Trump tariffs are suspended, sorting out investment opportunities in the 90-day window of crypto market

Reprinted from panewslab

04/11/2025·18DAuthor: IGNAS , DEFI RESEARCH

Compiled: Tim, PANews

Cryptocurrencies are currently completely restricted by macroeconomic factors.

All I saw in my X were macroeconomic analysis, not airdrop mining guides or Meme coins.

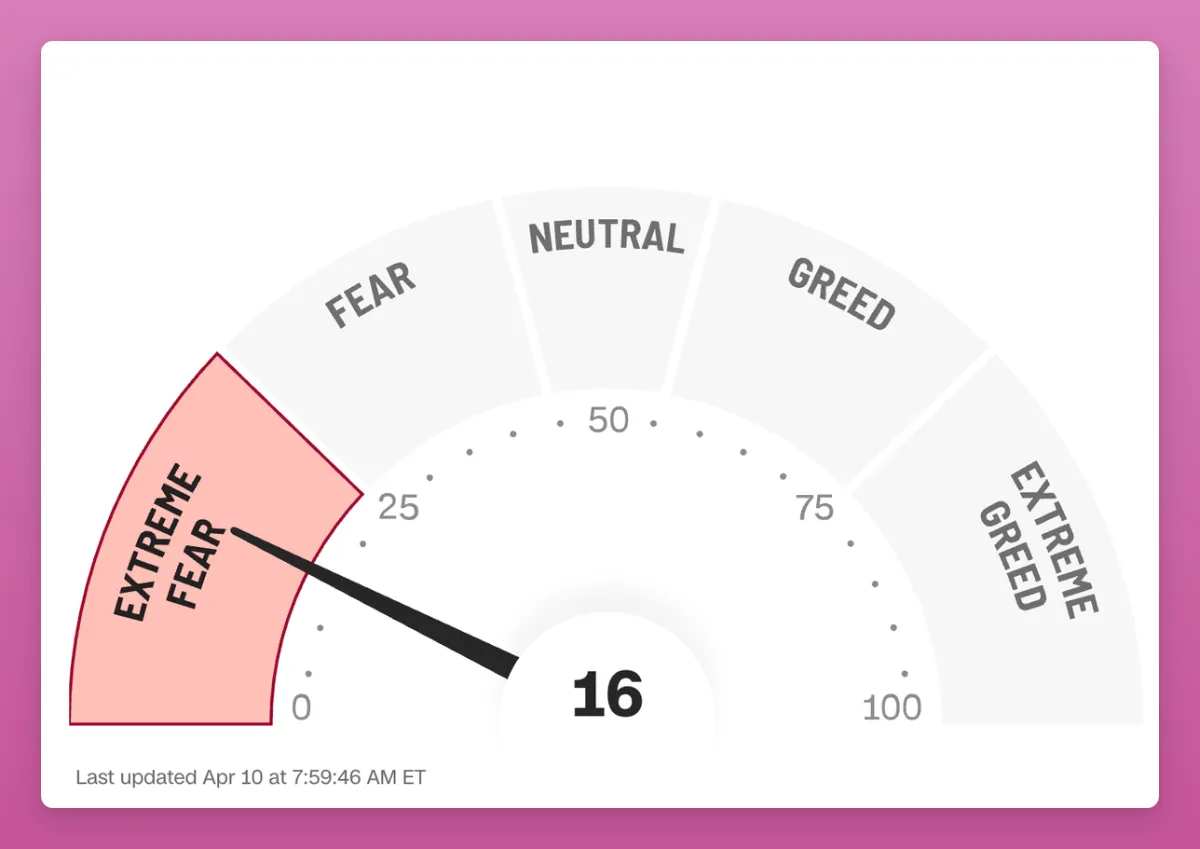

At the time I write this, cryptocurrencies and traditional financial markets are still at "extremely fearful" levels (even after some tariffs are lifted).

Moving forward in the cryptocurrency field has never been as challenging as it is now, and as a content creator, I have never experienced the shortcomings of myself so deeply. Although I know that my level of macro analysis is average, I still want to share it.

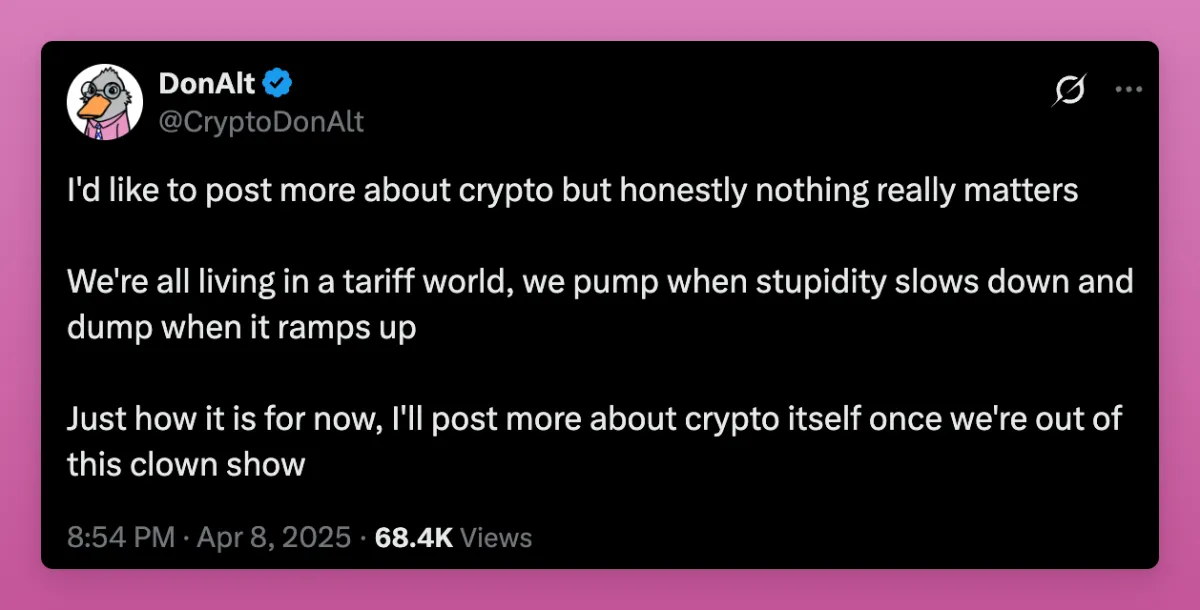

I agree with DonAlt: In today's crazy world, people's thinking about cryptocurrencies is far from deep enough.

Unfortunately, if this does mark a shift in the world pattern and the end of the big debt cycle (as Dalio said), we will face an unstable macroeconomic environment in the coming years.

However, in some relatively stable areas, people's focus will shift to dynamic developments within the encryption system.

The 90-day tariff suspension may also bring some opportunities.

