds rate.

The Fed will reduce liquidity by $180 billion due to quantitative tightening (QT), and will also drive an additional $237 billion in liquidity injections due to the reduction in RRP balances due to the Fed's adjustment of the incentive rate. In total, this represents a net liquidity injection of $57 billion.

Ministry of Finance

"Bad girl" Yellen told the market that she expects the Treasury Department to begin taking "extraordinary measures" to fund the U.S. government between January 14 and 23. The Treasury has two options to pay the government's bills: either issue debt (a negative impact on dollar liquidity) or spend funds from its checking account at the Federal Reserve (a positive impact on dollar liquidity).

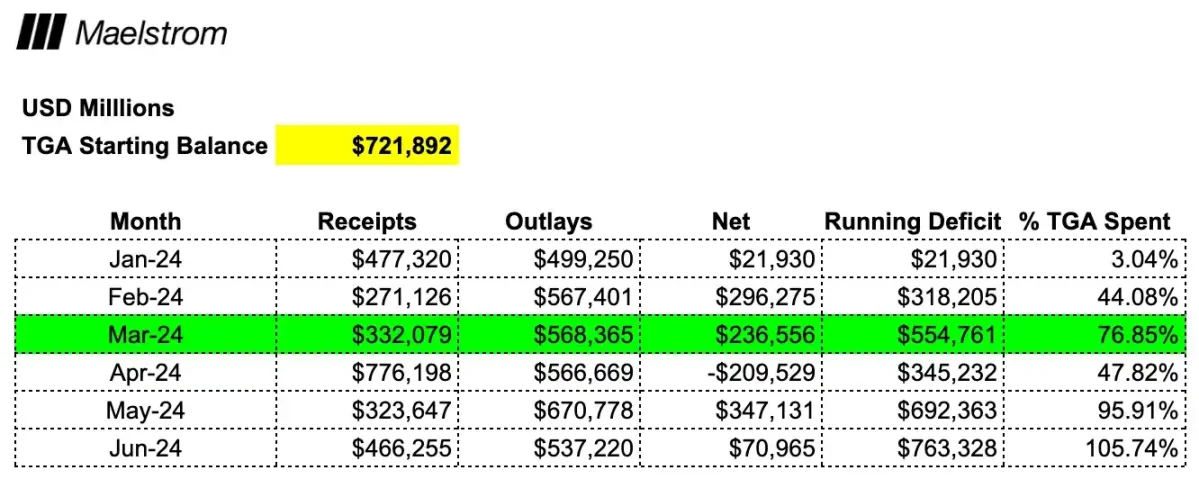

Since the total debt cannot be increased until the U.S. Congress raises the debt ceiling, the Treasury Department can only spend funds from its checking account, the TGA. Currently, the TGA's balance is $722 billion. The first big what-if is when politicians agree to raise the debt ceiling. It will be the first test of Trump's support among Republican lawmakers. Keep in mind the margins of his governance — razor-thin Republican-Democratic majorities in the House and Senate.

There is a group of Republicans who like to hold their chests high and arrogant, claiming that they care about reducing the size of bloated government every time the debt ceiling issue is discussed. They'll delay voting for a debt ceiling increase until they get some big returns for their districts.

Trump has failed to persuade them to veto a spending bill through the end of 2024 if the debt ceiling is not raised. Democrats, after suffering a gender-neutral bathroom defeat in the last election, are unlikely to help Trump unlock government funds to pursue his policy goals.

Harris 2028, is anyone interested? In fact, the Democratic presidential candidate will be that silver-haired man, Gavin Newsom. So, to move things along, Trump would be wise to keep the debt ceiling issue on the agenda until absolutely necessary, before introducing any legislation.

Raising the debt ceiling becomes critical when not raising it would result in a technical default on maturing Treasury securities or a complete government shutdown. Based on the 2024 balance of payments data released by the Treasury, I estimate that this will happen between May and June of this year, when the TGA balance will be completely depleted.

