Platform currency valuation revolution: From the low-key rise in GT market value, the long-term game of the exchange ecology

Reprinted from panewslab

04/16/2025·5DOriginal link: https://cn.cointelegraph.com/news/a-long-term-game-of-exchange-ecosystems

Original source: Cointelegraph Chinese

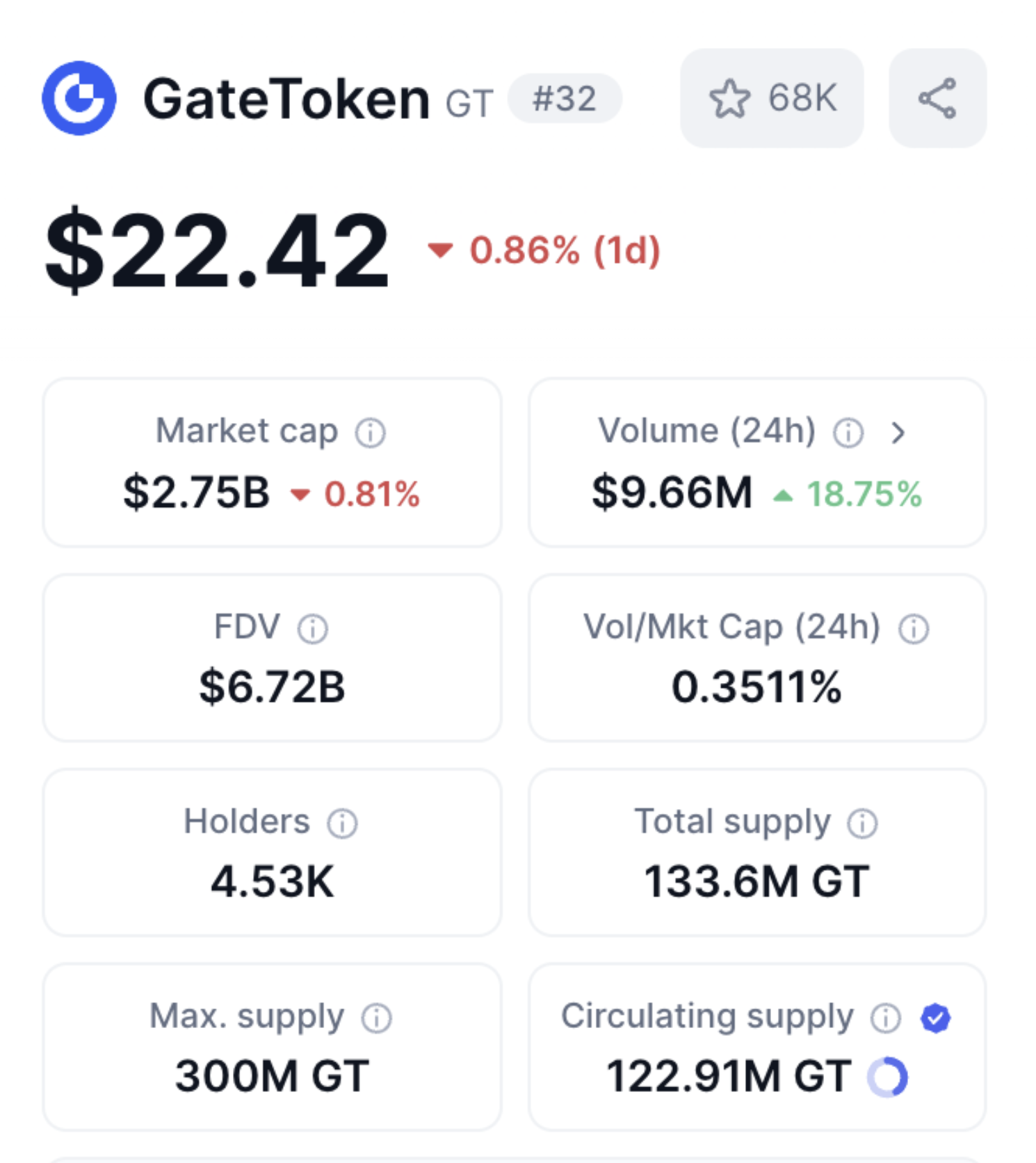

The cryptocurrency market in 2025 showed significant "structural fluctuations" characteristics: Bitcoin maintained high fluctuations under the support of institutional funds, but small and medium-sized market capitalization assets were generally under pressure, and market liquidity was concentrated in leading assets. Against this background, as the core value carrier of the exchange ecosystem, the internalization of the track has been further intensified. According to the latest data in April 2025, the market value of Gate.io platform currency GT has climbed to 32nd place in the world, and its quotation is stable above US$22, becoming one of the few platform currency representatives to achieve "counter-cyclical growth". This phenomenon not only reflects the market's revaluation of the GT ecological value, but also reveals a deep transformation in the exchange competition logic - from simple traffic competition to the competition of ecological value capture efficiency.