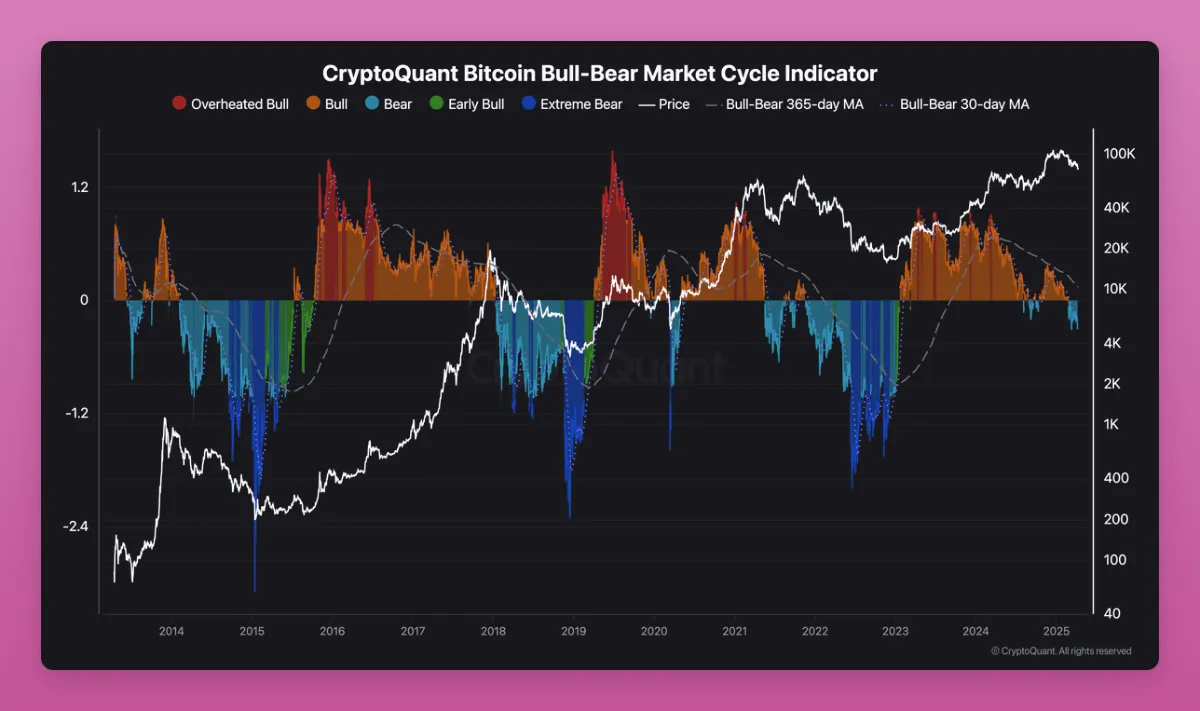

Bitcoin: Bull or bear market?

In hindsight, when I released "Bul or Bear Market" in February: What will happen next? 》 When you write this blog post, you should clear your stock.

I shared some on-chain data charts for Bitcoin (below), and the market immediately turned from bullish to bearish. Don’t blame me, like most KOLs on X, I cannot correctly predict the direction of the market.

What I understand is that in a bull market driven by internal factors, the importance of on-chain data exceeds that of a bull market driven by external macro factors (such as the current bull market).

Bitcoin has become a macro asset, and two major schools of thought are arguing.

- Is Bitcoin a risky asset like stocks?

- Is Bitcoin a safe haven asset like gold?

Many people have not fully realized that the major dilemma facing Bitcoin is that if it cannot establish the attributes of safe-haven assets and has always been highly correlated with the Nasdaq index, then the current price will lose fundamental support. Once this characteristic of linkage with risky assets is solidified, institutional investors will lose interest in them.

In my article "The Truth and Lies of Cryptocurrency 2025", I describe Bitcoin as an atypical hedging tool to combat macroeconomic uncertainty.

Bitcoin cannot be both digital gold and risky assets at the same time.

Bitcoin will reach $250,000 in 2025, and Ethereum will rise to $12,000.

BlackRock's correlation research confirms this, and even Dalio, who had previously been skeptical of Bitcoin, admitted that Bitcoin is a "mean of wealth storage":

"In the early stages of the big debt cycle, currency is 'hard currency', which means it is both a medium of exchange and a means of wealth storage that is difficult to increase the supply at will, such as gold, silver and Bitcoin. Cryptocurrencies like Bitcoin are now becoming a widely accepted hard currency because it is a widely accepted currency worldwide and has limited supply. The biggest and most common risk of currency becoming an invalid wealth storage means is the risk of currency being issued in large quantities. Imagine if you have the power to create money, who would not be tempted to issue a large amount of additional issuance? Those who hold this power will always do this." — Dalio How the State goes bankrupt: Introduction and Chapter 1

I highly recommend reading Dario's latest book, How the Country Gos Bankrupt. In his book, he proposed that the United States is currently in a typical large debt cycle. Dario believes that in the process of debt restructuring, a new world order is also needed.

This is the only in-depth analysis of the current situation in the world.

In short: the United States will print money, and other countries with deep debt will follow suit. You can imagine what Bitcoin would be like in this case.

Bitcoin seems to be more like a risky asset than gold (which is hitting record highs). I think those who see Bitcoin as a risky asset are selling it to those who see Bitcoin as a safe haven asset.

I really like the passage from BlackRock interview with Bankless: He mocked analysts who insisted that Bitcoin is a native crypto field of risky assets because they actually trade Bitcoin based on macroeconomic indicators such as unemployment data, non-farm employment reports or ISM manufacturing index.

Perhaps a simpler theory can explain the current trend of Bitcoin: it is purely driven by liquidity and currency over-issuance. When currency tightens, Bitcoin fluctuates like junk coins; when central bank printing machines are on full power, Bitcoin crushes all risky assets.

This is also what crypto analyst Hayes keeps promoting.

To be honest, I expect Bitcoin to soar because the fiat currency system is being completely defeated.