Visualizing the speed and intensity of TGA (Treasury Account) usage helps predict the moment of greatest effect when funds are used, and the market is forward-looking. Given that these data are publicly available, and we know that when the Treasury is unable to increase total U.S. debt and accounts are close to being depleted, markets will look for new sources of dollar liquidity. With usage at 76%, March seems to be the time when the market will ask "when is next?"

If we add the total USD liquidity from the Fed and Treasury as of the end of the first quarter, the total comes to $612 billion.

What happens next?

Once a default and shutdown loom, a last-minute deal will be struck and the debt ceiling will be raised. At that point, the Treasury will be able to borrow again on a net basis and must refill the TGA. This will have a negative impact on U.S. dollar liquidity.

Another important date in the second quarter is April 15, when taxes are due. As can be seen from the table above, government finances improved significantly in April, which was negative for USD liquidity.

If the factors affecting TGA balances were the only factors determining cryptocurrency prices, then I would expect a local market top to end the first quarter. In 2024, Bitcoin reached a local high of around $73,000 in mid-March before moving sideways and beginning a months-long decline on April 11, just before the tax was due.

trading strategy

The problem with this analysis is that it assumes USD liquidity is the most critical marginal driver of total global fiat liquidity. Here are some additional considerations:

- Will China speed up or slow down the creation of RMB credit?

- Will the Bank of Japan start raising interest rates, which will make the USD-JPY appreciate and unwind the leveraged carry trade?

- Will Trump and Bessent engage in a massive overnight devaluation of the U.S. dollar relative to gold or other major fiat currencies?

- How effective has the Trump team been in quickly reducing government spending and passing bills?

These major macroeconomic issues cannot be determined in advance, but I am confident in the mathematical models of how RRP and TGA balances change over time. My confidence is further validated, especially by the market's performance from September 2022 to now: increased USD liquidity due to the decline in RRP balances has directly led to the rise of cryptocurrencies and stocks, although the Fed and other central banks have maintained a stable performance since the 1980s. The fastest rate hike.

FFR cap (right, green) versus Bitcoin (right, magenta) versus the S&P 500 (right, yellow) versus RRP (left, white, inverted). Bitcoin and stocks bottomed in September 2022 and rebounded on the back of falling RRP, with over $2 trillion of USD liquidity injected into global markets. This is a deliberate policy choice by "bad girl" Yellen to drain RRP by issuing more government bonds. Powell and his financial tightening efforts to combat inflation were completely ineffective.

Despite all the caveats, I think I've answered the question I originally asked. That said, the Trump team’s disappointment in failing to deliver on its proposed legislation to support cryptocurrencies and commerce can be made up for by an extremely positive USD liquidity environment, with USD liquidity increases in the first quarter of up to 6120 billion dollars.

As is the case almost every year, the plan is that the end of the first quarter will be the time to sell, take some time off, go to the beach, nightclubs, or ski resorts in the Southern Hemisphere and wait for dollar liquidity conditions to improve again in the third quarter.

As Chief Investment Officer of Maelstrom, I will encourage risk takers in the fund to adjust their risk to "DEGEN" (extreme risk) mode. The first step in this direction was our decision to enter the emerging field of decentralized science (DeSci). We like undervalued junk coins and bought BIO, VITA, ATH, GROW, PSY, CRYO, NEURON.

For more insight into why Maelstrom thinks the DeSci narrative has the potential to be repriced higher, read Degen DeSci. If things go as well as I describe, I will adjust the baseline in March and jump into the "909 Open High Hat" stage. Of course, anything can happen, but overall I'm bullish.

Perhaps the Trump market sell-off occurs from mid-December 2023 to late 2024, rather than mid-January 2025. Does that mean I'm a bad prophet sometimes? Yes, but at least I can absorb new information and opinions and make adjustments before they lead to significant losses or missed opportunities.

This is what makes the investment game intellectually engaging. Imagine how boring life would be if you could make a hole-in-one every time you hit the ball, make every three-pointer in basketball, and make every ball in pool.

jinse

jinse