Compared with the market performance of mainstream platform coins horizontally, GT's "low-key climb" is particularly worthy of attention. As of April 2025, its circulating market value has surpassed many traditional financial derivative tokens, and among the top 50 cryptocurrencies in the world, GT is the only platform coin that has achieved synchronous growth in the three indicators of "transaction volume, number of users, and destruction" for three consecutive quarters. Behind this "counter-trend resilience" is the deep coordination between the exchange ecological construction and the token economic model.

1. Data digging: Where does GT's excess returns come from?

The value performance of platform coins essentially reflects the overall competitiveness of the exchange. Judging from the gains in the past 180 days, GT has a 148.29% increase far exceeding BNB (3.32%) and OKB (29.17%). This gap reveals three core trends:

-

Difference in growth momentum: The top platform coins (such as BNB) have a relatively high ecological maturity and their growth tends to flatten; while GT relies on Gate.io's "high growth ecosystem" and is still in an accelerated period of value release.

-

Comparison of deflation efficiency: As of Q1 2025, the cumulative destruction of GT reached 177 million (accounting for about 60% of the total), far higher than the average annual destruction ratio of most platform coins (usually less than 20%). This "exceeding deflation" directly pushed up the scarcity premium of GT.

-

User growth dividend: Gate.io's number of users exceeded 22 million (234% growth in 2024), and the transaction volume reached US$3.8 trillion (120% annual growth), which is significantly higher than the industry average, providing continuous support for the demand side of GT.

It is worth noting that GT's market value/trade volume ratio is significantly lower than that of leading platform coins such as BNB, which means that there is still a lot of room for repair in its valuation - if Gate.io maintains its current growth trend, GT's market value benchmarking potential may be further released.

2. GT's competitive advantages over other platform coins: ecological

empowerment and strategic depth

In the platform currency track, GT, BNB and OKB show completely different development paths. As the industry leader, BNB's value support mainly comes from the scale effect of Binance ecosystem; OKB relies on OKX Chain's technical iteration. GT's strong performance is rooted in the "Tripe" value system built by Gate.io: deflation-driven, scenario penetration, and strategic forward-looking.

1. Deflation model: From "passive destruction" to "active value management"

GT adopts a dual-track mechanism of "profit repurchase + targeted destruction":

-

Rigid deflation: 20% of the platform's net profit in Q1 2025 will be used for GT repurchase and destruction, and the circulation volume is expected to be reduced by more than 12 million pieces this year;

-

Scenario consumption: GT, as a native token of Gate Chain, continues to consume in DeFi, NFT cross-chain and other scenarios, further reducing circulation.

In contrast, the deflation design of most platform coins only relies on fee deductions, lacks diversified consumption scenarios, and the long-term deflation efficiency is limited.

2. Strategic layout: dual-wheel drive of compliance and globalization

The strategic focus of Gate.io in 2025 clearly points to:

-

Compliance: It has obtained EU MiCA license and principled approval of the Middle East VASP, with a reserve ratio of over 128% (ranked third in the world), significantly reducing policy risks;

-

Globalization: sponsoring the F1 Red Bull team, deploying in Latin America and Southeast Asian markets, and the user geographical distribution is more balanced;

-

Product Innovation: The contract market share target has been increased to 10%, and AI trading assistant and MEME innovation zone have been launched.

3. Valuation depression and growth certainty

-

Gate.io's spot trading volume has ranked among the top three in the world, but its platform currency market value is still only 1/15 of that of BNB. If the market share of Gate.io contracts increases from 5% to 10%, the market value of GT may have 2-3 times the room for revaluation.

-

GT's deflation rate (about 8% annualized) far exceeds the industry average (2%-3%), and the demand for use brought about by ecological expansion has formed continuous buying pressure. This mismatch of "super supply and demand increase" makes it more defensive in the volatile market.

These measures not only enhance the platform's anti-cyclical nature, but also inject long-term growth expectations into GT.

3. Conclusion: The essence of platform currency competition is

ecological war

The current competition in the platform coin track has shifted from "traffic scale" to "ecological quality". GT's counter-trend growth confirms Gate.io's differentiated advantages built by deep deflation, scenario innovation, and compliance layout. For investors, GT's fixed investment value lies not only in its short-term growth, but also in its positioning as a "ecological value aggregator". With Gate.io's transformation into a Web3 infrastructure service provider, GT may become the core link connecting transactions, asset management and on-chain applications.

In the future, the competition for platform coins will focus more on real value capture efficiency and global compliance capabilities. Although market volatility risks always exist, GT's performance in deflation model, ecological expansion and strategic execution has outlined a clear path for value growth.

Related recommendations: Gate.io celebrates its 12th anniversary, its brand is renewed and upgraded, and its doors open to the future of encryption