Ethereum: No worst, only worse

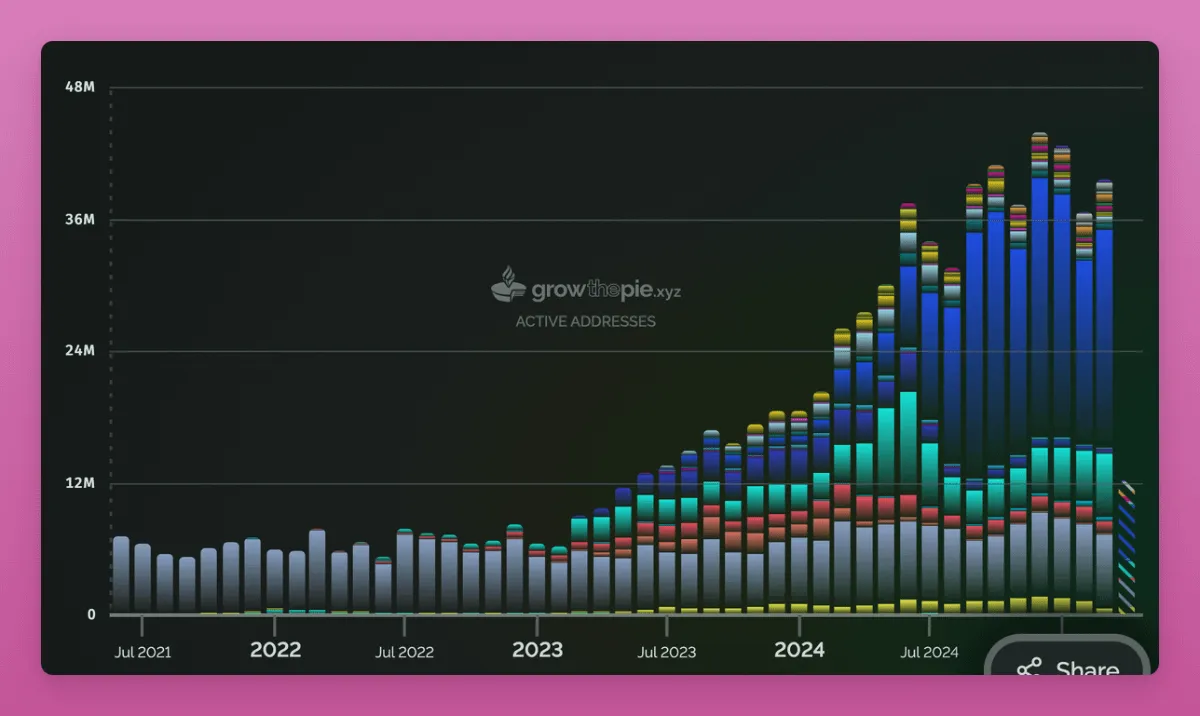

If we evaluate the value of ETH based on fundamental factors such as active addresses and handling fees, it makes sense for ETH to pull back to its 2018 level.

If we count the active addresses of each L2, we can see growth, but this is entirely due to the Base chain. Other chains such as Optimism and Arbitrum are stagnant.

First, as I explained in this post, I don't think GAS fees are the only factor in evaluating the value of L1.

Rather than focusing only on the expense shunt effect of layer 2 solutions on Ethereum and viewing it as a threat, consider ETH as a productive asset:

- In the IC0 era, ETH is a general currency participating in token sales: the funding pools of the project parties are denominated in ETH. Ironically, this impact still has its own consequences, as many old projects are still selling ETH accumulated from the fundraising that year.

- During the summer of DeFi, ETH is the underlying asset for mining various food and animal coins. For example, in the SUSHI/ETH liquidity pool, you need to provide ETH to mine SUSHI tokens, etc.

- During the NFT boom, ETH was (and still is) the main currency.

My strategy manual for DeFi investment madman in the bull market is to bet on the L1 public chain as a productive asset: use tokens such as SUI, STX, INJ, SOL and other tokens to participate in ecological mining to obtain airdrop tokens. Once the airdrop is obtained, sell it immediately for the underlying L1 assets and repeat the process.

But most of these first-tier blockchain projects have failed to successfully develop their ecosystem. Even if a few projects (such as STX and SUI) have made some progress, the token airdrop effect of their ecosystem is unsatisfactory.

The reason I bet on ETH is that Eigenlayer's re-staking mechanism will make ETH the most efficient productive asset in blockchain history: by re-staking ETH, you can not only obtain higher returns than pure pledge, but also get a large amount of airdrops from Eigenlayer ecosystem projects.

Eigenlayer failed. I thought Symbiotic might have a chance, but now it doesn't matter.

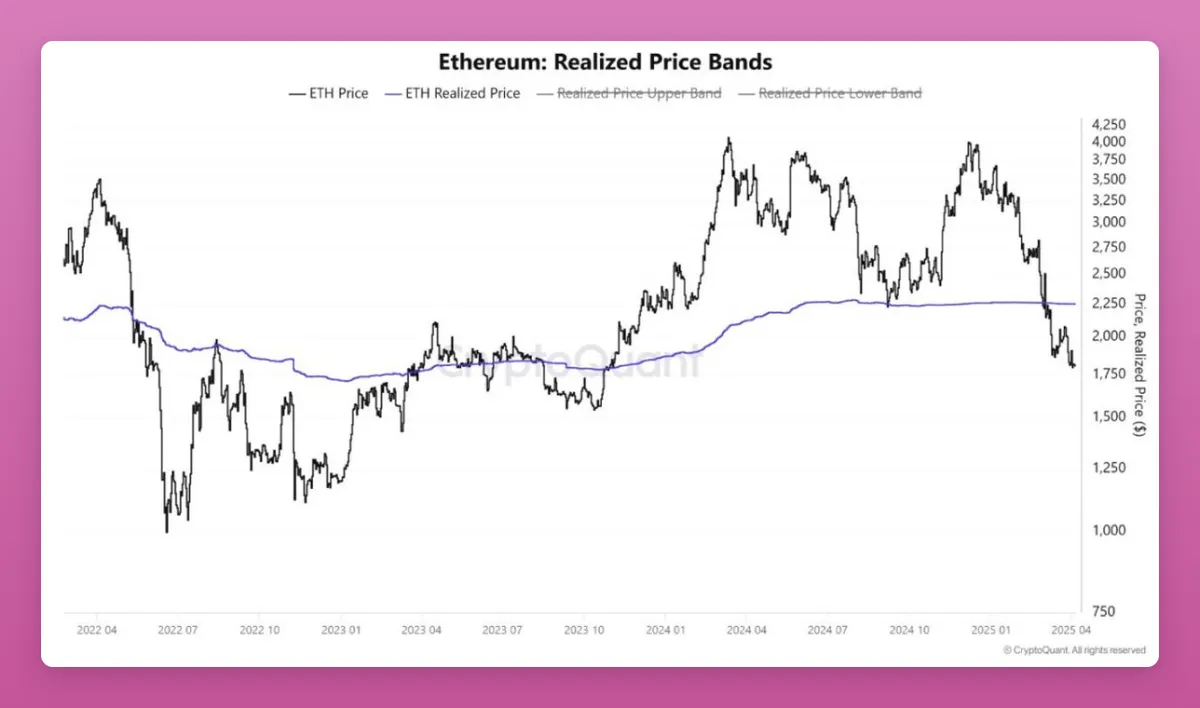

Bullish signal? The average cost price for Ethereum holders is $2,200, so most holders are in a loss-making state.

