Golden Web3.0 Daily | California sues Trump for tariff policy

Reprinted from jinse

04/16/2025·3DDeFi data

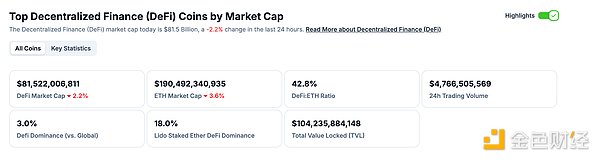

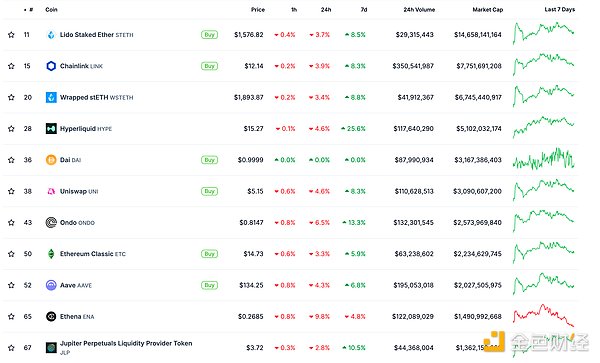

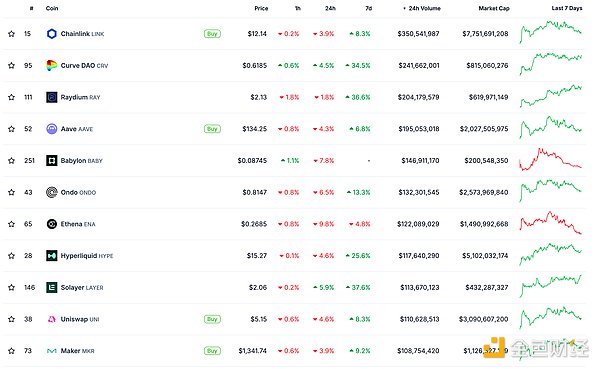

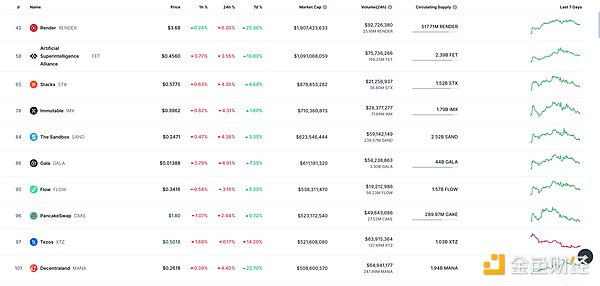

1. Total market value of DeFi tokens: US$81.522 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$4.766 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

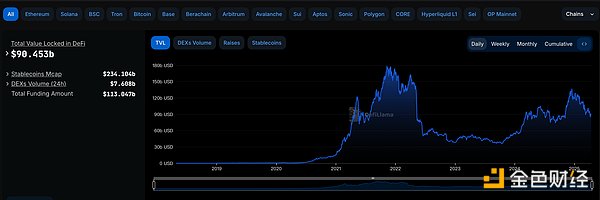

3. Locked assets in DeFi: US$90.453 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

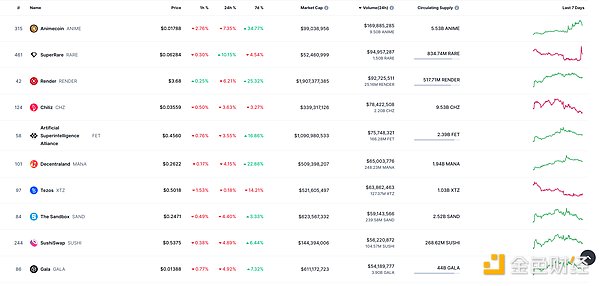

1.NFT total market value: US$15.721 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 1.842 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

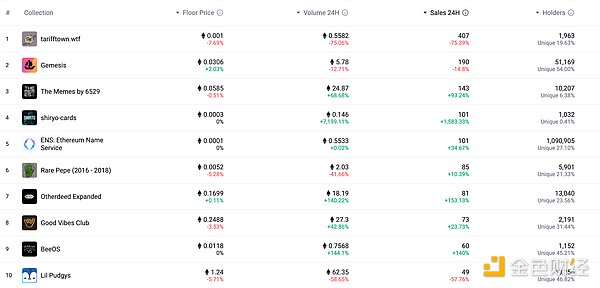

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

California sues Trump for tariff policy saying it is illegal and undermines the economy

California Governor Newsom's office issued a statement on Trump's tariff measures, saying the state will file a lawsuit in an effort to stop Trump's tariff policies. California's major industries from Silicon Valley to agriculture rely heavily on global trade, so it could lose billions of dollars due to tariffs. "President Trump's illegal tariff measures are bringing chaos to California's families, businesses and our economy - pushing up prices and threatening employment," Newsom said in a statement. The lawsuit has been Newsom's most direct legal challenge to Trump's policy agenda since Trump took office in January. Newsom's argument is directed at the U.S. International Economic Emergency Powers Act, which Trump imposes tariffs without Congress' approval. The Democrat believes Trump has no right to impose tariffs under the law, which is consistent with a view to similar lawsuits filed by a group of U.S. businesses on Monday.

