Is the encryption market over? 9 core indicators reveal the bull top signal

Reprinted from panewslab

02/05/2025·2MHow to accurately predict the apex of the bull market? You must master these 9 key indicators!

The apex of accurate prediction of the buffet market of the encryption market is almost impossible, but you can use these data indicators to determine whether the market is close to the top.

If the 5 signals appear at the same time, then you have accumulated enough wealth, or you can only go back to McDonald's to work ...

Now, let's unveil the secret of the end of the bull market together.

1. NUPL (unrealized net profit/ loss)

Market emotional indicator

When NUPL enters the fanatic/ greedy area (more than 75%), it usually means that the market is close to the top, and investors are becoming too optimistic.

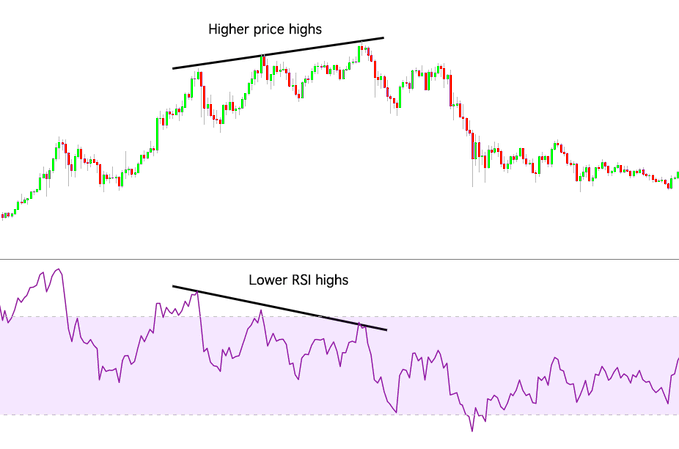

2.RSI (relatively strong and weak index)

Short -term super -buy signal

When the RSI exceeds 90, the market is usually in extreme super-buying status. Historical data shows that the high point is usually formed within 4-7 weeks, and then call back.

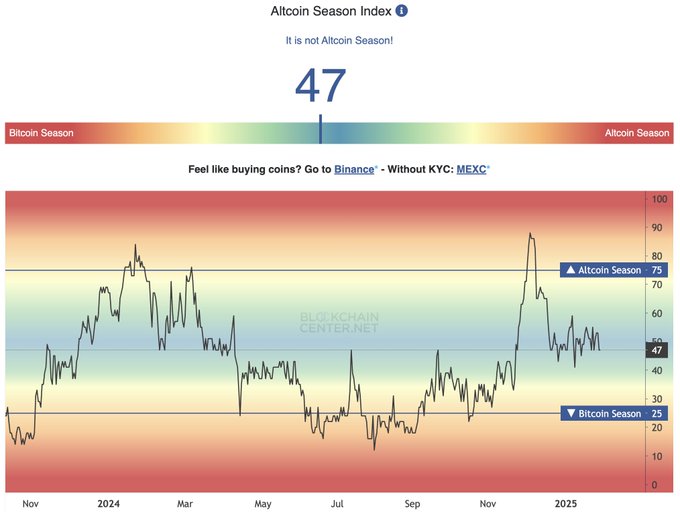

3. Congzhong Season Index (Altcoin Season Index)

Congzheng VS Bitcoin

When the index exceeds 85, it means that the cottage coin will win Bitcoin as a whole, which is usually a sign of the market entering the enthusiastic stage.

4. MVRV Z-SCORE (actual value of market value vs)

Determine whether the market is extremely overestimated

When the MVRV Z-SCORE is more than 6, it indicates that the market may be close to the top and need to be alert to potential risk.