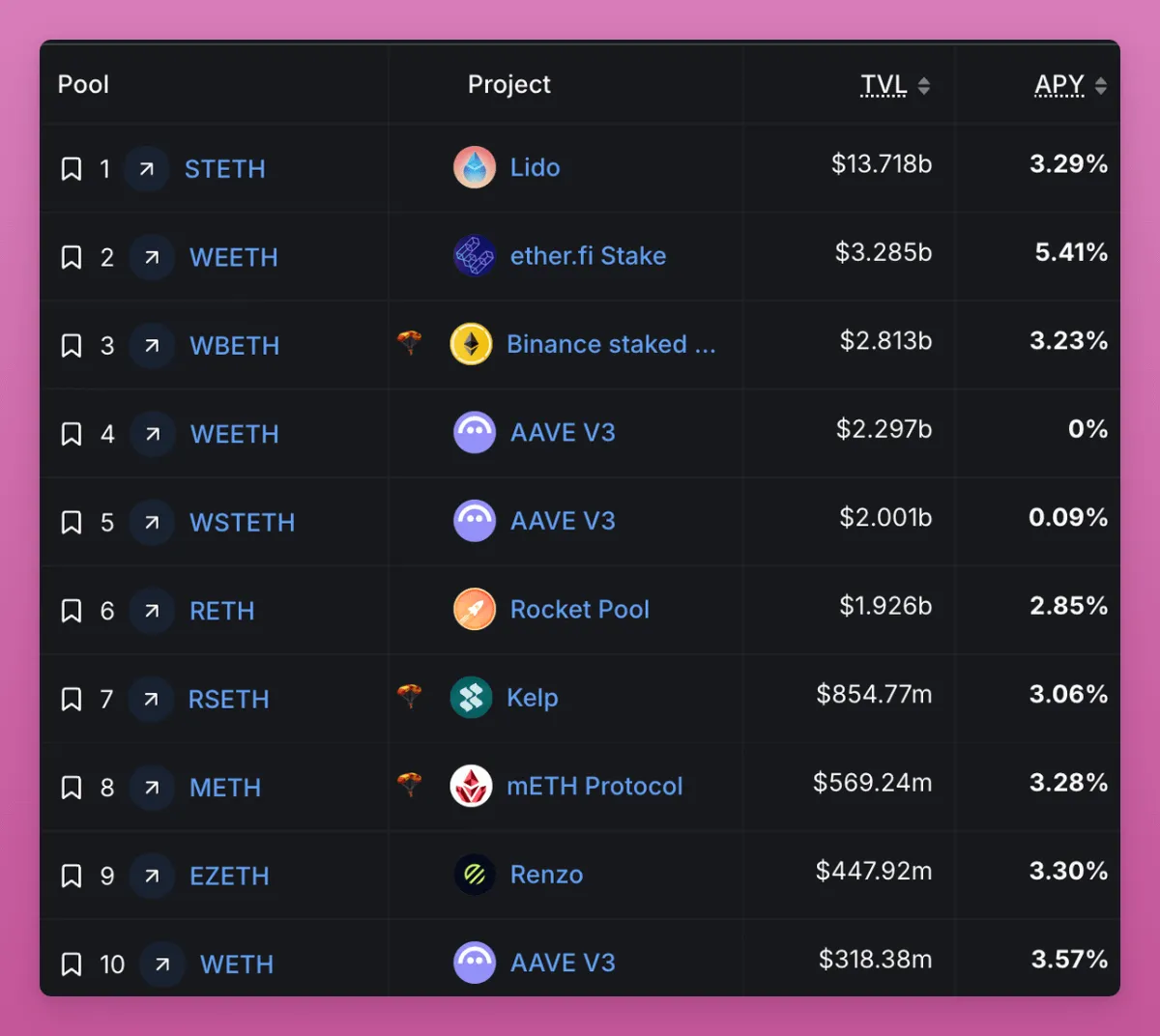

At present, ETH is still an asset with certain production attributes and is mainly used as collateral in the DeFi ecosystem. However, in this market cycle, its production attributes are not as good as SOL, because SOL plays a core role in the Meme currency boom (as a medium of trading and a means of value storage).

I think SOL is following the trend of ETH because the Meme currency collapse has not been replaced by other narratives that can drive SOL demand. However, because SOL has a low market capitalization and provides high inflation rewards, users can still get an annualized rate of return of 25% in Kamino's Multiply liquidity pool. Can anyone find such a high profit for me in ETH?

To reverse the trend of ETH, you need to:

- A stable macro-environment and a favorable regulatory environment that supports risk appetite;

- Make ETH a more productive asset.

Changes in U.S. regulations are good news for Ethereum and other Layer 1s. These changes will attract more stablecoins inflows, drive asset tokenization, and accelerate the overall adoption of blockchain technology.

But even if asset tokenization on Ethereum (compared to other blockchains) shows a very optimistic outlook, it does not necessarily mean that the ETH we hold will surge.

Just imagine, if Tesla stocks can be traded on-chain through Ethereum, this would be a major benefit to DeFi. Tens of billions or even trillions of dollars in the traditional financial market can be used as collateral and stablecoins are loaned for daily consumption scenarios.

If Apple's stock can be traded globally through Uniswap, this will lead the DeFi protocol (and its tokens) into the golden age. We can finally get rid of the current stage of relying on internal circulation and leverage demand. At that time, the cost generation of platforms such as Aave, Fluid, Uniswap will increase exponentially.

- But what does ETH mean for it as a productive asset? There is no doubt that transaction volume will grow, but the Ethereum Foundation is planning to significantly reduce the handling fees for Layer 1 and Layer 2 solutions.

- User Question: I want to know if RWA assets will be paired with Ethereum or stablecoins? But to be honest, why choose to pair with ETH?

- Will the transaction be conducted on L2 (such as Base) that does not distribute income to the L1 main network? Will the Ethereum Foundation mandate that L2 pays a share of the share to L1?

- ......

Many questions have not been answered yet.

RWA tokenization is the most bullish narrative among Ethereum bulls, but as Sam explains below, this may not necessarily have a significant boost to Ethereum prices.

Currently, a number of emerging projects are following the trend of Ethereum's RWA tokenization and institutional adoption into the market: such as Plume, Ethena, and the Layer 1 blockchain for traditional finance launched by Securities.

Overall, I would like to see ETH become a more productive asset again. As a low-yield collateral for continuous depreciation, it is not enough to support the market value growth of US$200 billion in assets.

Current productive assets

Which assets are the most productive at present?

Hyperliquid (HYPE)

There are two main reasons for choosing HYPE:

- Hyperliquid generates more expense revenue than Solana and Ethereum and uses these revenue to repurchase HYPE tokens.

- The HyperEVM ecosystem is on the rise, with HYPE as its core token.

The HyperEVM network is filled with a large number of forked DeFi protocols, and these projects are preparing to issue their respective tokens. Our strategy is very clear: identify the most promising protocols and deposit HYPE tokens into it.

