Freedom, Crypto and Politics: Tether invests heavily in Rumble's strategic chess game

Reprinted from jinse

02/08/2025·4DAuthor: Revc, Golden Finance

1. Background and overview ****

Founding time and founder:

Founded in October 2013 by Canadian tech entrepreneur Chris Pavlovski, headquartered in Toronto and headquartered in Longboat Key, Florida. Its original intention was to provide a platform for small content creators to replace YouTube, and solve the latter's traffic suppression problem of independent creators.

Positioning and Vision:

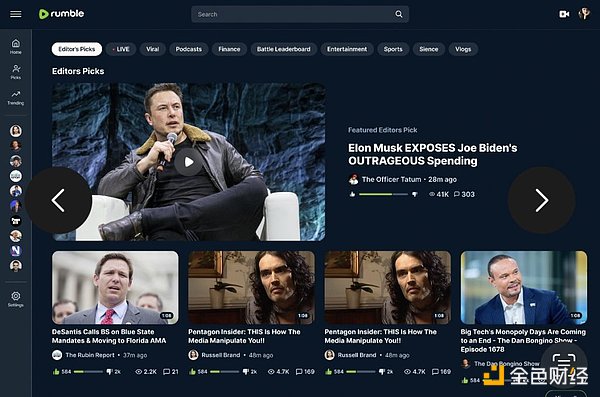

Rumble takes "freedom of speech" and "anti-cancellation culture" as its core positioning, claiming to protect the open Internet ecology and support diversified expression. Although the platform emphasizes neutrality, its user base is highly conservative and is often regarded as a representative of the "alternative technology" camp.

Development history:

-Turning in 2020: Trump switched to Rumble due to banned by mainstream social media, and the platform users surged from 2 million to 20 million, becoming the center of political discussion.

- 2024 outbreak: Thanks to Trump's second-elected crypto policy dividend, Rumble's stock price soared 190%, and was deeply tied to Trump's Truth Social to provide him with video streaming technical support.

- Strategic upgrade in 2025: received US$775 million in investment from Tether (acquired 103 million shares per share), and funds are used for global expansion, cloud service enhancement and crypto integration programs.

2. The strategic logic behind Tether investment ****

1. The resonance between political alliances and crypto layout

It's no accident that Tether chose Rumble:

-Trump Effect: Rumble is known as "Trump Concept Stock" and its user base is highly overlapping with Trump supporters. Tether uses this to strengthen ties with conservative forces in the United States and cater to crypto-friendly policies promoted by the Trump administration (such as Bitcoin reserve program, opposition to CBDC).

- Policy dividend capture: After Trump was elected, the US crypto regulatory environment has improved significantly, the SEC has turned to " guided regulation " . Tether has paved the way for USDT to penetrate the US market by investing in Rumble . ****

2. Ecological coordination and strategic hedging

- Creator Economic Innovation: Rumble plans to integrate Bitcoin and USDT payments and launch the crypto wallet Rumble Wallet , allowing creators to receive rewards through cryptocurrencies and reduce their dependence on traditional financial systems. Tether uses this to expand the USDT application scenario and consolidate the dominant position of stablecoins. ****

-Diverable investment layout: Tether has been involved in agriculture, AI , brain-computer interface and other fields in recent years. Investing in Rumble is a key link in its hedging crypto market fluctuations and building a " entity + digital " global distribution network. ****

3. Financial strength and regulatory game

- Tether's unaudited profit in 2024 reached US$13 billion, holding US$94.5 billion in US Treasury and US$7 billion in excess reserves, providing confidence for its aggressive investment.

- Although Tether CEO Paolo Ardoino has expressed caution (need to wait for US regulation to be clear), investing in Rumble has released its "test water temperature" signal and may further expand its U.S. business in the future.

3. The deep binding between Rumble and Trump 's camp ****

1. Truth Social’s technical pillar

- Rumble provides video and streaming services to Trump's social media platform Truth Social, which forms a "content + infrastructure" alliance. Trump consolidates his political influence through Truth Social, while Rumble uses this to obtain high-traffic content and enhances user stickiness.

-Political narrative empowerment: Rumble set a record of 1.79 million online audiences during the 2024 presidential election, becoming the main base of conservative public opinion, and is highly consistent with Trump 's " anti - establishment " narrative . ****

2. The political symbolism of crypto payments

- Rumble plans to support USDT rewards, which is not only a financial strategy to hedge inflation, but also a political gesture to the crypto community.

-Risk Controversy: Rumble's close ties with Trump have raised questions about market manipulation. For example, the WLFI project requires partners to purchase equivalent tokens, which is accused of using political influence to lock in liquidity and exacerbating the industry's trust crisis.

4. The politicized dilemma and opportunities in the crypto industry

1. Policy dividends and dependency risks

- Trump fulfilled his promises of loosening regulatory restrictions and supporting mining. The scale of Bitcoin ETF exceeded 1.1 million BTC, and institutions such as MicroStrategy continued to increase their holdings. But the market is overly dependent on a single politician, and the repetitive policy (such as the game between Congress and the Federal Reserve) may cause severe fluctuations.

-Case warning: WLFI projects lose tens of millions of dollars due to their ETH and BTC holdings, exposing the high-risk speculative attributes of politically related projects.

2. Compromise of decentralized ideals

- Although Rumble's cooperation with Tether claims to "break traditional control", its deep binding with Trump's camp reveals that the crypto industry is still difficult to get rid of centralized power intervention. For example, Tether consolidated the hegemony of the US dollar by repurchasing US bonds, forming a subtle conflict with the concept of " decentralization " .

Summary: Finding value anchor points in the political craze ****

The rise of Rumble and Tether's investment reflect the complex ecology of the crypto industry and political power intertwined. It demonstrates the potential of combining free speech platforms with decentralized finance, but we should also be wary of political manipulation and bubble risks.

Future Challenges:

- Rumble needs to balance content review and freedom of speech to avoid becoming a breeding ground for extreme speech;

- Tether needs to prove that its investment can truly empower the creator economy, not short-term speculation;

This game of freedom, encryption and politics may become a historic experiment to reconstruct the digital power landscape. ****

panewslab

panewslab

chaincatcher

chaincatcher