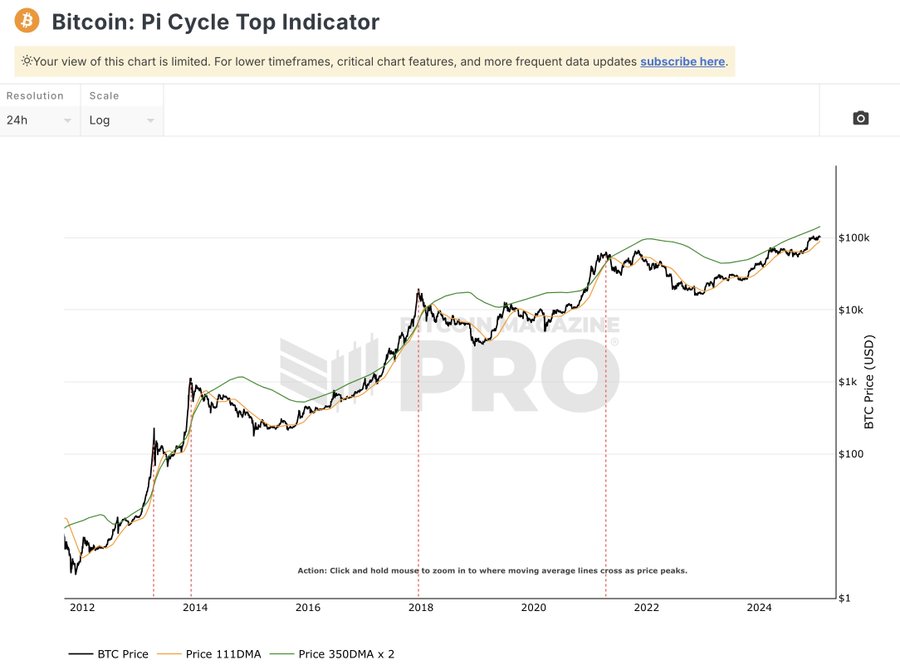

5.Pi Cycle Top indicator

Accurately identify Bitcoin bull market

This indicator successfully predicts the main price of Bitcoin in multiple cycles.

When it sends a warning signal, it means that the bull market is about to reach its peak.

6. MACD (moving average convergence and divergence)

Trend change and kinetic signal

When MACD appears, a dead fork means that the market's momentum is weakening and the trend may reverse.

7.mfi (fund flow index)

Sale pressure monitoring

Similar to RSI, but MFI combines transaction volume data, when it shows extreme super -buying, it is usually indicated that the market is top.

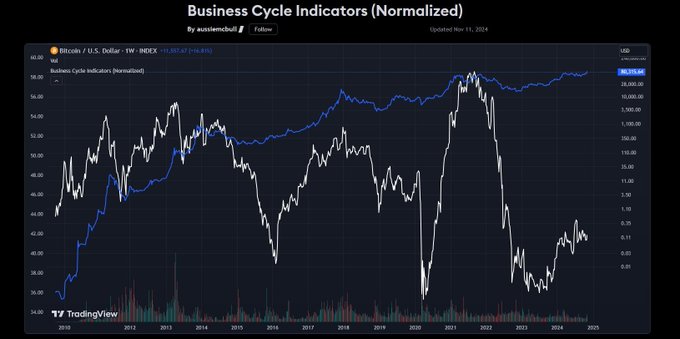

8. Composite Business Cycle Index

Macroeconomic impact

When the index exceeds 50, it indicates that the market may soon enter the peak stage.

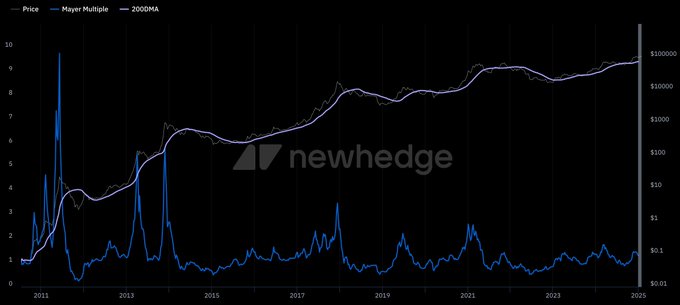

9.mayer Multiple (Mill multiple)

Price VS 200 daily line

Historical data show that when Mayer Multiple reaches 2.4, Bitcoin is usually at the peak of the bull market.

in conclusion

Although it is difficult to accurately predict the market, these nine indicators can help you evaluate the market position more scientifically. The bull market frenzy can make you make a lot of money, but if you do not have a clear exit strategy, it may also allow you to return to before liberation overnight.

jinse

jinse

chaincatcher

chaincatcher