Most decentralized applications focus on circular leverage strategies, and their typical operations are as follows:

- Pledge assets to HYPE LST.

- Borrow it as collateral to assets or mint stablecoins.

- Use the borrowed assets to cycle again.

This can pose risks if there are problems with the operational steps. So I adopted a conservative strategy: participate in Nansen interactions by staking LSTs or using Hyperliquid native platforms. (Nansen is about to airdrop!)

With decentralized applications emerging and changing, by the time I published the article, things might have been different.

To be honest, I plan to swipe the ecological airdrop and sell it out to get more HYPE. Although this is not very good.

Initia (INIT)

Although it has not been launched yet, once the project is launched, I think there will be good mining profit opportunities.

As I explained in my previous post about the "Five Popular Upcoming TGEs", Initia's "Sacred Liquidity" mechanism allows users to earn rewards in two ways: users can either stake INIT tokens individually or stake INIT-X liquidity pool tokens approved by the agreement (these LP tokens need to be paired with INIT tokens), both of which allocate benefits through the entrusted proof-of-stake DPoS mechanism.

Built-in liquidity is a good Ponzi token economic mechanism, which mandates 50% or more INIT tokens as paired tokens for tokens in all ecosystems. These LP tokens must pass the governance whitelist review.

However, I am cautious here: INIT's "native liquidity" model is similar to Berachain. While the yield on Berachain has been very impressive, if you don’t know what you’re doing, those sly liquidity providers may lose all your money.

Research the ecosystem and seize the opportunity to exit.

Sonic(S) and Ronin(RON)

Both ecosystems are conducting liquidity mining activities:

Sonic's 200 million S token marketing campaign will end in June 2025. Despite the overall market plunge, as the core asset of the ecosystem, S is more stable than Bitcoin and performs better than Ethereum and SOL, which is the characteristic of productive assets. However, June may be a worrying time node for S holders.

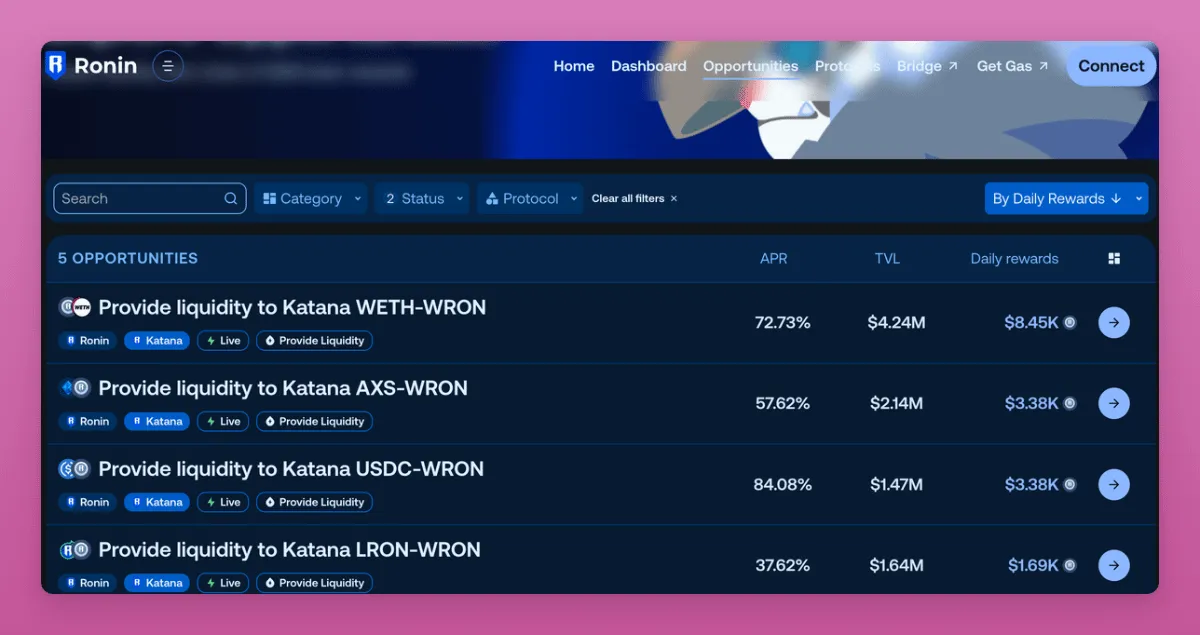

Ronin will provide a total of $3 million in multiple liquidity pools, with the yield on USDC/RON and ETH/RON pairs of about 75%.

There is also Bitcoin, is it a surprise?

Although earning profits on Bitcoin is the holy grail that everyone pursues, they are accompanied by security compromises: you need to deposit Bitcoin into a layer 2 protocol or other third-party address controlled by multiple signatures.

Still, BTCFi protocols like Lombard Finance push its TVL to $1.7 billion without much attention, surpassing platforms like Pancakeswap, Raydium and Rocket Pool.

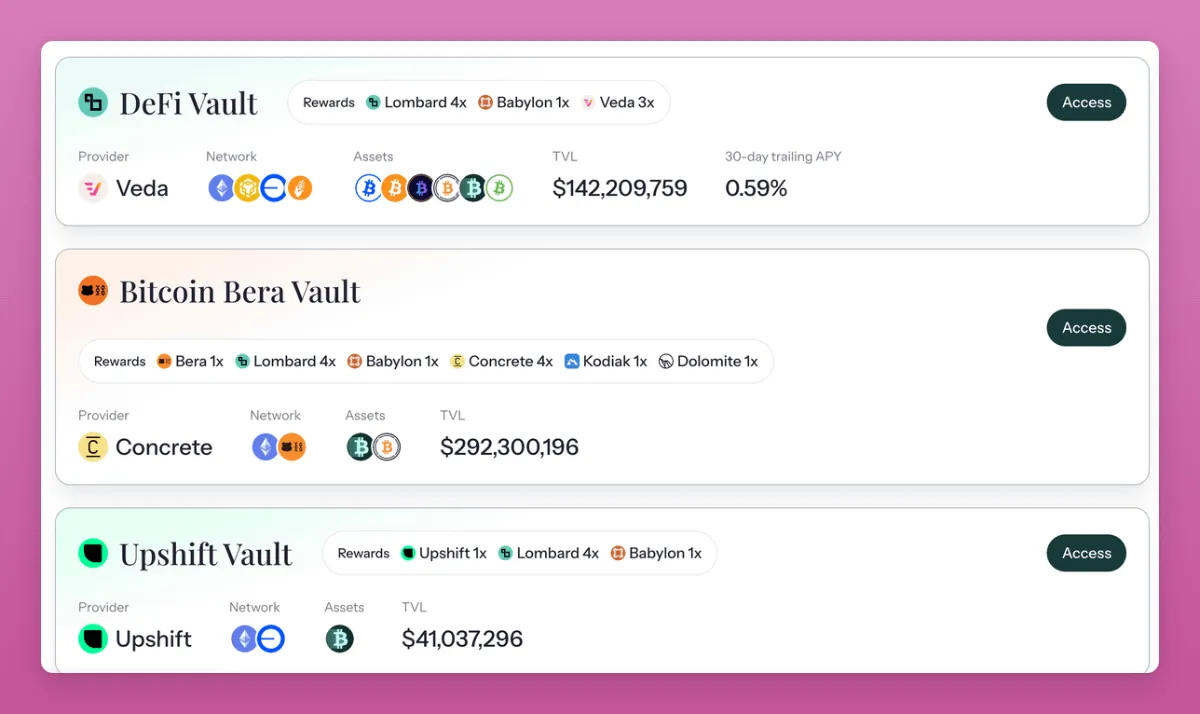

You can participate in the profit farming of multiple protocols simultaneously through the Lombard vault, receiving revenue and airdrop rewards from up to 6 protocols at once.