MEME hot spots

1.TRUMP will unlock 40 million tokens on April 18, accounting for about 20% of the circulating supply

According to ai_9684xtpa monitoring, the TRUMP huge unlock countdown is two days, and the TRUMP Dev address has removed 366,000 TRUMP and 4.6 million USDC liquidity from Meteora 16 hours ago. Currently, the address has 14.72 million TRUMPs and 200 million USDC liquidity in Meteora, while the chain still holds 15.38 million TRUMPs worth US$120 million. TRUMP will unlock 40 million tokens on April 18, accounting for about 20% of the circulating supply and 4% of the total token supply; if it flows into the market, it will cause large coin price fluctuations, so pay attention to risks.

2. The TRUMP project party extracted US$4.6 million by removing liquidity 13 hours ago and deposited it into Coinbase Prime

According to Lookonchain monitoring, the TRUMP project party withdrew US$4.6 million from the pool by removing liquidity 13 hours ago, and then transferred the funds across chains to Ethereum and deposited them into Coinbase Prime.

DeFi hotspots

1.BaFin, Germany, ordered Ethena to stop issuing USDe token-related businesses

Golden Finance reported that the German Federal Financial Regulatory Authority (BaFin) has ordered Ethena GmbH to stop its business related to the issuance of USDe tokens. BaFin discovered that Ethena GmbH's operations were seriously flawed in the authorization process and imposed sanctions on it, resulting in the revocation of its USDe token offering. The company entered the German market under the transitional terms of the European Crypto Assets Market Supervision Agency (MiCAR), but withdrew its application for authorization on April 3, 2025. Therefore, EthenaGmbH cannot continue to operate in the EU and must implement its USDe token redemption plan under BaFin's supervision. BaFin also imposed a mandatory fine of 600,000 euros and prohibited it from paying and selling to protect the company's assets from creditors' debts.

2. Liquidity Infrastructure Orderly launches OmniVault

On April 16, liquidity infrastructure Orderly launched OmniVault, and ordinary DeFi users can also become liquidity providers (LPs) and earn high returns through passive means. OmniVault adopts a market-making strategy managed by trusted institutions, allowing LPs to be deposited into USDC and earning revenue on multiple networks Orderly-supported. The benefits obtained by LP are guaranteed by market maker Kronos.

3. Unichain TVL soars to $71 million driven by liquidity incentives

According to the Uniswap Foundation data, Unichain TVL soared to more than $71 million since Gauntlet provided UNI incentives to Unichain's 12 pools for two weeks, while Unichain TVL had only less than $1 million, of which USDC/USDT0 Pool reached $44 million. Currently, the daily rewards of 12 Unichain Pools are about US$330,000 equivalent UNI, of which USDC/USDT0 PooL are 7,784 UNIs (worth approximately US$40,600).

4.Noble 's new "AppLayer" allows developers to build stablecoin tools on Celestia

April 16th news, Noble, a blockchain platform focusing on RWA and stablecoin issuance, announced on Wednesday that it will launch Ethereum-compatible Rollup solution "AppLayer" to expand its platform capabilities. The solution allows developers to build customized RWA applications and infrastructure, and is scheduled to be officially launched in the third quarter of 2025. AppLayer will be built on the modular blockchain Celestia to reduce storage costs by leveraging its data availability scheme. This solution is also compatible with Ethereum Virtual Machine (EVM), which can achieve seamless integration with the Ethereum ecosystem DeFi project.

5.Solana Eco Payment Agreement Solayer launches unmanaged encrypted debit cards

According to Golden Finance, Solana's ecological payment solution, Solayer, announced the launch of a non-custodial cryptocurrency debit card, where users can directly use crypto assets to consume without custodial funds. This product is implemented through cooperation with Visa, supporting real-time exchange of SOL and SPL tokens for fiat currency settlement, while maintaining full control of the private keys. Solayer said the move is aimed at promoting the large-scale application of cryptocurrencies in daily payment scenarios.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

panewslab

panewslab

chaincatcher

chaincatcher