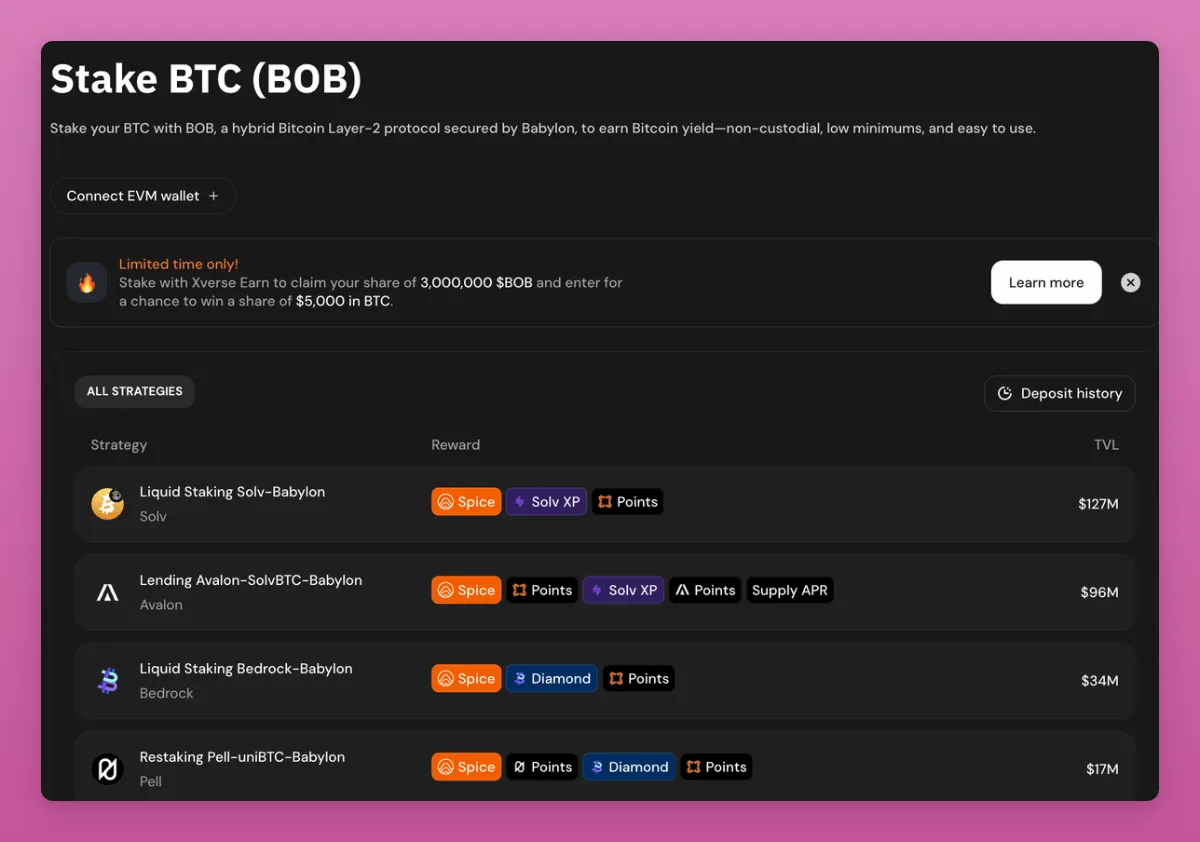

Other easy-to-use earning opportunities are provided by Xverse and Bob L2 platforms.

For example, you can stake BTC to Babylon through Solv Protocol and get liquid staking token solvBTC.BBN.

The annualized yields of each project are not yet clear, but at the time of writing, Babylon ecosystem's token BABY has been traded online, with a current market value of US$282 million and a FDV of US$1.2 billion.

By comparison, EIGEN's current market capitalization is $183 million and FDV is $1.3 billion.

Perhaps the re-pled narrative has not disappeared, but has just quietly unfolded in the Bitcoin ecosystem.

Two bad precedents in token economics

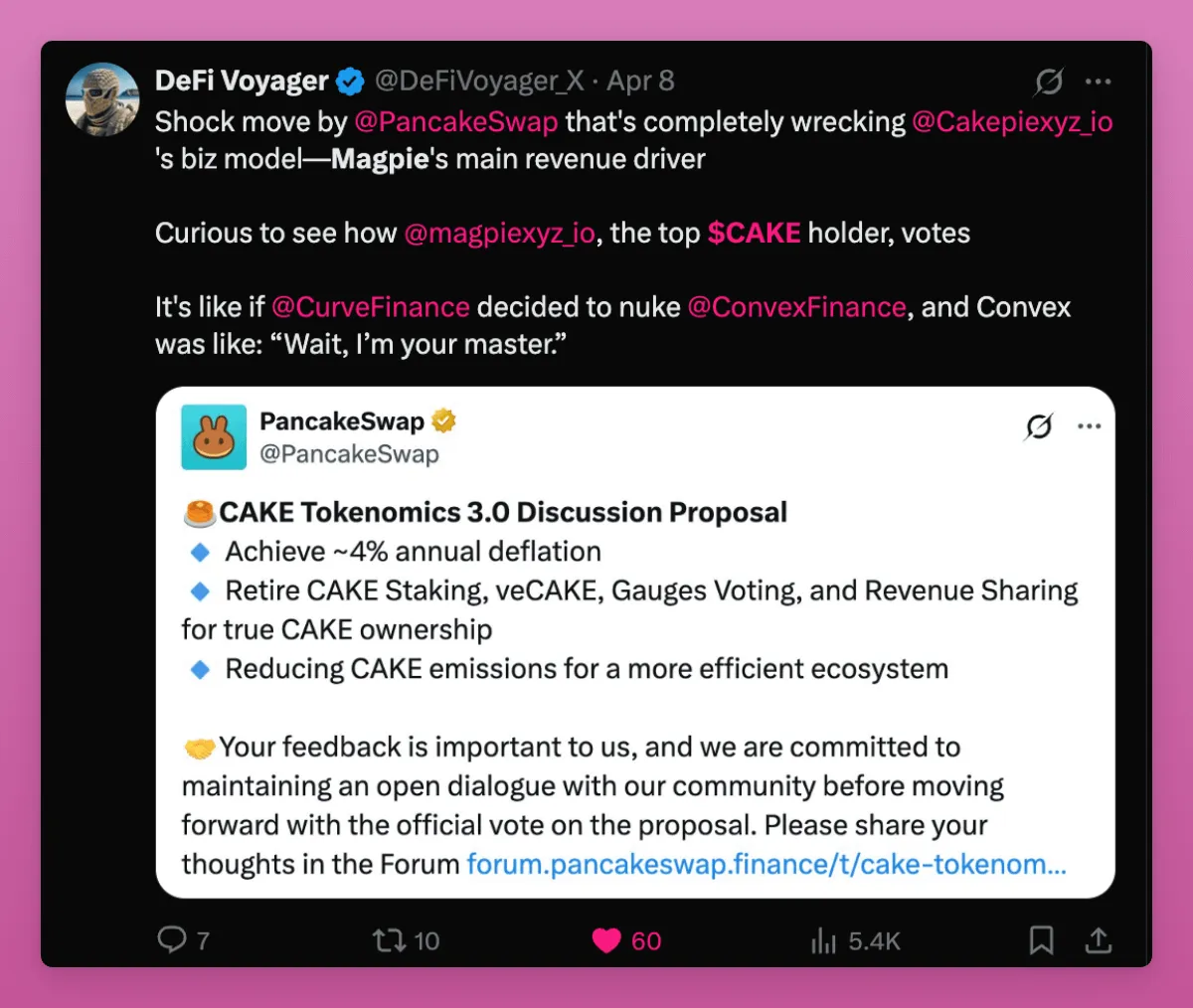

PancakeSwap

PancakeSwap is currently working closely with Binance, focusing on the TGE campaign jointly launched by both parties as Binance is committed to promoting its Web3 wallet.

This collaboration is a major benefit for Pancakeswap, whose trading volume has made it the second largest decentralized exchange after Uniswap. Pancakeswap's single-week fee revenue reached US$11.26 million, only $2 million less than Hyperliquid.

However, this did not push up the price of CAKE.

To solve this problem, CAKE is transforming its token economic model from the original "revenue sharing and community-driven decision-making" mechanism to a team-led "repurchase and destruction" model.

The problem is: PCS, Magpie and StakeDAO protocols that adopt the governance meta-aggregator business model encountered Rug.

This is similar to the relationship between Convex and Curve, where veCRV tokens are used for governance and reward releases, but to simplify the process and integrate the proceeds, the CVX tokens run as an upper-level protocol.

This is a precedent for investors to consider before investing in similar metagovernment protocols.

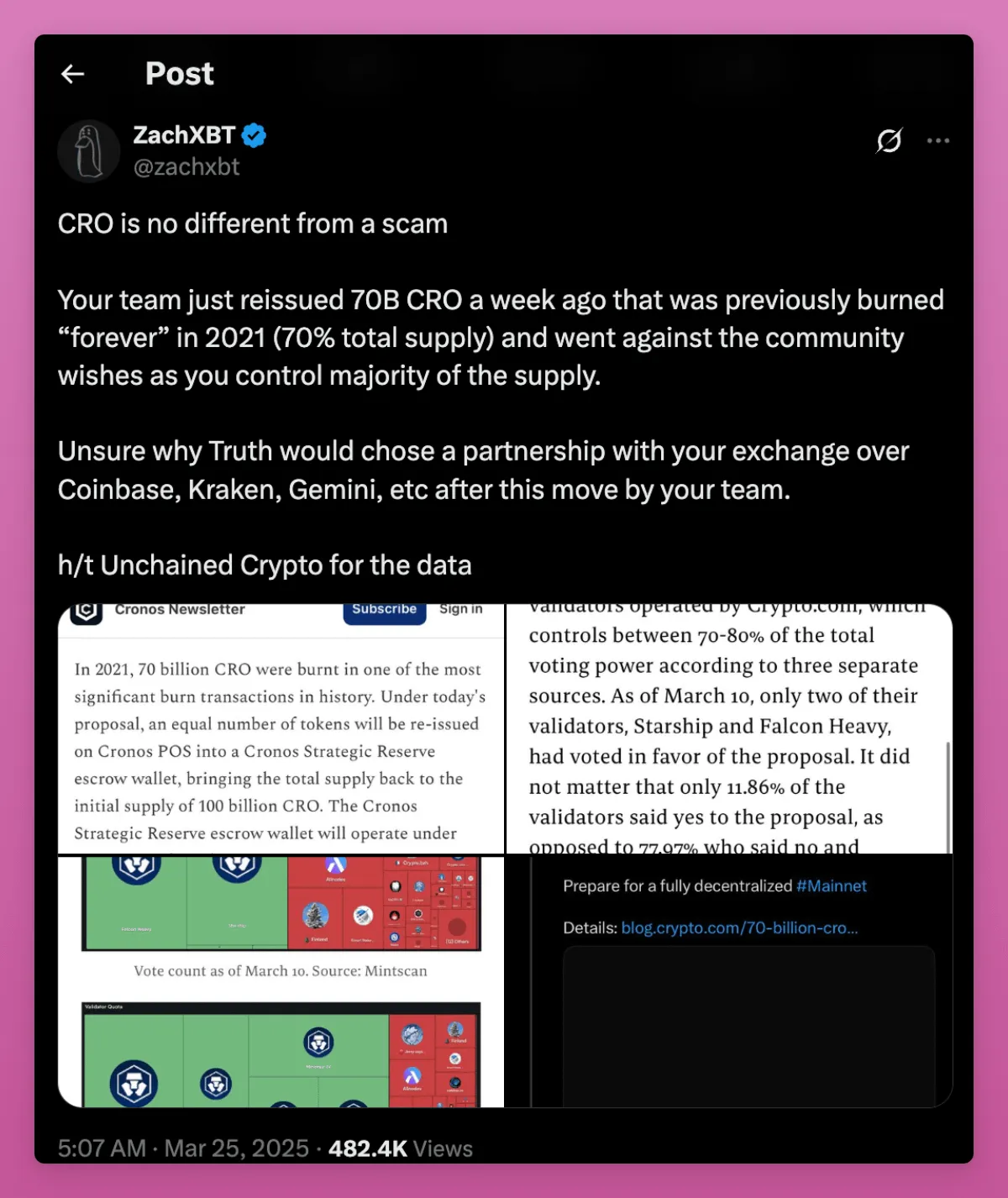

Crypto.com

Compared to PCS, Crypto.com is much worse.

Simply put, Crypto.com did not destroy 70% of its BURNT tokens in 2021, and then announced a cooperation with Trump Media to launch an encrypted ETF including CRO itself.

Crypto.com takes fraud to a whole new level. Unfortunately, the industry seems to have forgotten about this, but I will never forget it. Crypto.com will always be on the blacklist of businesses I hate the most.

Both projects set bad precedents for the industry. Token economics must be predictable to be worth investing. No wonder people only believe in Bitcoin.

If the total cap of 21 million Bitcoins is cancelled one day, please be prepared to deal with large-scale sell-offs.

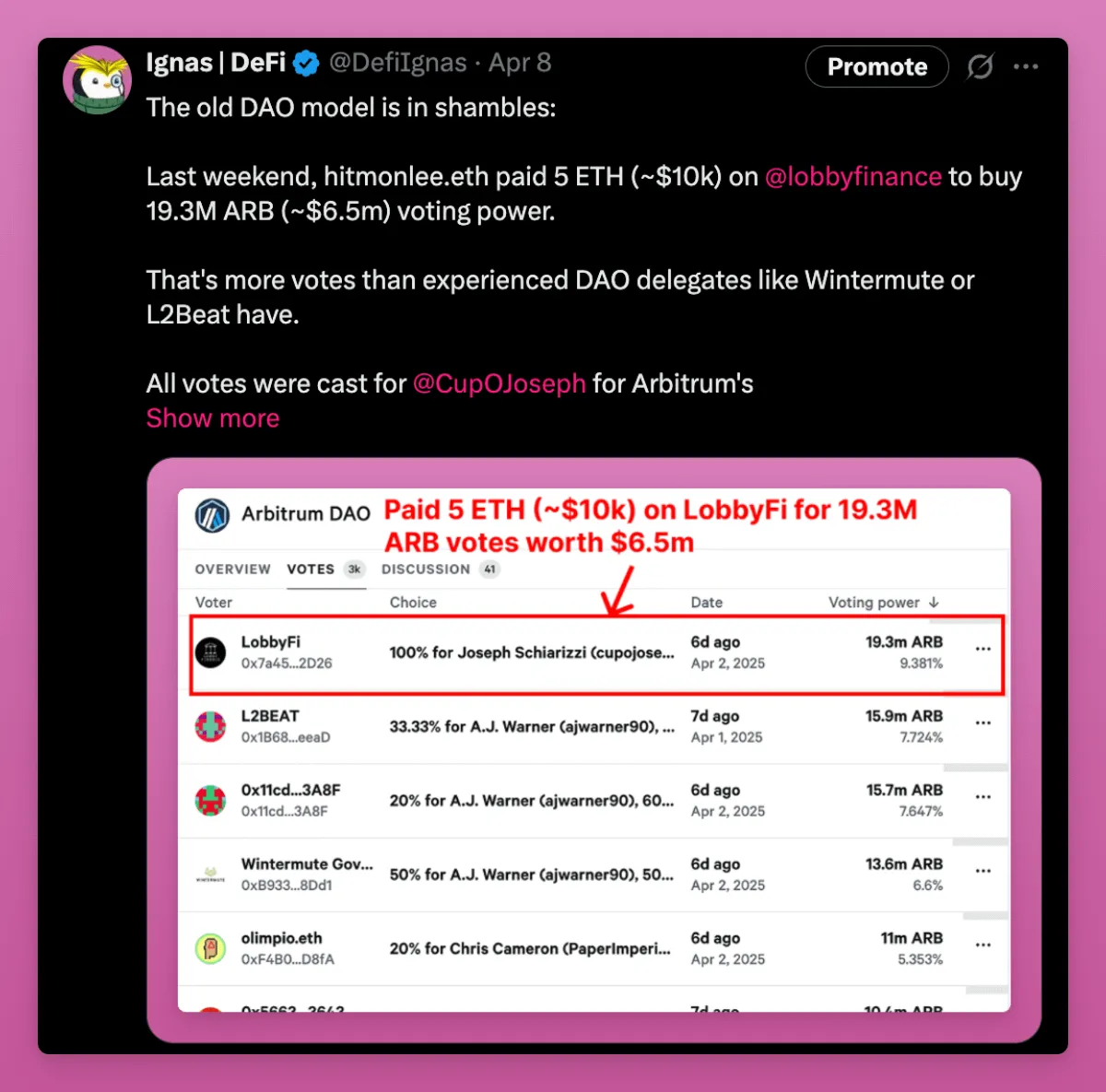

The old DAO is dead, the new DAO is long old

I think the old DAO model is undergoing innovation, but many people have missed the fun in it due to the current turbulent macroeconomic situation.

In a few months, I expect many DAOs will start trying different voting models and adjusting their token economics.

Lobbying in the DeFi sector (purchasing voting rights) will evolve into an increasingly serious problem due to the lack of attractiveness of DAO tokens that lack actual revenue sharing or pledge rewards.

Aragon allows DAO to be launched as a modular entity, and the decentralized management of governance rights is achieved through plug-ins with different functions.

To be honest, Futarcy is the most exciting project.

It uses the forecast market to guide decisions, aiming to improve efficiency and reduce the flaws of the "1 coin = 1 vote" model.

Arbitrum DAO considers starting the staking mechanism:

Two forecast markets were created:

- Market A: If a pledge mechanism is implemented, what will the price of ARB within six months?

- Market B: If the pledge mechanism is not implemented, what will the price of ARB be in six months?

ARB token holders can bet in both markets. If the predicted price of ARB tokens displayed by Market A is higher than that of Market B, a pledge mechanism will be adopted.

This could revolutionize the way DAO votes.

After realizing all this and the Lobby Finance incident on Arbitrum, Arbitrum leadership has released a new "Arbitrum Vision".

To address the inefficiency problem, the core teams of Arbitrum Foundation and Offchain Labs will now handle most of the decisions.

This also follows the growth trend of BORGs (budget, consistent, limited scope, governance-based) entities, especially Lido.

Lido's new vision of BORG and Arbitrum are both committed to solving the same core problem: DAO, while decentralized, operates chaotic, inefficient and lacks a clear execution architecture.

In short, the real decentralized governance that Arbitrum tried failed to achieve, and teams like Lido have retaken the dominance.

What will happen next?

When the current government can change the direction of cryptocurrencies with just one post, it becomes extremely difficult to predict what will happen next.

However, I am closely watching the market performance of Babylon tokens, Initia's TGE progress, and how Ethereum's Pectra upgrade will improve the current user experience.

Trump's decision to postpone the 90-day increase in tariffs has eased market pressure, so I think all project parties will take advantage of this window period to launch tokens and launch main networks.

It's time for all our panic to go away in these three months.

To do this, I plan to share my insights on emerging and promising crypto projects. There are so many things to study!